Highlights:

- U.S. Bitcoin ETFs saw a $274.6 million inflow on Monday, signaling investors confidence.

- Most BTC ETFs saw outflows in March while Grayscale Bitcoin Mini Trust ETF saw inflows.

- Ethereum ETFs experienced a $7.3 million outflow, marking the ninth consecutive day of withdrawals.

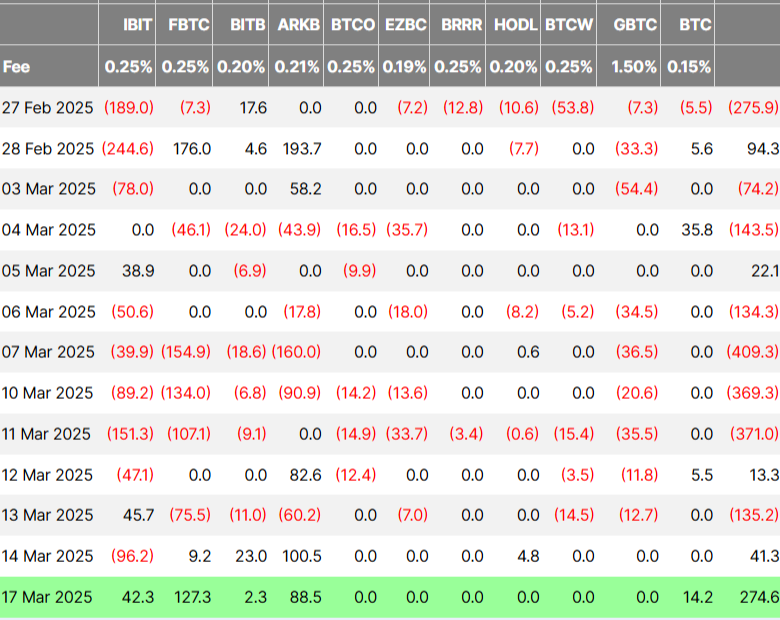

U.S.-based spot Bitcoin (BTC) ETFs saw a strong one-day inflow of $274.6 million on March 17. It shows growing investor confidence in the leading cryptocurrency. According to the data from Farside, BlackRock’s iShares Bitcoin Trust (IBIT) had the highest inflow among Bitcoin products, gaining $42.3 million.

Fidelity’s Bitcoin ETF (FBTC) came next, drawing in $127.3 million in new investments. ARK & 21Shares’ ARK Bitcoin ETF (ARKB) saw a strong inflow of $88.5 million, showing increasing interest in funds from well-known industry players.

Grayscale’s two Bitcoin funds had different results. Grayscale Bitcoin Trust (BTC) gained a modest $14.2 million, while Grayscale Bitcoin Trust (GBTC) saw no change for the day. Bitwise’s Bitcoin Strategy ETF (BITB) received an extra $2.3 million, while VanEck’s Bitcoin Strategy ETF (HODL) had no new inflows. Valkyrie’s BRRR, Invesco’s BTCO, Franklin’s EZBC, and WisdomTree’s BTCW had no inflows on March 17, each recording $0 million.

Only Grayscale Bitcoin Mini Trust Remains Positive in March

Most spot Bitcoin ETFs performed poorly in March. IBIT had $552 million in outflows and $84.6 million in inflows. FBTC saw $517 million in outflows and $136.5 million in inflows. GBTC experienced over $200 million in outflows with no inflows. Grayscale’s Bitcoin Mini Trust ETF stood out, with no outflows and over $55 million in inflows. Overall, spot Bitcoin ETFs had over $1.6 billion in outflows and only $351 million in inflows in the first 17 days of March, resulting in a net outflow of nearly $1.3 billion.

Bitcoin’s price fell by 0.76% in the last 24 hours. After briefly exceeding $84,500 on Monday, it settled near $83,000, reflecting ongoing market uncertainty. Over the past week, Bitcoin rose by 1.27% but has dropped 15% in the last month.

The performance of crypto exchange-traded products comes as Bitcoin and crypto market sentiments turn bearish. On March 18, founder and CEO of CryptoQuant Ki Young Ju stated that the “Bitcoin bull cycle is over.”

Every on-chain metric signals a bear market. With fresh liquidity drying up, new whales are selling Bitcoin at lower prices.@cryptoquant_com users who subscribed to my alerts received this signal a few days ago. I assume they've already adjusted their positions, so I'm posting… pic.twitter.com/0EIrpTCPVi

— Ki Young Ju (@ki_young_ju) March 17, 2025

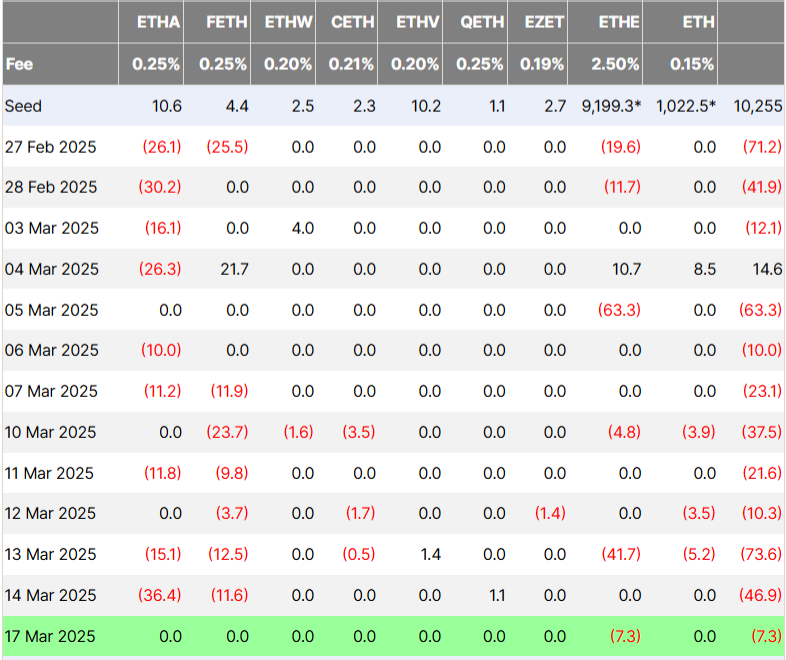

Ethereum ETFs Face Outflow

On the same day, spot Ethereum (ETH) ETFs had a net outflow of $7.3 million, marking nine straight days of withdrawals, according to Farside data. The entire outflow came entirely from Grayscale’s Ethereum Trust (ETHE). BlackRock’s ETHA, VanEck’s ETHV, Franklin’s EZET, Grayscale’s ETH, Fidelity’s FETH, Bitwise’s ETHW, Invesco’s QETH, and 21Shares’ CETH all had no net inflows for the day. This continued the recent decline in Ethereum-focused funds. It fueled speculation that investors are shifting money from ETH to BTC as Bitcoin regains key price levels.

Like BTC ETFs, Ether-based investment products are also struggling. ETHA had the highest outflows at $126 million, with no monthly inflows. FETH saw $73 million in outflows and only $21 million in inflows. Ether ETFs showed negative results throughout March, except for March 4, when inflows reached $14 million. The rest of the month saw poor performance, with total outflows exceeding $300 million.

Best Crypto Exchange

- Over 90 top cryptos to trade

- Regulated by top-tier entities

- User-friendly trading app

- 30+ million users

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong.