Highlights:

- Ethereum’s market value is rising following the SEC’s decision to end its investigation.

- The launch of the Spot Ethereum ETF marks the beginning of the altcoin season, presenting a golden opportunity for Ethereum’s market.

- Ethereum addresses increase holdings as exchange supplies hit multi-year lows.

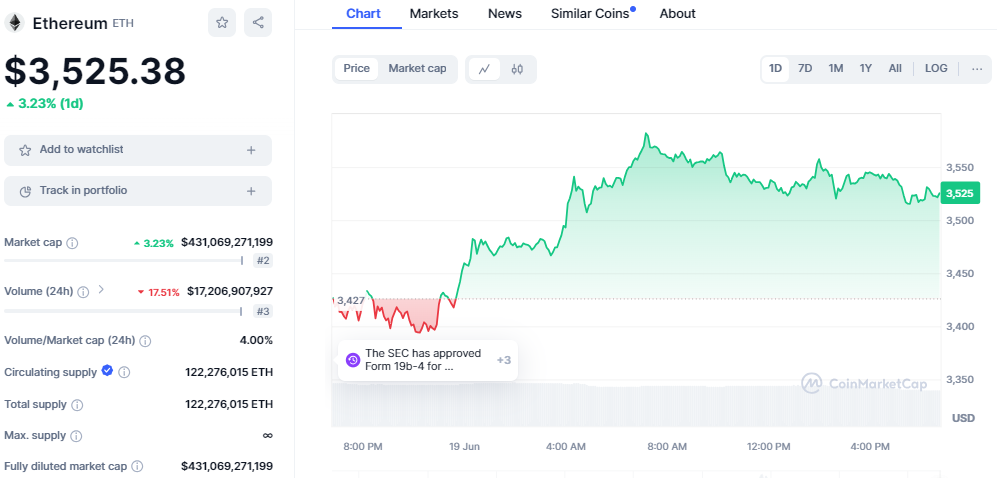

Ethereum price is on an upward trend, catching the attention of investors and enthusiasts alike. ETH is trading at $3,525, reflecting a 3.23% increase in the last 24 hours and a 2.57% drop over the past week. The 24-hour trading volume stands at $17.2 billion, with a market cap valued at $431 billion.

Ethereum Investigation Concludes: SEC Clears Path for Growth

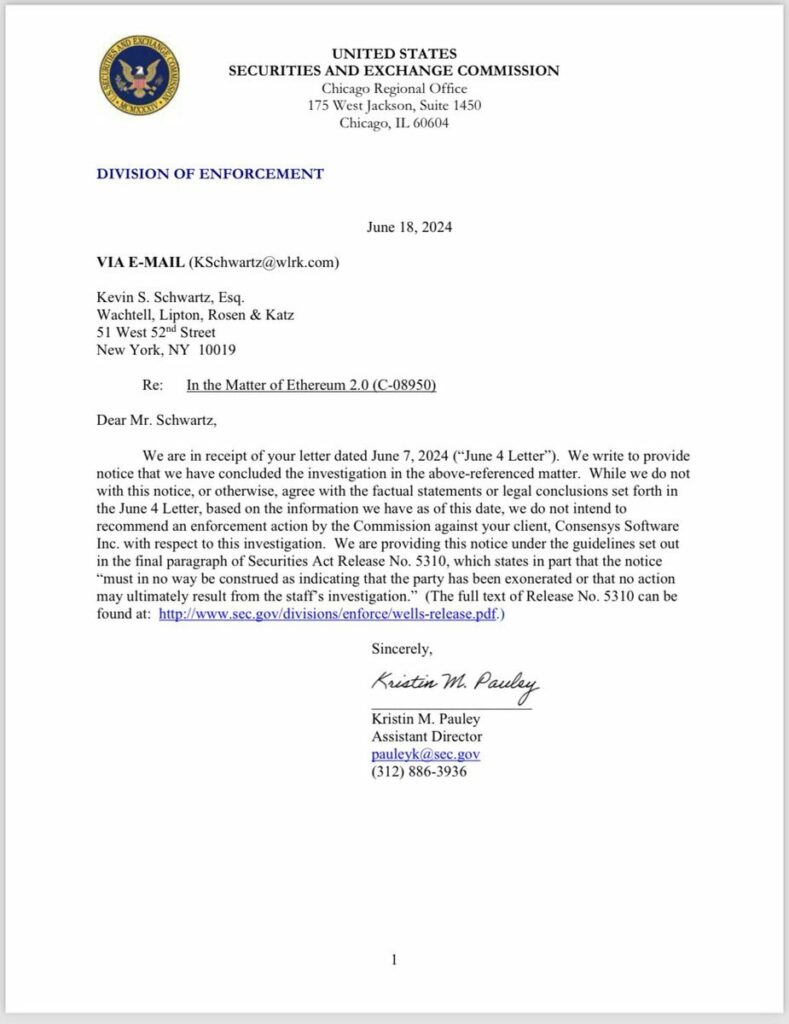

The SEC has concluded its investigation into Ethereum without filing any charges related to its sales as securities. This outcome has been met with enthusiasm from investors and the Ethereum community.

Following the resolution, Ether’s value surged past $3,500. This development came after Consensys, a major Ethereum developer, contested the SEC’s regulatory stance. They advocated for Ethereum to be classified as a commodity rather than a security.

Consensys initiated a legal challenge in April 2024 to limit the SEC’s regulatory reach over Ethereum. They sought a judicial declaration affirming its status as a commodity. The culmination of this legal battle, combined with public and political support, led to a favorable outcome from the SEC’s Enforcement Division on June 18.

This resolution lifted a significant uncertainty that overshadowed Ethereum, potentially impacting its classification and market demand. With the SEC’s scrutiny now resolved, Ethereum is poised for growth, unfolding an opportunity for investors to turn $1,000 to $1 million potentially.

SEC Poised to Approve Spot Ethereum ETFs by July

Spot Ethereum exchange-traded funds (ETFs) are anticipated to start trading in the US this year, generating expectations of increased volatility in Ether’s price. The U.S. Securities and Exchange Commission (SEC) is expected to approve the long-awaited Spot Ethereum ETF filings by July 2. This anticipated move comes amidst several key factors aligning towards regulatory clarity and heightened market interest in crypto-based investment products.

Good sign. Prob see rest roll in soon. Then prob one more round of fine-tune comments from Staff. End of June launch a legit possibility altho keeping my o/u date as July 4th https://t.co/WymshkTvat

— Eric Balchunas (@EricBalchunas) May 29, 2024

SEC Chair Gary Gensler’s recent public statements have further influenced expectations regarding the approval timeline for ETH ETFs, potentially setting an opportunity for Ethereum investors to turn $1,000 to $1 million. Gensler indicated that approvals for such products could be expected “over the course of this summer.” This statement underscores the SEC’s proactive stance towards embracing innovation, positioning Ethereum for significant growth.

Gary Gensler stated that the #Ethereum ETF will likely be listed during the Summer.

It adds up to the theory of the final correction before the big surge happens.

The approval of the S-1 files is a ‘Sell the Rumour, Buy the News’ type of event for #Altcoins.

— Michaël van de Poppe (@CryptoMichNL) June 13, 2024

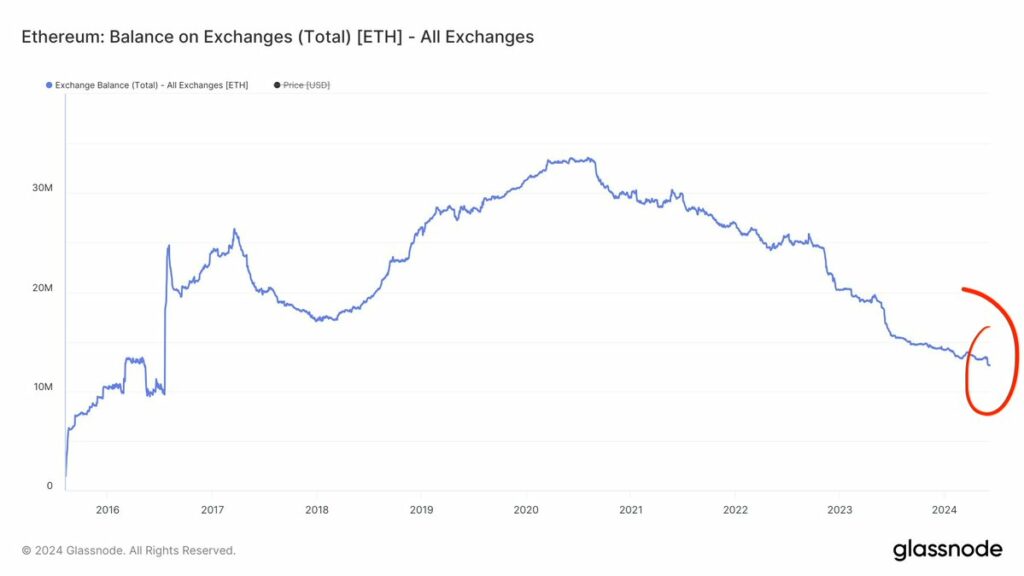

ETH Whales Accumulate as Exchange Balances Drop

Recent on-chain data highlights a significant shift in Ethereum’s market dynamics. Recently, addresses holding between 10,000 and 100,000 ETH have notably increased their holdings by over 240,000 ETH, valued at approximately $840 million. This substantial accumulation underlines a growing confidence among the whales in Ethereum’s potential amid broader market fluctuations.

Whales have bought over 240,000 $ETH during the recent #Ethereum price dip, totaling around $840 million! pic.twitter.com/j5jnxJul4q

— Ali (@ali_charts) June 12, 2024

Concurrently, the supply of ETH on centralized exchanges has been witnessing a steady decline, reaching levels not seen for several years. This trend suggests a possible reduction in selling pressure and increased long-term holding sentiment among investors. A decrease in exchange balances often signals bullish sentiment, boosting investor’s $1,000 to $1 million investment.

Moreover, this pattern of accumulation and reduced exchange supply could hint at an upcoming shift in market dynamics. Investors should closely monitor these metrics, as they can provide early indicators of significant market movements. The activity of large holders can particularly impact market sentiment, potentially leading to broader market implications.

How High Can Ethereum Go?

Ethereum has recently transcended the critical resistance level of $3,500, effectively converting it into a robust support zone. This significant achievement reflects a strong investor interest and suggests a stable base for potential future price increases. Market expert Jelle projects that ETH could achieve new all-time highs, potentially reaching as much as $5,000 by year’s end.

$ETH successfully turned $3,500 into support!

Very few people are ready for this one to make new all-time highs, but $5,000 ETH is very much on the menu this year.

Let’s roll. pic.twitter.com/k438SvCX2o

— Jelle (@CryptoJelleNL) June 17, 2024

Moreover, this upturn in Ethereum’s fortunes contrasts sharply with the broader market sentiment, which has dipped to its lowest in three months. This divergence highlights Ethereum’s unique position in the current market dynamics, where it seems poised for an upward trajectory despite general market hesitations.

Additionally, Ethereum’s journey through fluctuations since 2021 has been marked by notable highs and lows. Yet, the current phase is markedly bullish, as evidenced by its capability to maintain and build upon the $3,500 level as a new foundation for growth.

Furthermore, this recent development could signal a sustained bullish phase for ETH as it consolidates above this newly established support. Market watchers and potential investors should keep a close eye on these movements, as Ethereum’s current trends could set the tone for its performance in the coming months.

Learn More

- Binance Labs Makes Investment in Rango’s Cross-Chain Decentralized Exchange

- 20 Top Cryptocurrencies to Watch for 2024 – Detailed Reviews

- Next Cryptocurrency to Explode in 2024

Disclaimer: Cryptocurrency is a high-risk asset class. This article is provided for informational purposes and does not constitute investment advice. You could lose all of your capital.