Highlights:

- Bitcoin and Ethereum ETFs have recorded losses for the first time.

- Fidelity Bitcoin ETF (FBTC) and ARK 21Shares Bitcoin ETF (ARKB) led Bitcoin ETF Outflows ahead of GBTC.

- BTC and ETH continue to dip, as Bitcoin could soon drop below $60,000 while ETH has plummeted below $3,000.

Bitcoin (BTC) and Ethereum (ETH) Exchange Traded Funds (ETFs) recorded outflows for the first time in the August 2 ETF sales data. Bitcoin ETF suffered significant losses, with over $200 million in outflows. Bitcoin’s latest outflows were massive, considering previous weeks of consistent inflows and minimal outflows.

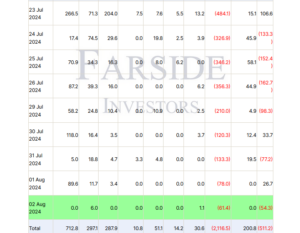

Interestingly, the latest flow trends proceeded a day characterized by inflows for Bitcoin and Ethereum ETFs. To clarify, on August 1, Ethereum ETFs witnessed $26.7 million in net inflows, while Bitcoin ETFs registered $50.6 million gains. While market participants would likely prefer the August 1 trend to persist, the reverse eventually happened, eliciting heightened market uncertainties.

🚨 US #ETF 02 AUG: 🔴$237M to $BTC and 🔴$54M to $ETH

🌟 BTC ETF UPDATE (final): -$237M

• This is the biggest outflow since May 2!

• The 10 US Bitcoin ETFs saw a total outflow of $80.7M this week (outflows on 2/5 trading days).

• 8 US BTC ETFs, excluding #BlackRock (IBIT)… pic.twitter.com/XHKOOzd0ne

— Spot On Chain (@spotonchain) August 3, 2024

Bitcoin ETFs Consistent Inflows

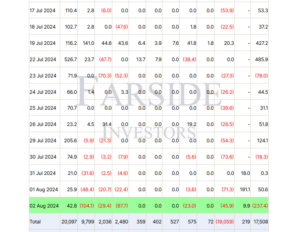

Before its most recent sales trend, Bitcoin ETFs have sustained remarkable net inflows for the past few days. According to Farside statistics, between July 15 and August 2, Bitcoin ETFs witnessed losses only on two occasions. Notably, on July 23, Bitcoin ETFs saw $78 million in losses, while July 30 witnessed $18.3 million outflows.

The August 2 outflows imply that Bitcoin ETFs only witnessed losses thrice in fifteen trading days. Hence, it corroborates initial claims about Bitcoin ETFs sustaining more inflow trends than outflows. Also, it supports market participants’ price impact fears, stemming from the fact that the over $200 million outflows seem massive.

Bitcoin ETFs Latest Sales Data

In the latest BTC ETF sales statistics, only BlackRock Bitcoin ETF (IBTC) and Grayscale Mini Bitcoin ETF (BTC) witnessed inflows. Notedly, IBTC led the positive netflows with $42.8 million, while Grayscale Mini registered $9.9 million. Meanwhile, Valkyrie Bitcoin ETF (BRRR), Franklin Bitcoin ETF (EZBC), Invesco Bitcoin ETF (BTCW), and WisdomTree (BTCO) all sustained their zero flows trend.

In losses, Fidelity Bitcoin ETF (FBTC) and ARK 21Shares Bitcoin ETF (ARKB) exceeded Grayscale Bitcoin ETF (GBTC). For context, Grayscale has been leading outflows in Bitcoin and Ethereum ETFs. Hence, it is surprising that GBTC recorded $45.9 million outflows while FBTC and ARKB registered $104.1 million and $87.7 million, respectively. Meanwhile, Bitwise Bitcoin ETF (BITB) and VanEck Bitcoin ETF also recorded outflows. They witnessed $29.4 million and $23 million, respectively, culminating in a net $ 237.4 million outflows.

Ethereum ETFs Record Minimal Activities

Contrary to Bitcoin’s active ETFs, Ethereum ETFs recorded reduced market actions. Intriguingly, only three out of the nine ETFs witnessed market shifts. Grayscale Ethereum ETF (ETHE) maintained its outflow trends with $61.4 million. Conversely, Fidelity Ethereum ETF (FETH) and Franklin (EZET) witnessed inflows of about $6 million and $1.1 million respectively. Consequently, the net outflow was $54.3 million.

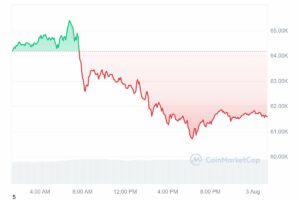

Bitcoin and Ethereum ETFs Trends Reflecting in ETH and BTC Prices

At the time of writing, Bitcoin is down by about 4% in the past 24 hours and trading at about $61,500. The pioneer cryptocurrency has been on a downhill trajectory for the past few days, evidenced by its marked declining variables. If nothing drastic happens to salvage the situation, chances abound that Bitcoin will drop below $60,000 soon.

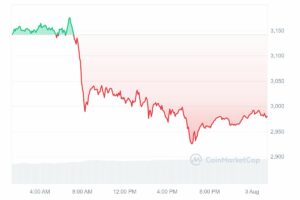

Like Bitcoin, Ethereum has also been on a downtrend even before BTC’s drops started becoming pronounced. Notedly, the number one altcoin is changing hands at about $2,980, reflecting a 5.2% decline from the previous day. Despite the declines, Ethereum’s 24-hour trading volume is up by about 21.66% with a $22.1 billion valuation.

Read More

- Next Cryptocurrency to Explode in August 2024

- Ethena Price Prediction 2024 – 2040

- Next 100x Crypto – 12 Promising Coins with Power to 100x

- Bitvavo Teams Up with Nasdaq to Boost Market Abuse Detection

- Senator Lummis Officially Introduces Bitcoin Reserve Bill in Senate