Highlights:

- CoinShares reports $441 million in inflows into digital asset investment products, reversing three weeks of outflows.

- Bitcoin led the inflows with $398 million, indicating strong investor confidence despite recent price weakness.

- Solana and Ethereum also saw notable inflows, with Solana attracting $16 million and Ethereum $10 million.

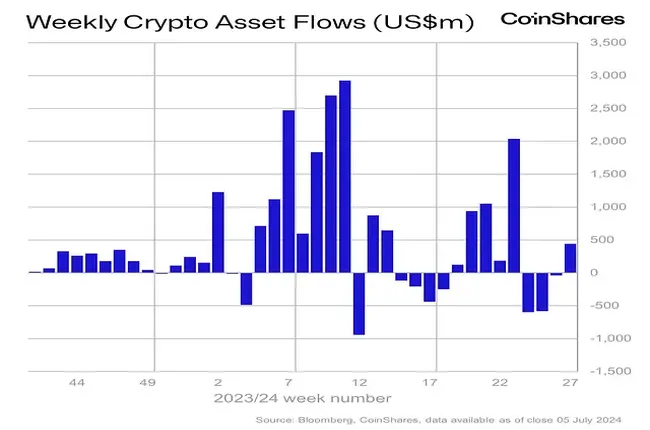

Global digital asset investment products experienced a remarkable rebound last week, recording net inflows of $441 million, according to a recent report by CoinShares. This surge follows three consecutive weeks of net outflows, signaling renewed investor confidence in the market.

According to CoinShares, digital asset investment products saw a total of $441 million in inflows last week, with recent price weakness triggered by Mt Gox and selling pressure from the German government likely seen as a buying opportunity. Bitcoin inflows amounted to $398…

— Wu Blockchain (@WuBlockchain) July 8, 2024

Market Response to Bitcoin Weakness

CoinShares head of research, James Butterfill, attributed the inflows to recent crypto price weakness, which investors perceived as a buying opportunity. Specifically, the activity surrounding Mt. Gox and selling pressure from the German government contributed to the market dip, prompting strategic investments.

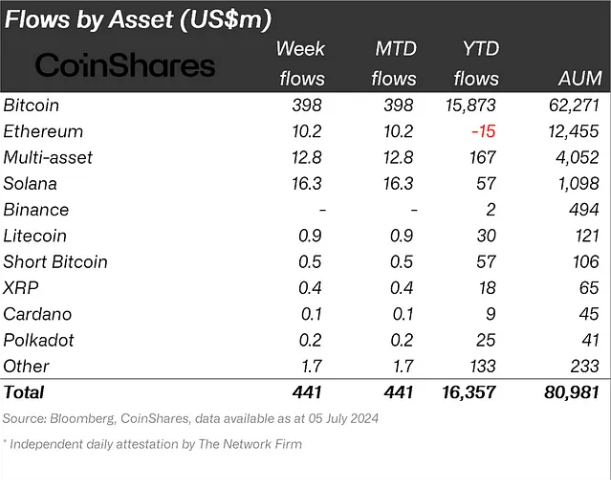

Bitcoin led the charge, attracting $398 million in inflows. However, this represented only 90% of the total inflows, as investors showed increased interest in a broader range of altcoins. Solana emerged as a notable beneficiary, securing $16 million in inflows last week, bringing its year-to-date total to $57 million.

Solana’s robust performance can be attributed to ongoing discussions about a potential Solana ETF in the U.S. VanEck and 21Shares recently filed with the U.S. Securities and Exchange Commission for a spot Solana ETF, which may have fueled investor optimism.

In contrast, the SEC’s previous identification of SOL as a security in charges against Binance and Coinbase presents a potential regulatory hurdle. However, this did not deter investors from showing significant interest in Solana.

Ethereum also experienced a turnaround in sentiment, with $10 million in inflows. However, it remains the only major crypto investment product with net outflows year-to-date.

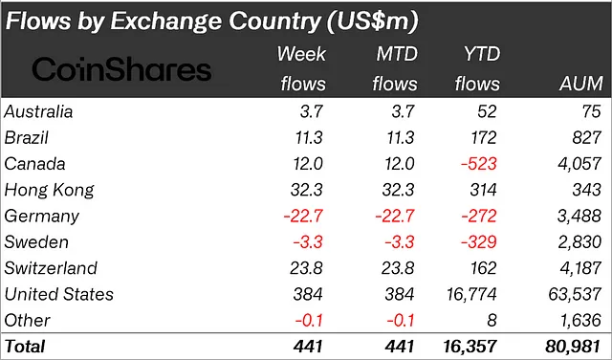

Geographical Distribution of Inflows

Regionally, the United States dominated the inflows, accounting for $384 million. Other significant contributions came from Hong Kong ($32 million), Switzerland ($24 million), and Canada ($12 million). Conversely, Germany experienced $23 million in outflows, reflecting mixed sentiment among investors.

Volumes in Exchange Traded Products (ETPs) remained relatively low at $7.9 billion weekly, consistent with the seasonal pattern of reduced trading activity during the summer months. This reflects a 17% lower participation rate compared to the total market for trusted exchanges.

Blockchain Equities Lag Behind

Despite the positive sentiment in digital asset investment products, blockchain-focused stocks did not share the same fortune. Blockchain equities recorded $8 million in outflows last week, bringing the year-to-date outflows to a substantial $556 million. This divergence underscores a lack of investor confidence in traditional blockchain-focused stocks compared to digital assets.

Last week, Mt. Gox moved over 47,000 BTC, worth around $2.7 billion, to an unknown wallet address as it began to repay its creditors. On the same day, repayments began in both Bitcoin and Bitcoin Cash to select creditors via appointed cryptocurrency exchanges as outlined in Mt. Gox’s rehabilitation plan. Some analysts speculated that most former Mt. Gox creditors could sell their Bitcoin, as its value has increased significantly since the exchange’s demise.

During the same week, the German government moved 3,000 BTC worth around $172 million to various crypto exchanges and an unknown wallet, adding to the selling pressure.

Learn More

- Next Cryptocurrency to Explode in July 2024

- Crypto Price Predictions

- Best Solana Meme Coins to Buy In 2024

- BCSC to Sanction LiquiTrade Over Canadian Security Act Violations