As of June 17, 2024, Ethereum remains in a local downtrend. The technical indicators show a balanced market with the potential for gradual gains in the midterm, up to 50% by July. The ongoing developments within the Ethereum network, coupled with broader macroeconomic factors and regulatory trends, will be essential in shaping its future price movements.

The price of Ethereum (ETH) is $3,522.26 today, with a 24-hour trading volume of $14,178,599,568.23. With a circulating supply of 120 Million ETH, Ethereum is valued at a market cap of $423,353,273,594. Despite these declines, Ethereum (ETH) is outperforming the global cryptocurrency market, down -5.60%.

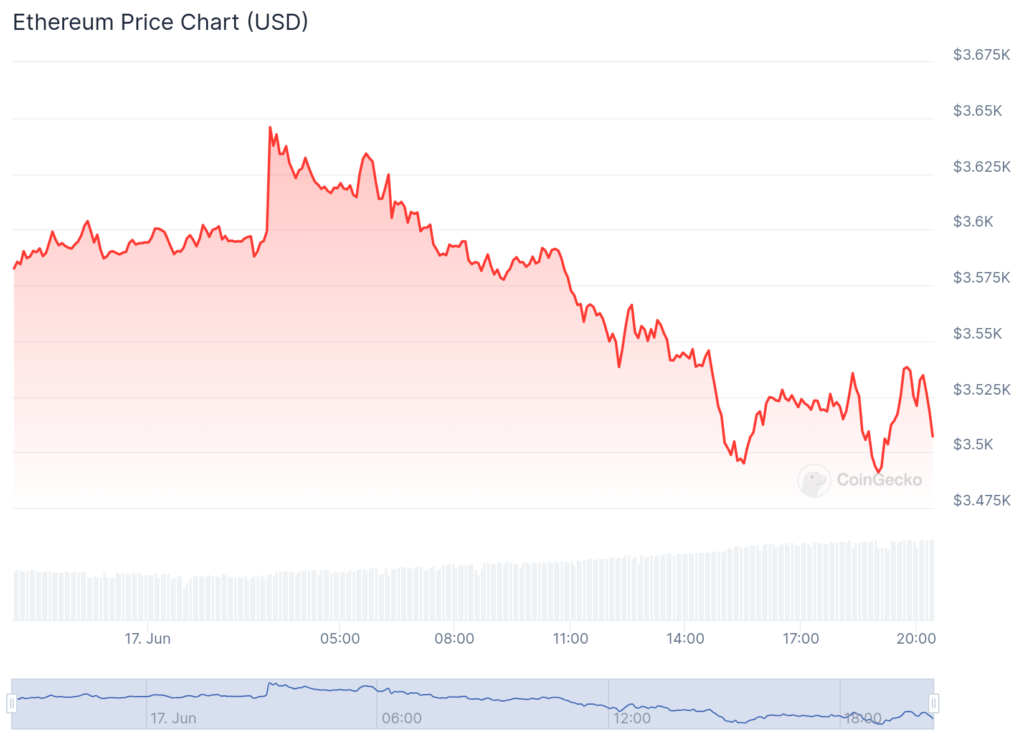

ETH/USD 24-hour price chart, source: CoinGecko

At least five indicators indicate a strong bullish outlook for the ETH market, suggesting that the leading altcoin could expereince a significant 505 price increase by July’s end. Let’s explore these potential catalysts in details.

Regulatory Environment

The regulatory landscape is poised to significantly impact Ethereum’s trajectory. Bloomberg ETF analyst Eric Balchunas indicated that spot Ether ETFs might begin trading as soon as July 2. The United States Securities and Exchange Commission (SEC) has shown minimal resistance, with only light comments on the spot Ether ETF applicants’ S-1 applications.

This proves a high probability that these ETFs could be declared effective before the U.S. Independence Day holiday. The approval and launch of these ETFs would likely drive institutional investment into Ethereum, bolstering its price.

Market and Economic Factors

Economic conditions and monetary policy will also play critical roles in Ethereum’s potential price surge. Anticipated rate cuts by the Federal Reserve could create a favorable environment for risk assets, including cryptocurrencies.

Lower interest rates make USD-denominated assets less attractive, potentially driving investors toward higher-yielding assets like Ethereum. This shift in monetary policy could enhance Ethereum’s appeal to investors, encouraging higher investments and driving up its price.

Adoption and Demand Drivers

Ethereum’s adoption in decentralized finance (DeFi) and non-fungible token (NFT) sectors continues to grow. The network remains a cornerstone for DeFi projects, serving as essential collateral in money markets and as a base trading unit for many decentralized exchanges (DEXs). This sustained adoption and demand within these innovative sectors underpin Ethereum’s potential for significant price increases.

Related: Ethereum’s Transaction Speed Hits New Highs with Layer 3 Xai Influence

Institutional and Global Developments

Institutional adoption is another significant factor. Large-scale investments and the integration of Ethereum into traditional financial systems, driven by ETH ETF approvals and global regulatory shifts, could enhance its market position.

Additionally, geopolitical factors and the global economic environment will influence Ethereum’s market dynamics, with regions like the UK, Singapore, and Japan potentially following the US lead in regulatory acceptance of crypto-based ETFs. This broadening institutional acceptance could drive substantial inflows into Ethereum.

Whale Accumulation and Market Dynamics

Ethereum whales have been actively accumulating ETH, indicating strong confidence in its future prospects. On-chain analyst Ali Martinez highlighted that over 700,000 ETH, valued at approximately $2.45 billion, have been accumulated by whales in the past three weeks.

#Ethereum whales have bought over 700,000 $ETH in the past three weeks, totaling approximately $2.45 billion! pic.twitter.com/sfmXnkqD49

— Ali (@ali_charts) June 15, 2024

This significant accumulation amid market volatility suggests that large holders are strategically positioning themselves for anticipated gains. The increased activity among these major players often precedes substantial price movements, as their actions can influence market sentiment and liquidity.

The Technical Front

Analyzing the weekly ETH/USDT chart provides further insights into Ethereum’s current market dynamics. The price of Ethereum currently stands at $3,522.26, with recent highs and lows indicating a consolidation phase. The Bollinger Bands suggest the potential for further gains, with the price positioned between the upper and middle bands. Specifically, the upper band is $4,070.52, the middle band (SMA 20) is $3,361.74, and the lower band is $2,652.95. This indicates that Ethereum is in a consolidation phase after a significant uptrend, with the potential to move higher if it breaks above the upper band.

The Relative Strength Index (RSI) stands at 59.27, below the overbought level of 70, suggesting that Ethereum is not currently overbought and still has room for upward movement. This neutral momentum indicates that Ethereum could see further gains if buying interest increases. Additionally, the Accumulation/Distribution (A/D) line is at 14.242M, showing a steady increase, which indicates ongoing accumulation despite the recent price pullback. This steady accumulation is a positive sign, suggesting that investors are continuing to buy Ethereum despite short-term price fluctuations.

Read More

- Pepe Price Signals Potential New Bull Run On The Horizon

- 20 Top Cryptocurrencies to Watch for 2024 – Detailed Reviews

- Next Cryptocurrency to Explode in 2024

Disclaimer: Cryptocurrency is a high-risk asset class. This article is provided for informational purposes and does not constitute investment advice. You could lose all of your capital.