Highlights:

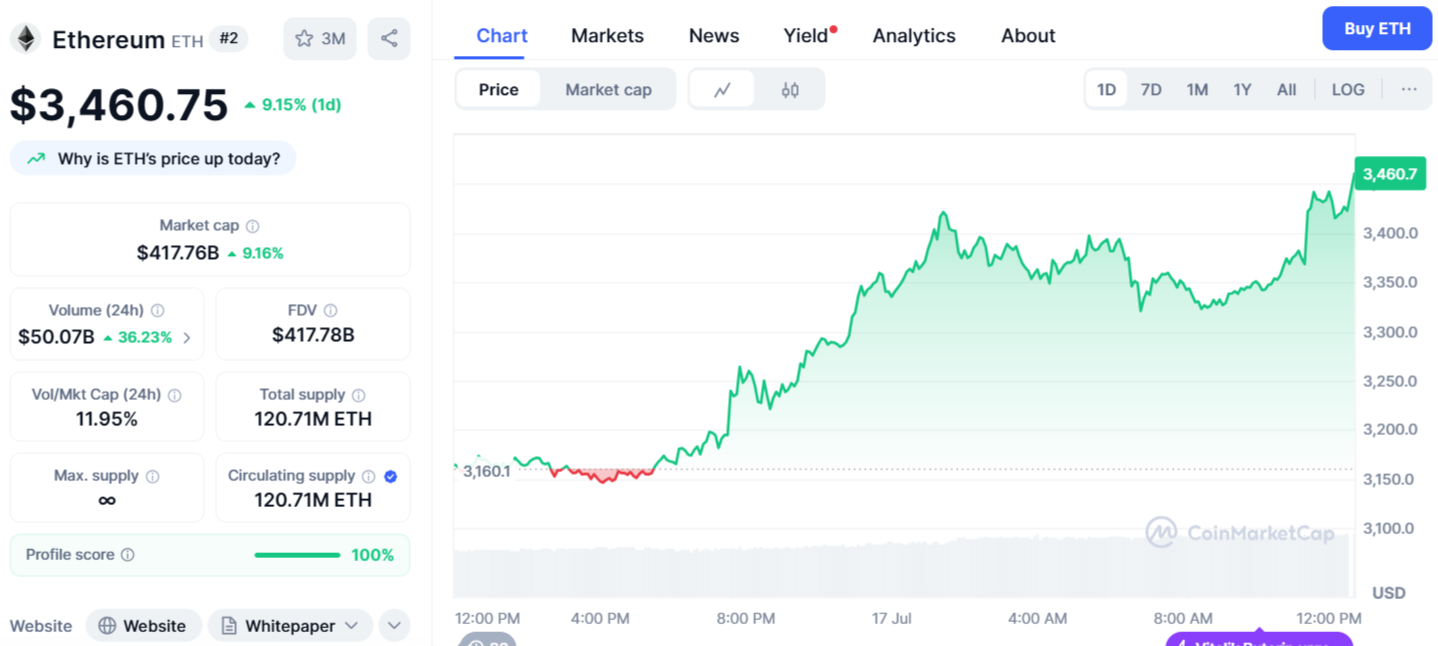

- Ethereum jumps 9.15%, hits $3,460 as ETF inflows break records again.

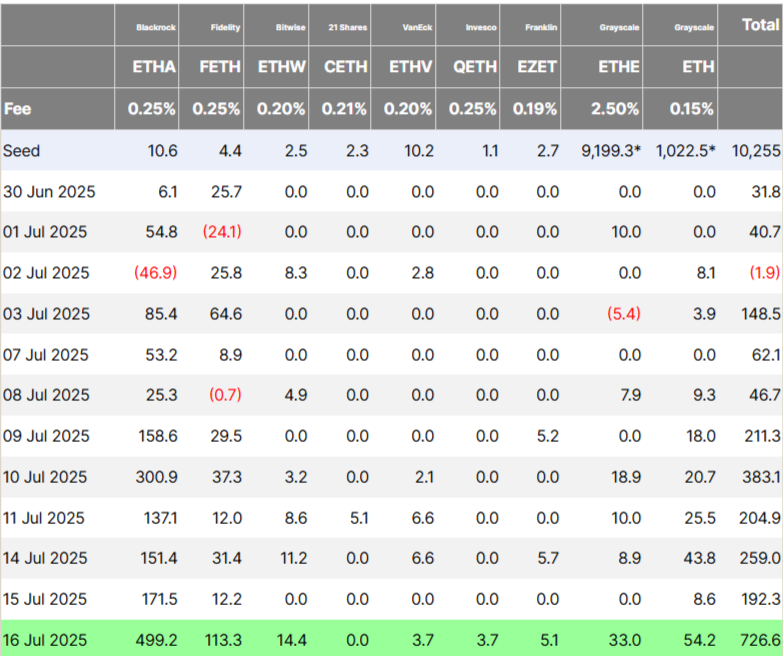

- Spot Ether ETFs add $727M in one day, led by BlackRock’s ETHA.

- ETH ETFs now hold over 5 million ETH, signaling strong institutional interest.

Ethereum recorded strong gains in the last 24 hours and is also seeing rising interest from institutions. Ether has jumped 9.15% and is now trading at $3,460, as per the data from CoinMarketCap. ETH has climbed 23% over the past week and is now up roughly 34% over the past month. The current price is just 30% below its all-time high of $4,878, reached back in November 2021.

The surge followed a record $726.6 million daily net inflow into nine U.S. spot Ether exchange-traded funds (ETFs) on Wednesday. BlackRock’s iShares Ethereum Trust (ETHA) reached a new daily inflow record, adding $499.2 million to Wednesday’s total. Fidelity Ethereum Fund (FETH) fund followed with the second-largest net inflow of $113.3 million, based on data from Farside Investors.

The overall ETH trend is still positive, with moving averages pointing upward. Even if momentum slows, institutional inflows and corporate buying may help limit any correction. If inflows remain strong or increase, ETH could soon make a move toward the $3,500 level. However, if overbought indicators grow and ETH fails to stay above the $3,300 range, it might enter a new phase of sideways consolidation.

Institutional Demand for Ethereum Soars as ETFs and Corporates Boost Holdings

U.S. spot Ether ETFs are now holding over 5 million ETH, which makes up more than 4% of Ethereum’s total circulating supply, as noted by Trader T. The latest peak significantly exceeded the earlier record of $428 million set on December 5. With this surge, total monthly inflows have now gone beyond $2.27 billion, highlighting the growing return of institutional interest in Ether.

7/16 Ethereum ETF Net Flow: $716.63 million

(US ETH ETFS HOLD: ~5 MILLION ETH)

(HIGHEST INFLOW AND VOLUME TRADED SINCE INCEPTION)$ETHA (BlackRock): $489.14 million$FETH (Fidelity): $113.31 million$ETHW (Bitwise): $14.45 million$QETH (Invesco): $3.72 million$EZET (Franklin):… https://t.co/5WzeHzAmIZ pic.twitter.com/JIUYgT7gw7— Trader T (@thepfund) July 17, 2025

In addition to ETF inflows, corporate treasuries have also played a role in Ethereum’s recent upward momentum. Over the past few months, multiple firms have revealed significant ETH holdings. Companies such as Bit Digital, GameSquare, and SharpLink Gaming are actively increasing their Ethereum reserves, aligning this move with their long-term balance sheet plans. BitMine Immersion Technologies, led by Fundstrat’s Tom Lee, also revealed it currently holds over $500 million worth of ETH in its corporate treasury.

Major financial firms, including Goldman Sachs and Standard Chartered, have begun shifting a portion of their Bitcoin holdings into Ethereum. According to data from Strategic ETH Reserve, around 53 publicly listed companies now hold close to 1.6 million ETH, with an estimated total value of $5.3 billion.

Altcoins Rally as Analyst Says Bitcoin Dominance May Have Peaked

Crypto analyst Matthew Hyland believes that if Ethereum continues its upward trend, Bitcoin’s dominance in the market may have already reached its highest point. At the same time, several altcoins joined Ethereum’s upward momentum. XRP climbed 8% to reach $3.15, Solana increased by 5.52% to $173.63, and BNB posted a 3.76% gain, bringing its price to $719. On Saturday, Hyland noted that altcoins could see even greater gains if Bitcoin’s dominance drops to 45%. At present, Bitcoin holds a market dominance of 62%.

If #ETH breaks bullish and remains bullish against BTC there is a 99% chance BTC Dominance has topped

It is basically impossible for Dominance to push higher if ETH continues higher against BTC https://t.co/BRgJeoIxR1

— Matthew Hyland (@MatthewHyland_) July 15, 2025

Best Crypto Exchange

- Over 90 top cryptos to trade

- Regulated by top-tier entities

- User-friendly trading app

- 30+ million users

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong.