Highlights:

- Ethereum ETFs had a $98.29 million net outflow on Monday, continuing a negative trend.

- Grayscale’s ETHE alone saw $210 million in outflows.

- Analyst predicts Grayscale’s ETHE outflows may drop this week despite recent losses.

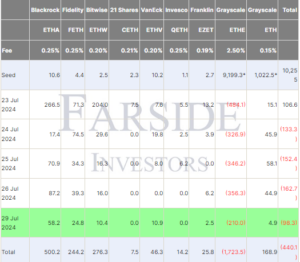

On July 29, US-based spot Ethereum (ETH) ETFs experienced a $98.29 million outflow, marking their fourth consecutive day of negative flow, according to the data from Farside Investors.

The Grayscale Ether Trust (ETHE) recorded $210 million in net outflows — the only one logging outflows among the Ether ETFs. Since its debut last Tuesday, the ETF has faced daily outflows totaling hundreds of millions of dollars. In contrast, the Grayscale Ethereum Mini Trust (ETH), a spinoff of Grayscale’s ETHE, saw $4.9 million in inflows. Grayscale’s ETH is one of the lowest-cost spot Ether products in the US market.

BlackRock’s iShares Ethereum Trust (ETHA) and Fidelity Ethereum Fund (FETH) topped the list with the largest net inflows, reporting $58.2 million and $24.8 million, respectively. VanEck’s Ethereum ETF (ETHV) reported $10.9 million in inflows, and the Bitwise Ethereum ETF (BITW) saw $10.4 million.

Franklin’s EZET recorded $2.52 million, while Invesco and 21Shares’ spot ether ETFs saw no flows. According to the data, the total daily trading volume for spot Ethereum ETFs was $773.01 million on Monday, down from $934 million on Friday and $956 million on Thursday.

Grayscale’s ETHE Outflows Could Subside this Week — Expert

In a post on X, Steno Research senior analyst Mads Eberhardt suggested that the significant outflows from Grayscale’s ETHE are likely to subside this week. Since its conversion, ETHE has seen over $1.7 billion in outflows, nearly 18% of the $9 billion it held before becoming an ETF on July 24. This figure has prevented Ether ETFs from having net inflows for four straight days, even though eight other ETH ETFs had positive flows.

The Ethereum ETF net outflow is yet to subside, but it is likely that it will happen this week. When it does, it's up only from there. pic.twitter.com/mJqbcyUTp5

— Mads Eberhardt (@MadsEberhardt) July 29, 2024

Since the ETF’s launch on July 23, BlackRock’s ETHA has received the highest cumulative inflows at $500 million. Bitwise’s ETHW follows with $276 million, and Fidelity’s FETH ranks third with $244 million in net inflows.

However, Eberhardt views the strong early outflows as a positive sign for short-term gains. “The Grayscale Bitcoin ETF outflow subsided significantly following the eleventh trading session,” he noted.

Further, he added:

“Since the Grayscale Ethereum ETF has experienced a much higher outflow relative to AUM [assets under management], we believe that peak outflow will occur sometime this week.”

In a follow-up post on X, Eberhardt hinted at the potential outcome after the peak of Grayscale outflows, suggesting readers consider the possibilities.

There is, of course, a net outflow from the Ethereum ETFs when Grayscale's primary Ethereum ETF is depleting at an unprecedented rate.

So, what happens once we move past the peak of these Grayscale outflows? Take a guess. pic.twitter.com/hbDzsqfc2n

— Mads Eberhardt (@MadsEberhardt) July 29, 2024

ETH Drops as Spot Ether ETFs Extend their Negative Trend

Following the substantial net outflows from Ethereum ETFs, the price of ETH dropped by 0.80% in the past 24 hours. As of writing, the second-largest cryptocurrency is trading at $3,345. ETH’s market cap is currently around $402 billion, with a daily trading volume of $17.1 billion.

Bitcoin ETFs Seen Consistent Inflows

In contrast to spot Ethereum ETFs, Bitcoin ETFs experienced a $124.1 million inflow on July 29, driven by Bitcoin’s dip to $66k. BlackRock’s IBIT ETF led with a $205.6 million inflow, the highest since July 22, raising its net inflows to $19.9 billion. Conversely, Grayscale’s GBTC ETF had a $54.3 million outflow, increasing its total net outflows to $18.9 billion. Bitwise’s BITB and Fidelity’s FBTC also experienced outflows of $21.3 million and $5.9 million, respectively. Despite these outflows, total inflows into Bitcoin ETFs are now at $17.7 billion.

Read More

- Next Cryptocurrency to Explode in July 2024

- Crypto Price Predictions

- Best Solana Meme Coins to Buy In 2024

- Qatar Shifts Crypto Stance, Plans New Regulations by End of 2024

- Ethereum Ecosystem Dominates Development Activity Charts with 2 Million Events

- Whales Secure 8.46 Million Chainlink Amidst Price Sideways Movement