Highlights:

- The Solana price is showing weakening momentum, dropping 3% to $210.

- On-chain metrics indicate a decline in Solana active addresses, signalling a bearish outlook.

- If SOL could defend the $210 level, a potential surge to $250 is imminent in the coming days.

Solana price is roaming in the red zone, plunging 3% to $210. Its daily trading volume has notably plummeted 4% to $8.58 billion, indicating a drop in market captivity. However, according to a recent report, Solana was reported to be generating nearly 40% of all dApp revenue across all blockchains. According to the latest data, Solana’s DApps represent $205 million out of the $509 million generated by Web3 apps. This impressive figure demonstrates that Solana is a significant player in the decentralised ecosystem.

📊REPORT: @Solana DApps generated approximately 40% of the total dapp revenue across all blockchains.

Total Revenue: $509M

Solana DApps revenue: $205M pic.twitter.com/dAL3OXvaWk— SolanaFloor (@SolanaFloor) September 24, 2025

Solana has increased its market share in Web3 DApp revenue, consistently outperforming Ethereum and major blockchains, such as Binance Smart Chain and Polygon, in recent times. The increasing demand for Solana’s fast blockchain, which charges lower fees than its rivals, solely fueled this shift. The data suggests that Solana will continue to thrive as more developers and users use its blockchain for decentralized services in the future. The project is poised to expand significantly in the Web3 space.

Solana On-Chain Metrics Signal a Bearish Outlook

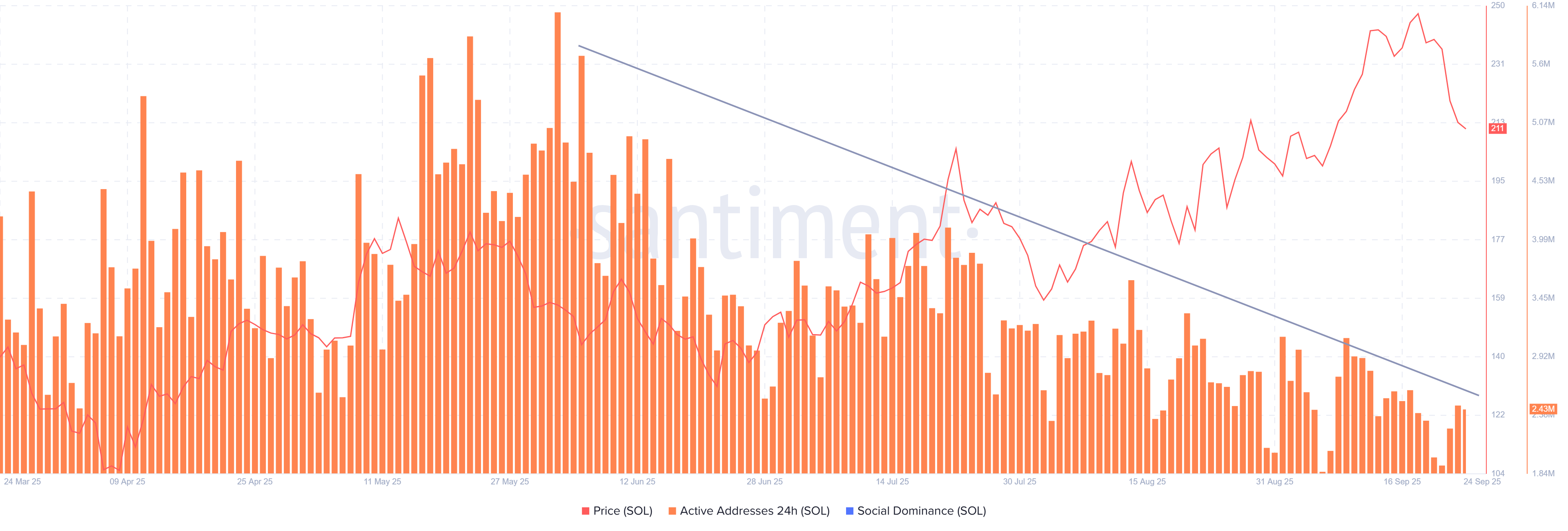

According to Santiment’s Daily Active Addresses index, Solana’s prices are likely to be short-lived. An increase in the metric indicates that more people are using the blockchain, while a decrease in addresses indicates less demand. SOL has been losing its daily active addresses constantly since mid-June. As of Tuesday, this figure stands at 2.43 million. Demand for SOL to utilize Solana’s blockchain is down, which signals a red flag for the Solana price.

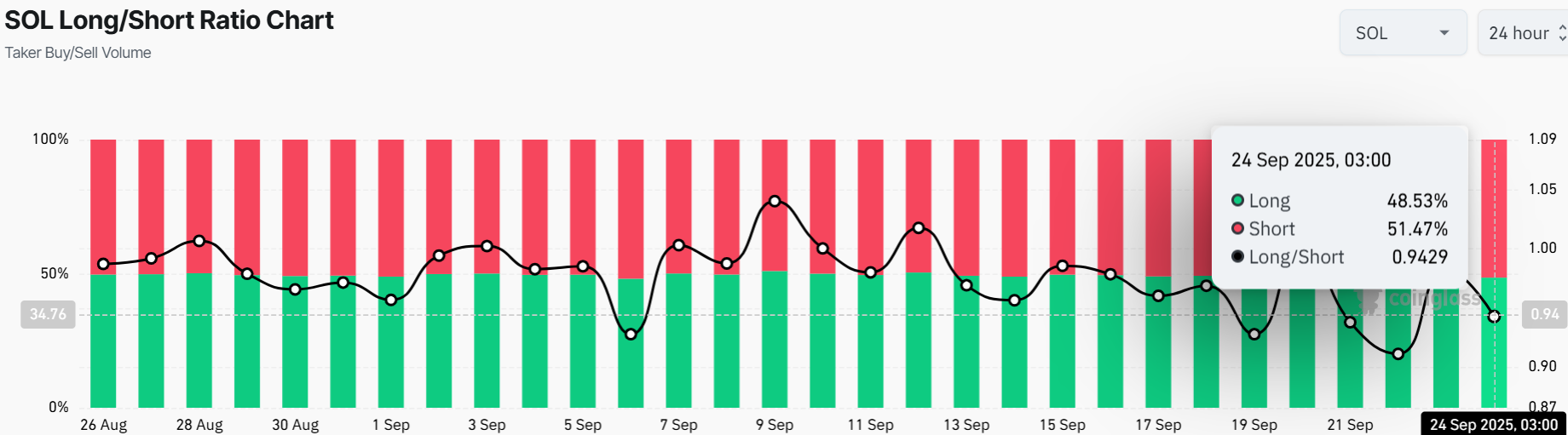

On the other hand, Solana’s Long/Short ratio sits below 1, at 0.9429. The shorts have garnered the lion’s share of 51%, while the longs take the remaining 48%. This shows that the Solana bears are in control, as traders are betting on the Solana price to decline.

Solana Price Momentum Slows as Bears Tighten the Grip

A glance at the Solana price daily chart reveals a decline in momentum, as the bears appear to be in control. The price has broken below the rising channel, as bulls find safety nets around $206 and $164 support zones.

Technical indicators are signalling a slowdown in SOL buy momentum, as indicated by the Relative Strength Index (RSI) at 43.34. However, it also means there is room to run if the bulls gain stamina. In the short term, SOL may test the $206 support level if the bears continue their campaign. A break below the current immediate support level around $206 could drag it down to $195, where bargain hunters might swoop in.

However, if bulls regain strength and defend the $210 level, a rally to $250 could be next, according to crypto analyst Ali Martinez. Meanwhile, the $233-$235 zone will be a key point to watch. If buyers hold, the Solana price will likely return to a bullish trend towards $250 soon.

Double buy signal on $SOL from TD Sequential. Defend $210 and $250 comes next! pic.twitter.com/wRrys14sJG

— Ali (@ali_charts) September 23, 2025

In the long term, Solana’s fundamentals, including its fast and inexpensive transactions, keep it a top contender. The recent dip, potentially facilitated by Bitcoin’s decline, may be a short-term correction, with the potential to recover to $250 or higher by October if the crypto market regains momentum.

Best Crypto Exchange

- Over 90 top cryptos to trade

- Regulated by top-tier entities

- User-friendly trading app

- 30+ million users

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong.