Highlights:

- Solana could hit $2,800 with an imminent 2,000% surge in sight.

- Market expert asserts that the SOL anticipated 2,000 surge stems from a previous ETH trend.

- Solana continues to outperform Ethereum in market and on-chain activities statistics.

Among crypto community members, it is not unusual for enthusiasts to draw similarities between Ethereum (ETH) and Solana (SOL). Renowned for its speed and scalability, Solana has positioned itself as a menacing ETH competitor, often dubbed the “Ethereum Killer.”

In a tweet attracting considerable attention, an expert took the ETH and SOL comparison to another level. According to the expert, Solana has mirrored Ethereum’s 95% downtrend that eventually culminated in ETH’s 2,000% surge.

Projection and Timeline from Previous Trend

Taking to his verified X handle, “MartyParty,” called his over 98.2K followers’ attention to a similar trend on ETH and SOL charts. In his Introductory statement, he noted, “Both Ethereum and Solana had 95% drawdowns.”

Going further, he stated that with an already established declining pattern on SOL’s chart, market participants’ focus should tend toward expectations. According to the expert, Ethereum’s 95% downtrend happened in 2017, eventually resulting in a 2,000% appreciation after 660 days. Interestingly, MartyParty asserted that he anticipates a similar outcome for Solana.

He noted that we are 619 days past the 95% downtrend, implying that a Solana’s 2,000% or more ascent is imminent. Meanwhile, he placed Solana’s price target at $2,800, considering the envisaged 2,000% upswing. In his exact wordings, the expert remarked, “Solana will do the same and more. We are 619 days since the drawdown. That’s SOL to $2800 starting soon (using same % and durations.)”

Meanwhile, citing reasons fueling his claims, MartyParty stated that he believes in price-making narratives. “Remember, price makes narrative. If you look at the why? You will find a thousand different reasons. I don’t buy it. Price makes narrative, not the other way around,” the expert commented.

Both Ethereum and Solana had 95% drawdowns.

All you must focus on now is what happens next. Ethereum went up 2000% 660 days after its drawdown. Solana will do the same and more. We are 619 days since the drawdown.

Thats $SOL to $2800 starting soon (using same % and durations)… pic.twitter.com/1qeOX4ToZO

— MartyParty (@martypartymusic) July 10, 2024

Will SOL Become the 2nd Most Valuable Crypto Asset?

Considering Solana’s 463.84 million circulating supply, a potential $2,800 price ascent will skyrocket its market cap to about $1.3 trillion. With other coins appreciating within the same time frame, Bitcoin’s market cap will exceed $1.3 trillion.

On its part, Ethereum boasts a relatively lower 120.2 million circulating supply. Hence, chances are high that its market cap will lie below $1.3 trillion even after appreciating. The remaining coins below ETH, Teether (USDT), and Binance coin (BNB) will be no match for the $1.3 trillion market Solana. Consequently, SOL could end up displacing ETH in the second spot.

Recall that in March, Solana displaced BNB to become the fourth most valuable asset after it touched $200 in March. Hence, it corroborates why BNB and possibly USDT will pose little or no hindrances to Solana’s crypto assets ranking ascent.

Solana’s Dominance Over Ethereum Continues

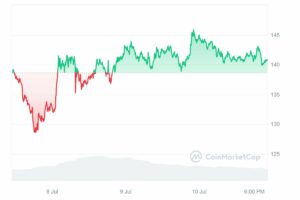

At the time of writing, Solana is trading at about $140.74 despite a 2.8% downtrend in the past 24 hours. Interestingly, in its 7-day-to-date and 14-day-date variables, SOL recorded upswings of about 3% and 2.5%, respectively.

Similarly, Ethereum is changing hands at around the $3,085 price region, reflecting a 1.1% decline from the previous day. However, contrary to Solana’s 7-day-date and 14-day-to-date statistics, ETH registered plunges of about 4.7% and 8.7%, respectively.

Aside from price movements, Solana has shown strength in other aspects. In a recent tweet making rounds, “SolanaFloor” reported that SOL surpassed ETH in weekly on-chain trading volume. The post on X read thus, “Breaking: Solana surpasses Ethereum in weekly on-chain trading volume, ending Ethereum’s dominance.”

🚨 BREAKING: @solana surpasses Ethereum in weekly on-chain trading volume, ending Ethereum's dominance. pic.twitter.com/gkJTSD6cZ3

— SolanaFloor (@SolanaFloor) July 10, 2024

Learn More

- Next Cryptocurrency to Explode in July 2024

- Crypto Price Predictions

- Best Solana Meme Coins to Buy In 2024

- Trump to Speak at Bitcoin 2024 Conference in Nashville Later this Month