Highlights:

- BTC spot ETFs have turned positive to end their four-day outflow streak.

- FBTC led the profits surge with over $200 million in cash inflows.

- Bitcoin ETFs could enjoy massive adoption following fresh filings from Bitwise and Strive, targeting the commodities investment from firms with significant BTC stores.

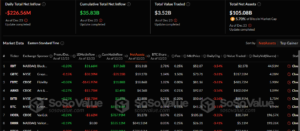

After four consistent days of recording net outflows, Bitcoin (BTC) spot Exchange Traded Funds (ETFs) turned positive on December 26. According to the renowned on-chain ETF flow tracker, SosoValue, the commodities attracted about $475.15 million in net inflows yesterday.

The positive input marked the Bitcoin ETFs first profitable outing this week. With only today remaining, the Bitcoin commodities must record another net inflow or risk closing the week with net losses. Moreover, the ETF rebound would spur hope for Bitcoin in its struggle to reclaim the coveted $100,000 price mark.

Market participants would love the new trend to persist beyond 2024 because it could become crucial in orchestrating several predicted price rallies in early 2025. With only a few days remaining for this year’s conclusion, it is left to see how events unfold in the coming few days.

Bitcoin spot ETF had a total net inflow of $475 million on December 26, the first net inflow after net outflows in the past four days. Fidelity ETF FBTC had a net inflow of $254 million. https://t.co/59u0BnEqLG pic.twitter.com/uIUu0Hfdjl

— Wu Blockchain (@WuBlockchain) December 27, 2024

FBTC Takes Charge of BTC Spot ETFs Latest Rebound

Unlike most market outings, where BlackRock Bitcoin ETF (IBIT) always leads the profit surge, Fidelity Bitcoin ETF’s (FBTC) impressive showing saw it displace IBIT yesterday. For context, FBTC attracted about $254.37 million in gains. Another top performer was ARK 21Shares Bitcoin ETF (ARKB), with approximately $186.94 million in net inflows.

Other profitable entities include IBIT, with $56.51 million, Grayscale Mini Bitcoin ETF (BTC) ($7.19 million), and VanEck Bitcoin ETF (HODL) ($2.70 million). Aside from gains, two entities attracted outflows, while the remaining five recorded zero flows. The BTC entities with negative flows include Grayscale Bitcoin ETF (GBTC) and Bitwise Bitcoin ETF (BITB). They registered losses of about $24.23 million and $8.32 million, respectively.

Following the positive inputs, Bitcoin ETFs cumulative net inflows soared from $35.49 billion to approximately $35.96 billion. The total value traded was roughly $2.13 billion, while the total net assets reflected $108.24 billion. It is worth noting that the total net assets valuation represents 5.72% of BTC’s $1.9 trillion market capitalization.

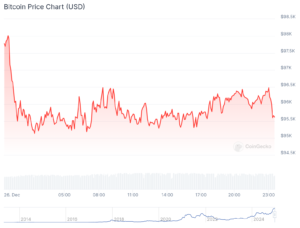

Bitcoin’s Price Record Slight Drop Despite Positive ETF Outing

At the time of press, Bitcoin is changing hands at approximately $96,100, following a 2.2% decline in the past 24 hours. While the token might have mirrored the generalized market slight downturn, it is worth noting that within the past 24 hours, BTC’s minimum and maximum prices were $95,134.28 and $98,246.55, respectively.

The price extremes above highlight Bitcoin’s embattled state even after establishing a $108,000 peak price within the month. Despite the subtle price decrement, BTC’s 24-hour trading volume displayed a 23.88% jump, boasting a $45.96 billion valuation.

Bitcoin ETF Exposure Could Soar as New Filings Target Reputable BTC Holdings Firms

In one of its most recent news, Crypto2Community reported that two asset management firms, Bitwise and Strive, have filed for ETF investments from companies with significant Bitcoin holdings. If approved, the initiative would expand Bitcoin ETF exposure among companies, boosting institutional investments and interests in the commodities.

Bitwise files for Bitcoin Standard Corporations ETF…

Would own stocks of companies that have adopted the “bitcoin standard”, which they define as holding at least 1,000 btc in corporate treasury.

The btc treasury operations virus is spreading. pic.twitter.com/me0XXX9a6g

— Nate Geraci (@NateGeraci) December 26, 2024

Notably, Bitwise’s proposed “Bitwise Bitcoin Standard Corporations ETF” would consider companies that met some criteria. The conditions include 1,000 minimum BTC holdings, $1 million in daily liquidity, and at least $100 million in market capitalization. On the other hand, Strive’s ETF planned launch would target investments in convertible bonds issued by corporate BTC buyers like MicroStrategy.

Strive, a company founded by Vivek Ramaswamy, files for a “#Bitcoin Bond” ETF. pic.twitter.com/bGCQgLPlEZ

— TFTC (@TFTC21) December 26, 2024

Best Crypto Exchange

- Over 90 top cryptos to trade

- Regulated by top-tier entities

- User-friendly trading app

- 30+ million users

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong.