Highlights:

- The Cardano price has plunged 9% to $0.51, as the crypto market swims in the red today.

- ADA’s DeFi TVL and funding rate continue to drop, indicating a bearish sentiment.

- The technical outlook signals a death cross in the ADA market as bears target a drop below $0.50.

The Cardano price still remains in red, trading at about $0.51, marking a 9% drop over the past 24 hours. The bearishness in the ADA market is also enhanced when the ADA rates of funding become negative, and the Total Value Locked (TVL) decreases. Technically, it helps in additional correction with goals of $0.50, low levels targeted by the bears.

According to DefiLlama, Cardano DeFi TVL has gone down to $240.19 million on Friday and has been in a downward trend since mid-August. The declining TVL indicates unhealthy activity and declining user interest in the Cardano ecosystem. This means that fewer users are depositing with ADA-based protocols, which is not a promising sign for its price.

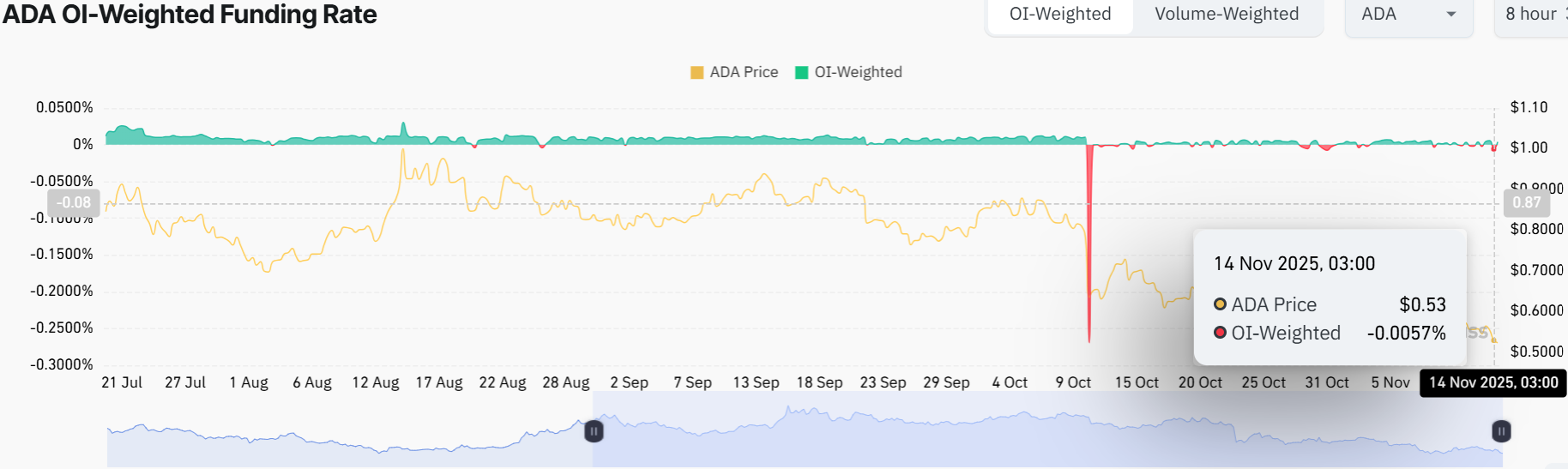

According to the OI-Weighted Funding Rate provided by Coinglass, the percentage of traders who expect the price of ADA to fall further is much higher than those who expect a rise. The indicator has reversed to a negative value and currently stands at -0.0057%. This is almost the same as the price drops at the end of October. The unfavourable ratio indicates that shorts are paying longs, implying that there is a bearish mood towards ADA.

Cardano Price Risks Further Downside Below $0.50

The ADA/USDT chart shows the coin’s price action trading below the green 50-day Simple Moving Average (SMA)(0.67), and the 200-day ($0.73), which is also trending downward. This signals a bearish tone as it hovers around $0.51. The recent crossover indicates a ‘death cross’ in the Cardano market, showing that the bears are in control.

The latest drop saw a massive volume spike of 46%, indicating panic selling or a big player cashing out. This signals peak indecision right now, with traders not sure if the Cardano price will bounce back or continue going down.

The Relative Strength Index (RSI) sits at 34.55, creeping into oversold territory, which might hint at a potential bounce if the bulls step up. Meanwhile, the Moving Average Convergence Divergence (MACD) is flatlining, showing no momentum either way.

Looking ahead, the short-term outlook is not looking bullish. If the Cardano price fails to hold above the current mark, further downside towards $0.50-$0.49 range could be imminent. On the flip side, a breakout above the upper trendline at ($0.59), with solid volume, could signal a reversal. This could potentially push ADA toward the $0.67-$0.73 resistance zones.

A clear breakout above this range may open the doors for further upside, potentially $1, by the end of the year. For now, investors should watch those support levels keenly as the chart is signaling caution. With no clear catalyst, the Cardano price may follow a sideways grind or dip further.

Best Crypto Exchange

- Over 90 top cryptos to trade

- Regulated by top-tier entities

- User-friendly trading app

- 30+ million users

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong.