Highlights:

- Fidelity’s Bitcoin ETP offers a competitive 0.35% ongoing charges figure, reduced from 0.75%.

- The FCA’s recent decision allows crypto asset-backed ETNs for professional investors in the UK.

- Fidelity’s ETP provides professional investors with a secure and cost-effective entry into the Bitcoin market.

Fidelity International has introduced its Physical Bitcoin Exchange Traded Product (ETP) on the London Stock Exchange (LSE). This significant move offers professional investors in the UK a secure and cost-effective way to invest in Bitcoin.

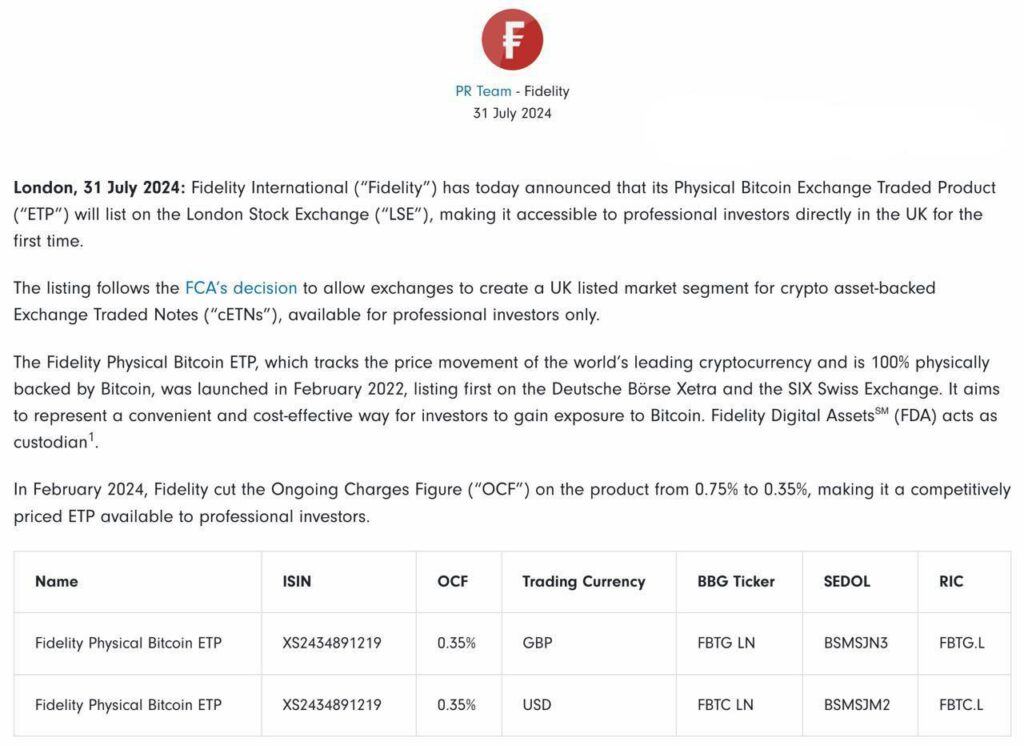

The Fidelity Physical Bitcoin ETP tracks Bitcoin’s price movements and is fully backed by the cryptocurrency. However, it will provide a competitive edge with an ongoing charges figure of just 0.35%, reduced from the previous 0.75%. This listing follows the Financial Conduct Authority’s (FCA) decision to allow exchanges to create a market segment for crypto asset-backed Exchange Traded Notes (ETNs) available only to professional investors.

Growing Institutional Interest in Digital Assets

The launch of Fidelity’s Bitcoin ETP on the LSE highlights the growing institutional interest and legitimacy of digital assets in the UK.

Stefan Kuhn, Fidelity’s Head of ETF & Index Distribution in Europe, commented:

Approval of the first spot bitcoin ETFs in the US has spurred interest from investors in cryptocurrencies worldwide. The FCA’s decision to authorize crypto asset-backed Exchange Traded Notes for professional investors is a positive development. It reflects the increasing acceptance and demand for digital assets offered through a secure and regulated exchange.

Fidelity International aims to provide a straightforward and secure entry point for professional investors in the UK with its Physical Bitcoin ETP. The product was initially launched in February 2022 on the Deutsche Börse Xetra and the SIX Swiss Exchange. However, this represents a convenient and cost-effective way for investors to gain exposure to Bitcoin. Fidelity Digital Assets (FDA) acts as the custodian for this ETP.

Enhanced Access to Bitcoin Investment

The recent launch of the Fidelity Physical Bitcoin ETP on the LSE makes it accessible to professional investors directly in the UK for the first time. This development reflects a significant step forward for digital assets in the UK. Moreover, this will draw considerable attention from professional investors. The regulatory changes and subsequent product launches by several firms. In addition, Fidelity, WisdomTree, and Global X have paved the way for increased institutional investment in the UK crypto market.

BlackRock Introduces Five New Active ETFs

BlackRock has launched five new iShares active equity ETFs, marking a significant expansion in its product range. The new ETFs listed on the London Stock Exchange, Euronext, and Deutsche Boerse aim to provide investors with low-cost, alpha-generating options.

The five ETFs include the iShares World Equity Enhanced Active UCITS ETF (WOEE), iShares U.S. Equity Enhanced Active UCITS ETF (USEE), iShares Europe Equity Enhanced Active UCITS ETF (EUEE), iShares Emerging Markets Equity Enhanced Active UCITS ETF (EMEE), and iShares Asia ex Japan Equity Enhanced Active UCITS ETF (AXEE). WOEE, EMEE, and AXEE have a total expense ratio (TER) of 0.30%, while USEE and EUEE have TERs of 0.20% and 0.25%, respectively.

These ETFs, managed by BlackRock’s systematic equity investment team, aim to outperform their regional MSCI indices.

Jane Sloan, EMEA head of iShares and global product solutions at BlackRock, stated:

The active ETF industry is expected to reach $4 trillion by 2030 as investors seek efficient risk-taking through ETFs in a scalable and repeatable way.

Additionally, Raffaele Savi, global head of BlackRock Systematic, emphasized that these ETFs build on over 10 years of experience. Moreover, they utilize AI, alternative data, and machine learning to uncover insights driving future returns.

The launch brings BlackRock’s active equity ETF range to seven. Consequently, this follows the introduction of the iShares World Equity High Income UCITS ETF (WINC) and the iShares US Equity High Income UCITS ETF (INCU) in March. In addition, BlackRock believes this expansion meets the growing demand for more dynamic investment strategies amid market volatility.

Learn More

- Next Cryptocurrency to Explode in August 2024

- Ethena Price Prediction 2024 – 2040

- Next 100x Crypto – 12 Promising Coins with Power to 100x

- Is It Time to Buy SOL? Solana Price Surges 0.5% to New Heights Outpacing Ethereum in Weekly Revenue