Highlights:

- Metaplanet adds 21.88 BTC to its reserves, totaling 225.6 BTC, valued at $14.6 million.

- The firm’s share price surged 25% following the latest Bitcoin purchase announcement.

- Metaplanet aims to hedge against inflation and a weakening yen by holding Bitcoin as a strategic reserve asset.

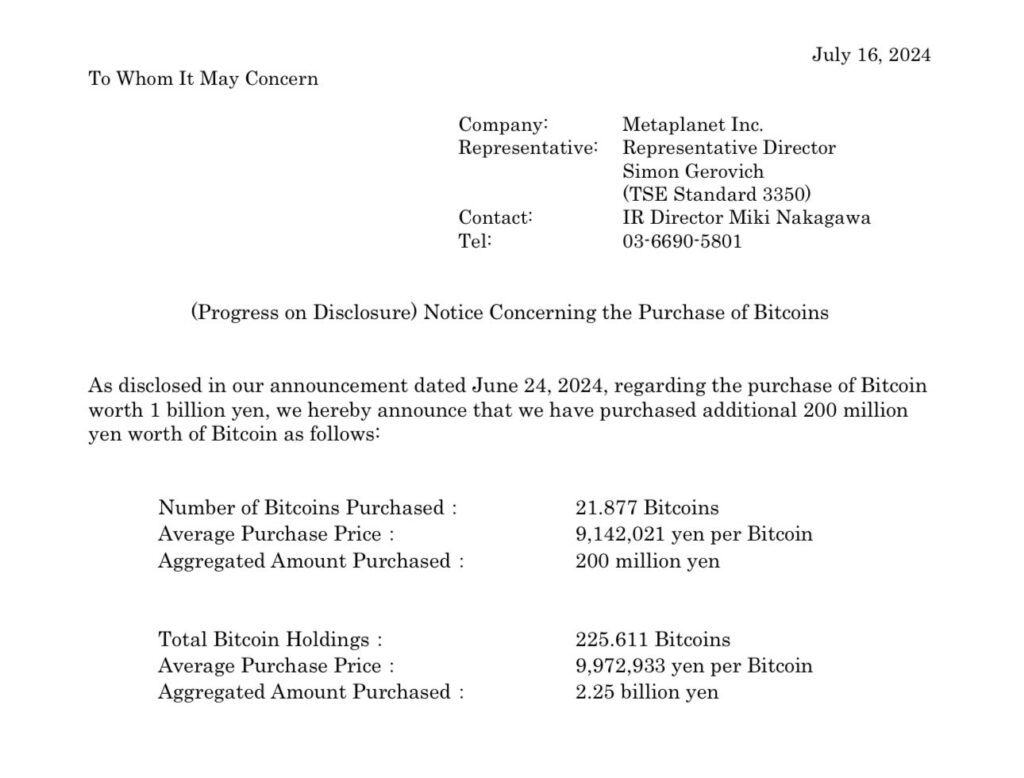

Metaplanet, known as ‘Asia’s MicroStrategy,’ has significantly increased its Bitcoin reserves by acquiring an additional 21.88 BTC, worth approximately ¥200 million ($1.4 million). This move comes as Bitcoin’s price rebounds toward $65,000.

Metaplanet’s Strategic Bitcoin Purchases

Japanese investment firm Metaplanet has been steadily increasing its Bitcoin holdings since April, establishing BTC as a strategic treasury reserve asset. The company’s statement on July 16 adds to its already substantial reserves, bringing the total to 225.6 BTC, valued at $14.6 million at press time. This follows a purchase of 42.46 BTC on July 8 for ¥400 million ($2.5 million).

The firm’s aggressive Bitcoin acquisition strategy is driven by the need to diversify away from the weak Japanese yen, which has been affected by low interest rates and economic challenges. Metaplanet views Bitcoin as a hedge against inflation and a means to safeguard its assets amid Japan’s economic uncertainty.

Following the latest Bitcoin purchase announcement, Metaplanet’s share price surged 22% within the first 30 minutes of trading on the Tokyo Stock Exchange on July 16, according to data from Google Finance. The price continued to rise, reaching a 25% increase to ¥117 ($0.74) in the opening hours.

In May, Metaplanet experienced a significant 158% increase in its stock price after revealing its Bitcoin investment strategy. The firm has continued to see positive market reactions to its ongoing Bitcoin acquisitions.

Comparison to MicroStrategy

Metaplanet’s approach closely mirrors that of MicroStrategy, the largest corporate holder of Bitcoin. On May 13, Metaplanet announced plans to employ a range of capital market instruments to enhance its Bitcoin reserves, following MicroStrategy’s example. This strategy aims to hedge against Japan’s economic challenges, including high government debt and a depreciating yen.

*Strategic Treasury Transformation and Bitcoin Adoption by Metaplanet* pic.twitter.com/Uz5RxkBV2D

— Metaplanet Inc. (@Metaplanet_JP) May 13, 2024

The yen has fallen nearly 54% against the US dollar since January 2021, while Bitcoin has risen over 145% against the yen in the past year. This disparity highlights the potential benefits of Metaplanet’s Bitcoin-focused strategy.

Future Plans and Market Impact

Metaplanet has also hinted at future plans to tokenize its shares on the Bitcoin layer-2 network Liquid. Potentially, this will increase global investors’ access. Arnab Naskar, co-founder of the security token platform STOKR, noted that this move could make Metaplanet’s shares more accessible to international markets.

The rising interest in Bitcoin among Japanese firms is part of a broader trend. A survey by Nomura and Laser Digital revealed that over 500 investment managers in Japan are considering crypto investments. Many are open to using stablecoins for settlements and daily transactions.

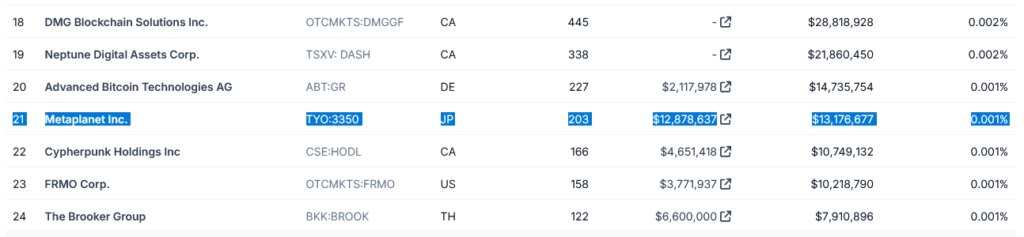

The firm’s latest purchase, amid Bitcoin’s 1% price increase over the past 24 hours, further solidifies its position as a major corporate Bitcoin holder. According to CoinGecko, Metaplanet is currently the world’s 21st-largest corporate holder of Bitcoin.

Metaplanet’s recent bond issuance through EVO FUND, aimed at further increasing its Bitcoin holdings, underscores its commitment to this strategy. The bonds, featuring an annual interest rate of 0.5%, are set to mature on June 25, 2025.