Highlights

- A market expert has claimed that SOL led ETH in the Ethereum vs. Solana July comparisons.

- Ethereum witnessed a busier July relative to Solana. However, Solana was more dominant in price actions.

- The expert also claimed that ETH ETF sales were insufficient to make ETH stand tall in the Ethereum vs. Solana debates.

A recent evaluation by a renowned market analyst has revealed that Solana (SOL) outperformed Ethereum (ETH) in July. The expert’s analysis considered several metrics, particularly Ethereum ETF sales and other significant variables. Considering that July was eventful with particularly landmark achievements for ETH, normal expectations would have hinged on Ethereum outperforming Solana.

A Brief Overview of Significant July Events for Ethereum

Ethereum began July with positive sentiments stemming from an anticipated earlier ETF sales approval by the SEC. However, the endorsement was eventually delayed by about two weeks, resulting in the ETF sales kicking off on July 23. Contrary to Bitcoin, ETH ETFs have recorded more net outflows relative to inflows. Consequently, it is eliciting concerns among market participants who might soon run out of patience.

Notably, whale activities touched a zenith level, resulting in ETH revisiting over ten years’ decline in exchanges’ supplies. The massive drop in exchanges’ token supplies raised speculation that July could see Ethereum skyrocket tremendously. However, the token has maintained a relatively constant price level. Meanwhile, Ethereum attained a significant milestone a few days ago. The token ecosystem dominated development activity charts with two million events, eliciting excitement among enthusiasts.

Significant Events in the Solana Ecosystem for July

Unlike Ethereum, Solana’s ecosystem was relatively quiet despite its remarkable price actions in July. Aside from its ever-busy meme coins ecosystem, Solana appeared in a recent list comparing revenue-generating crypto projects. Notedly, the ranking included top cryptocurrencies like Tron and Ethereum.

While Tron outperformed every other digital asset in 24-hour and 7-day revenues, Solana came second in 24-hour revenue. On the other hand, Ethereum was second In the 7-day generated revenue. Other significant July events for Solana stemmed from speculations about a potential Solana ETF release. For context, VanEck and 21Shares have filed for a spot ETF, implying that a Solana ETF could be imminent.

Expert’s Assertion in the Ethereum Vs. Solana July Performances

Taking to X, McKenna has asserted that Solana led the Ethereum vs. Solana comparison throughout July. In his exact wordings, the expert remarked, “Reviewing July performance, SOL outperformed ETH despite the launch of the Ethereum ETFs.” In addition, the expert stated that Solana and Ethereum are presently consolidating below their peak prices. Therefore, both tokens could stage an imminent breakout soon.

Furthermore, McKenna noted that his assertion implies that the Solana ecosystem, especially its meme landscape, is booming. On the contrary, the expert noted that ETH beta assets are underperforming. “ETH beta assets continue to underperform Ethereum despite PEPE,” the analyst added.

Reviewing July performance $SOL clearly outperformed $ETH despite the launch of the Ethereum ETFs.

SOLETH continues to consolidate below ATH and expecting on signs of risk on for a breakout.

Indicates exposure to Solana ecosystem and meme's going forward is a good move. pic.twitter.com/wCQoc5Wspm

— McKenna (@Crypto_McKenna) July 31, 2024

Ethereum Vs. Solana Market Actions Comparisons

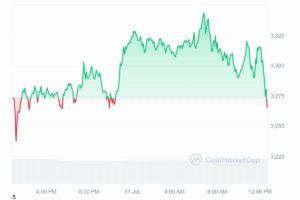

In price trajectory across July, ETH began the month strongly before the sudden generalized market slumps. The broader market declines resulted in ETH touching a monthly all-time low around the $2,800 region. However, Ethereum’s price has since stabilized. The coin costs about $3,300, reflecting a 1.1% upswing in the past 24 hours. Its 7-day-to-date, 14-day-to-date, and 30-day-to-date all recorded declines of about 3.5%, 3.4%, and 4.9%, respectively.

Like Ethereum, Solana also began July on an impressive note. It replicated a similar price trajectory as Ethereum, touching a monthly low of about $123 within the same period as ETH. However, unlike Ethereum, its price appreciation was more massive. SOL is changing hands at about $180, following a 1.6% jump in the past 24 hours. In its 7-day-to-date, 14-day-to-date, and 30-day-to-date statistics, SOL registered remarkable price surges. The increments were 0.1%, 14.8%, and 22.1%, respectively.

Learn More

- Next Cryptocurrency to Explode in August 2024

- Ethena Price Prediction 2024 – 2040

- Next 100x Crypto – 12 Promising Coins with Power to 100x

- MicroStrategy Reports 226,500 Bitcoin Holdings in Q2, Revenue Falls 7.4%

- Ethereum Price Forecast: More Downside Expected as the Bears Eye $2,917

- London Stock Exchange Welcomes Fidelity’s Bitcoin ETP