Connecticut has adopted a cautious but friendly approach to cryptocurrencies. It has even come up with several pieces of legislation and crypto-focused policy papers. These offer guidelines on treatment of cryptocurrencies, blockchain technology, and crypto exchanges in the state.

In this article, we will discuss everything cryptos in Connecticut with a keen interest on where and how to buy cryptocurrency in the Constitution state. We will also review all the crypto exchanges in Connecticut and walk you through the crypto buying process on one of the top altcoin exchanges.

How to Buy Cryptocurrency in Connecticut – An Easy 4-Step Guide

This four-step guide teaches you how to buy cryptocurrency in Connecticut on eToro, an SEC-regulated crypto exchange. The platform exposes you to all the best cryptos to buy in the US and you only need $10 to start investing. The process is also quick and beginner-friendly, taking no more than 5 minutes.

- Step 1: Open a free trader account: On the official eToro.US website or mobile trading app, click on the “Join Now” button. Fill out the registration form that appears here by entering basic personal information as your name and address.

- Step 2: Fund this account: To start buying cryptocurrencies on eToro, you first need to deposit at least $10. You can make the deposit via such supported payment processors as bank wire transfer, ACH transfer, PayPal, credit cards, and debit cards,

- Step 3: Identify the best crypto to buy: Once logged into the exchange, you will find a list of the best cryptos to buy. Click on one and select the “BUY’ option.

- Step 4: Start buying cryptos: Use the trading tab that appears upon hitting the buy icon to customize this investment. Hit the “Open Trade” button to add the coins to your wallet.

Investments are subject to market risk, including the possible loss of principal. Virtual currencies are highly volatile. Your capital is at risk.

We will provide a detailed walkthrough of the crypto buying process on eToro later on in this article. For now, we need to take a closer look at what our analysts consider the best places to buy cryptocurrency in Connecticut . Before that, though, we need to understand what the most popular cryptos are in Connecticut.

Most Popular Cryptos to Buy in Connecticut

Before digging into this topic, understand that there isn’t a universally accepted metric for identifying the most popular crypto in a particular state. It, therefore, is near impossible to accurately determine what the most popular cryptos are in Connecticut. Nevertheless, you can tell that Bitcoin ranks high among the most popular digital coins in the state by analyzing local news and social media chatter.

The legacy coin, together with the second most valuable crypto – Ethereum – is evidently the most traded crypto in the state. This observation is informed by the fact that these two are listed with virtually all crypto exchanges operating in the state. They also record some of the highest daily trade volumes. Other popular coins include:

- Dogecoin (DOGE)

- Ripple (XRP)

- Solana (SOL)

- Shiba Inu (SHIB)

- Tether USD (USDT)

- Bitcoin Cash (BCH)

- Tron (TRX)

- Chainlink (LINK)

Where to Buy Cryptocurrency in Connecticut

Connecticut’s crypto friendliness makes it possible for state residents to interact with all the top altcoin exchanges. These are considerably safe and have oversimplified the crypto-buying process. On the other hand, they also have varied trade limits and adopt different and unique features and tools.

Below, we review each exchange and discuss not just its features while also pointing out its core strengths and weaknesses. This should help ease your search for where to buy cryptocurrency in Connecticut

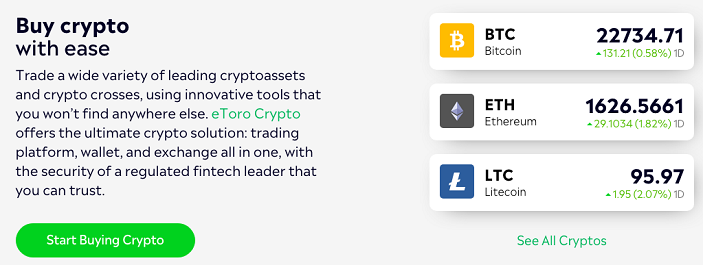

1. eToro – The Overall Best Crypto Exchange in Connecticut

eToro is a regulated crypto brokerage that exposes you to the most popular cryptos in Connecticut. Here, you get to interact with not just the most searched cryptos like Bitcoin and Ethereum but also the most volatile cryptos like Shiba Inu and Dogecoin. It also supports fractional investing for cryptos and you can start buying any of these coins with only $10.

You will also want to buy cryptos on eToro because it is transparent about the cost of trading on the platform. For starters, the transaction fee when you buy and sell cryptos is fixed at 1% of the trade volume. Secondly, it is clear about all the non-trading fees charged on the platform. These include the $5 dollar withdrawal fee, the 0.5% crypto transfer fees, and the $10 inactivity charge.

We also list eToro here because you don’t need crypto trading experience to use the platform. The crypto brokerage presents newbies on its platform with the copy trader tool. This lets them mirror the trade settings of the most profitable traders onto their accounts. The beginner will also have access to a vast educational resource that teaches, among other things, how to invest in cryptos.

Note that while eToro is primarily beginner-focused, it also integrates 75+ advance trading tools. These include customizable charts, drawing tools, indicators, news, and expert analysis. It is also quick in processing both deposits and crypto transactions. Not forgetting that both its web and mobile trading platforms are easily navigable. These help it appeal to expert traders.

- eToro is a safe exchange and presents you with free digital wallets

- eToro is a multi-asset brokerage – allowing for diversification

- The crypto buying process is straightforward

- Trade on the move with the eToro crypto trading mobile app

- You cannot deposit or withdraw cryptos directly to/from the eToro trading platform

- Supports a comparatively low number of digital assets

Investments are subject to market risk, including the possible loss of principal. Virtual currencies are highly volatile. Your capital is at risk.

2. Crypto.Com – A Popular Crypto Exchange with a Large Crypto Library

Crypto.com describes itself as America’s premier crypto trading platform. We list it here because it exposes you to an extensive crypto library. Today, you can buy and sell 250+ digital assets on the Crypto.com exchange. These range from the best DeFi coins to the most undervalued digital assets.

In addition to the large crypto pool, the CFTC-regulated exchange also makes it here because of its highly competitive trading fees. When buying Bitcoin on Crypto.com, for example, the transaction fees are volume-based and range between 0.75% and 0.00%. You also stand to benefit from a trading fee discount of up to 30% if you have staked CRO coins.

Further, Crypto.com exposes its platform users to lucrative passive investing programs. The two most popular are crypto staking and lending. Today, you can stake tens of cryptos on Crypto.com and earn double-digit interest rates for these coins annually. You also earn passively when you interact with the many DeFi programs offered on the Crypto.com DeFi Wallet.

You will also want to use the Crypto.com exchange because it presents you with multiple ways of buying digital currencies. First, you may use crypto trading bots, such as the DCA bot, Grid bot, and TWAP bot. You may also want to buy spot cryptos on the Crypto.com trading platform. Alternatively, buy cryptos on their OTC trading platform.

- Buy cryptos instantly with PayPal on Crypto.com

- The Crypto.com exchange appeals to both beginner and expert traders

- Crypto.com is safe and publishes its proof of reserves

- You can trade margined crypto derivatives on Crypto.com

- Charges high crypto withdrawal fees

3. Kraken – Best Crypto Exchange for Institutional Investors

Kraken is a wildly popular and highly reputable crypto exchange that has been around for more than a decade. If you have been following the crypto world news, you would have noticed the highly publicized legal battle between Kraken and the SEC. The regulator accused the exchange of listing what it considers securities and fined it $30 Million.

The settlement deal included a stipulation that Kraken wouldn’t offer passive investing programs to US citizens. You, therefore, cannot make money staking or lending cryptos on the exchange. These hurdles notwithstanding, Kraken remains one of the best crypto exchanges in Connecticut. It continues to draw lots of support from high volume traders and institutional investors.

To this class of investors, Kraken has availed the Dark Pool – an OTC trading platform. This lets them place large buy/sell orders pseudonymously and at highly competitive fees. The exchange then guarantees institutional-grade security by holding these coins in ultra-safe offline vaults. Not forgetting that Kraken’s deep liquidity translates to minimal-to-no slippage.

Kraken is also a great contender for one of the best crypto exchanges for active traders in Connecticut. It provides a Kraken PRO trading app that not only features more trading pairs but also charges lower trading fees. It also integrates 100+ advanced trading tools and supports margin trading with leverages of up to 5X.

Though it is designed to appeal to professionals, it has integrated several beginner-friendly tools and resources. These include the one-click buy option that lets you buy other cryptos Bitcoin and instantly with cards. You will also have access to extensive educational resources on the Kraken exchange.

- Good customer service options

- Access tens of the best cryptos and 10+ crypto trading pairs

- You only need $10 to start buying cryptos

- Trade NFTs with zero gas fees

- High fees when you buy cryptos instantly

- No passive investing

Investments are subject to market risk, including the possible loss of principal. Virtual currencies are highly volatile. Your capital is at risk.

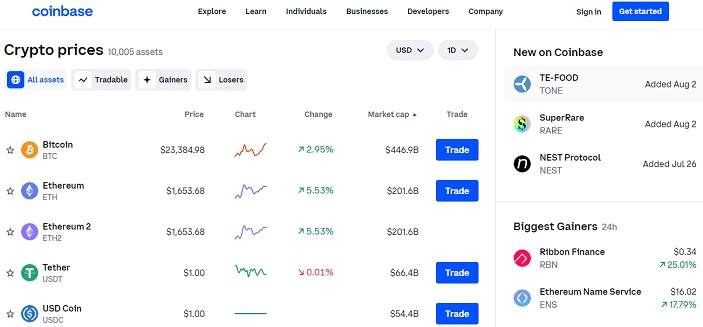

4. Coinbase – The Most Beginner-Friendly Crypto Exchange in Connecticut

When using Coinbase in Connecticut, you will have access to 100+ of the most popular cryptos. Like all the top altcoin exchanges, it also supports fractional investing with a trade minimum of $2. Further, you get to interact with the most popular ways of buying digital assets. These include the one-click buy option, which lets you buy Bitcoin and other cryptos instantly with PayPal or cards.

You also have the option of trading cryptos on the Coinbase web trading platform. For expert traders, the exchange presents them with the Coinbase PRO app. This features more crypto trading pairs and charges lower crypto trading fees. They also expose you to more advanced crypto trading and analysis tools. You can even set price alerts and notifications on the Coinbase trading platforms.

You would also want to buy cryptos on Coinbase because is supports all the popular deposit ad withdrawal methods. These include cards, eWallets like PayPal, ACH transfers, and even cryptos. The fees charged on buying cryptos with cash depends on your preferred payment method. You, for example, will pay a fee of between $0.99 and $2.99 if you buy cryptos worth less than $200.

Two more factors that make Coinbase one of the best cryptos in the US. First is its commitment to promoting cryptos in the country and the second is its safety record. Note that Coinbase stores as much as 98% of client private keys offline. It then insures the remaining 2%, while your cash deposits into the platform are insured with the FDIC for up to $250,000.

- Earn passively when you staking or learn about cryptos

- It has quick client onboarding and crypto-buying processes

- Coinbase is publicly traded

- You can buy cryptos on Coinbase

- Coinbase has been hacked in the past

- Has a complex fee structure

5. Uphold – The Best Multi-Asset Crypto Exchange in Connecticut

Launched in 2014 as a Bitcoin reserve platform, Uphold is one of the oldest and most reputable trading platforms on this list. In less than 10 years, Uphold has gone from being a Bitcoin storage company to facilitating the trade of 280+ cryptos. You only need $10 to start buying these cryptos. Plus, you may opt to use the Uphold web trader or their innovative mobile app.

We would like to observe that though Uphold has morphed into a fully-fledged brokerage, it still keeps with its promise of crypto security. It still provides crypto users with an ultra-secure and free digital wallets. It has never been hacked and the client assets are 100% reserved. Uphold is transparent about its holdings and even publishes a proof-of-reserves report that is updated every 30 seconds.

In addition to these, Uphold has adopted a unique approach to crypto investing. Unlike most exchanges that will only let you buy cryptos with either fiat or other cryptos, Uphold introduces the anything-to-anything trading model. This implies that you can Buy cryptocurrency in Connecticut with virtually any other asset supported on the platform. For example, you can buy Ethereum with Silver or Apple stocks here.

Other factors making Uphold one of the best crypto trading platforms in Connecticut include the fact that it has an OTC platform. It lists new coins early, exposing you to the next 100x cryptos and is deeply liquid. Its simple and one-step trading tool also simplifies the crypto buying process, helping it draw in beginner investors.

- Offers clients personalized support to help them reach investment goals

- Uphold Academy teaches everything crypto to beginner investors

- Uphold is licensed in the US and subject to regular independent audits

- Doesn’t share customer data or loan client money to third parties

- Uphold aren’t insured by the FDIC

- Uphold have low to no liquidity

Investments are subject to market risk, including the possible loss of principal. Virtual currencies are highly volatile. Your capital is at risk.

6. BitStamp – The Best Crypto Exchange for Active Traders

Several factors make BitStamp one of the best crypto trading platform for active traders in Connecticut. First is the fact that it is home to 100+ of the most popular cryptos in the US. It is also a multi-platform exchange that lets you trade via a web platform, the crypto trading mobile app, and BitStamp PRO. These integrate 100+ advanced trading and analysis tools as well as powerful APIs.

In addition to being multi-platform, BitStamp maintains some of the fastest transaction processing speeds. It also supports multiple crypto deposit methods and lets you withdrawal cryptos directly to your bank account. Equally important, BitStamp maintains one of the highest industry leading site uptime.

But BitStamp doesn’t just appeal to active traders, it also draws in institutional and beginner investors. It achieves this by making it possible for one to buy cryptos instantly with cards and eWallets like PayPal. Its deep liquidity and OTC trading platform, on the other hand, help it appeal to institutional investors.

Other factors making it one of the top trading platforms in Connecticut include the fact that it is a safe exchange. It also has a solid reputation for reliability and a highly responsive support team. Not forgetting that it has also integrated several passive income generating programs, especially crypto staking.

- It also educates users on how to invest or keep cryptos safe

- Supports a great selection of digital assets

- Doesn’t charge crypto withdrawal fees

- Doesn’t support popular cryptos like Binance coin and Tron

- BitStamp suffered a security breach in 2015

Is Crypto Investing Legal in Connecticut?

Yes, cryptocurrencies, blockchain technology, and crypto investing are all legal in Connecticut. Like most other crypto-friendly sates, the Constitution state has come up with several pieces of crypto-focused legislations and advisories. These started with defining what a virtual currency is under the state’s money transmission act.

Connecticut has also introduced a money transmitter license for crypto-handling businesses and entities like crypto exchanges and brokerages. The license is issued by the Connecticut Department of Banking, which has already published several opinions regarding cryptos and crypto exchanges. Interestingly, though, the state laws indicate that a crypto exchange may be denied a license at the discretion of the commissioner.

In addition to guidance from the Department of Banking, the Connecticut governor has also signed several crypto bills into law. Some of the most impactful were the House Bill 5506 and Senate Bill 3 on 7th and 10th May 2022, respectively. In 2018, the governor has also signed the Senate Bill 443 bill that sought to establish “a working group to develop a master plan for fostering the expansion of the blockchain industry in the state.”

Crypto Taxes in Connecticut

At the time of writing, Connecticut doesn’t have clear crypto taxation laws. It follows the federal guidelines for taxation of digital assets as set by the IRS. This implies that cryptos are treated as property for taxation purposes. Returns from crypto investments will, therefore, be subject to capital gains tax payable to both the state and federal levels.

Practical Tips for Buying Bitcoin and Top Cryptos in Connecticut

Making money and keeping it when investing in cryptos is an art that goes beyond choosing a crypto exchange. Some tips and tricks, when incorporated into your crypto investing journey, will increase your chances of making money when investing in crypto. Here are a few:

Consider DCA

Dollar cost averaging is arguably the most effective long term investing strategy. It is an emotionless strategy that works best for beginners and comes in handy in helping you avoid market mistiming.

Proper crypto research

The best tool in any crypto investor’s arsenal is the ability to research and understand a coin. You need to learn how to check such core features as its tokenomics, price history, sustainability of underlying blockchain technology, and reaction to macro trends. You can get this data from crypto data aggregation platforms such as CoinMarketCap, CoinGecko, or Coinlore.

Leveraging market trends

You also need to learn how to leverage market trends and direction. Learn when to invest in lucrative trends, when to go long, and when to short cryptos. You also need to learn how to detect volatile markets and master when to convert altcoins with erratic price action to stablecoins.

Get in early and learn when to exit a market

ICOs have moved to the crypto exchanges. Keep up with the leading trading platforms to learn when they are listing new coins. These are the next cryptos to explode. Investing in a few early on exposes you to explosive gains within a short period of time. But you also need to learn when to sell a new token – when its price action and hype stagnate and before it starts losing value.

Take advantage of airdrops

Airdropping in crypto is a form of marketing that involves distributing free coins and tokens to the market. In most cases, these coins are issued to individuals who have interacted with a protocol or chain before the launch of its official token. Interacting with new and promising blockchains and protocols increases your chances of benefiting from airdrops.

How to Buy Cryptocurrency in Connecticut Walkthrough

We have already mentioned that eToro has a quick and straightforward crypto buying process. Below, we walk you through this process and teach you how to buy Bitcoin and other cryptos on the multi-regulated crypto brokerage.

Step 1: Open an Account

Open the official eToro website or download the eToro crypto trading mobile app. Click on the “Join Now” button on either platform and complete the registration form that appears. It will only ask for basic personal information, your income source, and trading experience.

Step 2: Verify your account

The account registration process on eToro is only considered complete after you have verified your identity. This involves sending a clear photo of your driver’s license, state ID, or passport to eToro. Note that the name on this identification document must match the name used to create this account.

Step 3: Deposit Funds

You can only start investing in cryptos on eToro after you have deposited at least $10. Hit the “Deposit Now” icon on your user dashboard, select a payment method, and proceed to fund this trading account.

Step 4: Choose a Cryptocurrency to Buy

When you hit the “Discover” tab on your eToro account dashboard, you will see all the assets that you can buy on eToro. Select “Cryptos” to bring up a list of all the virtual currencies supported on eToro. Identify the best crypto to buy from this pool and hit the “BUY” option against it.

Step 5: Buy Cryptocurrency

A trading tab will pop up. Use is to customize your investment by indicating how much you intend to invest in the particular crypto. To execute the purchase of the said crypto, hit the “Open Trade” button.

Note: eToro deposits the private keys for the crypto you just purchased on the brokerage-provided web wallet. To move them to a third party exchange or wallet, you first need to transfer them to the eToro Money wallet app. The process is straightforward but be ready to part with a 0.5% (capped at $50) crypto transfer fee.

Investments are subject to market risk, including the possible loss of principal. Virtual currencies are highly volatile. Your capital is at risk.

How to Sell Cryptos in Connecticut

eToro has also oversimplified the process of selling digital assets purchased on its platform. This is how you go about it:

- Step 1: Start by logging back into your eToro trading account.

- Step 2: On the user dashboard, hit the “Portfolio” button. This brings up your crypto portfolio, indicating all the digital assets you have bought on eToro.

- Step 3: Click on the crypto you wish to sell and select the “Sell” option.

- Step 4: A sales tab will pop up, and you will need to use it to customize this transaction. Indicate whether you wish to sell a portion of the crypto asset or liquidate the entire position. Click on the “Close Trade” button to execute the sale.

Note: Crypto sales on eToro and instantaneous and the brokerage will deposit the cash equivalent of the asset you just sold into your cash account. Use these funds to buy Bitcoin or any of the hottest cryptos supported here. Alternatively, initiate a cash withdrawal.

Conclusion

Buying cryptos in Connecticut is easy. The state’s friendly approach to cryptos has been welcoming, allowing all the best crypto exchanges in the US to pitch tents here. Most of these have oversimplified the crypto-buying process on their platforms. They have also made it possible for anyone to buy the best future cryptos in just a few steps and with as little as $1.

Are you a Connecticut resident that wants to start buying cryptos today? Be guided by the step-by-step crypto buying process that we have outlined above.

Investments are subject to market risk, including the possible loss of principal. Virtual currencies are highly volatile. Your capital is at risk.

More States Buying guides on Crypto2Community

- How to Buy Cryptocurrency in New Jersey

- How to Buy Cryptocurrency in Nevada

- How to Buy Cryptocurrency in Maryland

- How to Buy Cryptocurrency in Illinois

- How to Buy Cryptocurrency in Hawaii

- How to Buy Cryptocurrency in Georgia

- How to Buy Cryptocurrency in California

- How to Buy Cryptocurrency in North Carolina

- How to Buy Cryptocurrency in Colorado

- How to Buy Cryptocurrency in New York

- How to Buy Cryptocurrency in Washington

- How to Buy Cryptocurrency in Delaware

- How to Buy Cryptocurrency in Idaho

- How to Buy Cryptocurrency in Indiana

- How to Buy Cryptocurrency in Kansas

- How to Buy Cryptocurrency in Iowa

- How to Buy Cryptocurrency in Louisiana

- How to Buy Cryptocurrency in Kentucky

- How to Buy Cryptocurrency in Arizona

- How to Buy Cryptocurrency in New Hampshire

- How to Buy Cryptocurrency in Pennsylvania

References:

- https://www.sec.gov/newsroom/press-releases/2023-237

- https://www.politico.com/newsletters/politico-influence/2024/01/22/coinbase-grows-its-lobbying-footprint-00137076

- https://www.cnbc.com/2021/08/24/coinbase-slammed-for-terrible-customer-service-after-hackers-drain-user-accounts.html

- https://www.cga.ct.gov/2022/ACT/PA/PDF/2022PA-00118-R00HB-05506-PA.PDF

- https://www.coinlore.com/all_coins

FAQs

What is the best crypto exchange in Connecticut in 2025?

eToro has been ranked highly by investors and reviewers as one of the best altcoin trading platforms in Connecticut. It lists this high because of its ease of use, transparency, and safety.

What cryptos should I buy in 2025?

Your choice of crypto investment should be guided by such factors as your investing strategy, investing goal, and understanding of the crypto markets. Beginners will want to go for relatively safe long term investments like Bitcoin and Ethereum. Experienced traders may on the other hand go for the more volatile altcoins and meme coins.

How to buy Bitcoin in Connecticut?

It is simple. Start by identifying a good crypto exchange, creating a user account with them, and making a deposit. Find the best crypto to buy for you and proceed to buy that digital asset.

Is crypto taxed in Connecticut?

Yes, Connecticut taxes crypto gains. You will be taxed if you receive an income in the form of cryptos and for capital gains from crypto investing.

How can use cryptos in Connecticut?

You may pay for goods and services using cryptos at some Main Street and online stores in Connecticut. You may also invest in cryptos passively on popular exchanges.

Is Binance.US legal in Connecticut?

Yes, you can buy cryptos on the Binance.US exchange in Connecticut.

Is Gemini legal in Connecticut?

Yes, you can buy cryptos on the Gemini exchange in Connecticut.