Highlights:

- Investors are becoming cautious as BONK’s sentiment and funding rate turn negative

- BONK saw a significant surge before declining today

- Major cryptocurrencies are under selling pressure; Bitcoin hasn’t recovered significantly post-decline

The price of BONK is expected to drop as the fervour surrounding meme coins appears to be waning. In other words, the initial excitement of meme coin investors is dwindling, reflected clearly in their recent actions and market behaviour. We dive right in on the action to see what’s next for the meme coin market and what set expectations for the next few months.

Investors Wave BONK Goodbye

While BONK’s price previously benefited from investor optimism, this sentiment is diminishing due to unfavourable macroeconomic conditions in the crypto market. This shift is evident in the weighted sentiment of BONK investors, a metric that aggregates and analyzes all relevant mentions and expressions to gauge public opinion or investor sentiment.

Positive sentiment indicates bullishness, whereas negative sentiment suggests bearishness. For BONK, investor sentiment has been bearish since the start of the month, and this trend is becoming more pronounced.

BONK’s Negative Funding Rate

The growing scepticism among investors is also reflected in BONK’s funding rate. This rate, a periodic payment exchanged between traders in a futures contract, helps keep the contract price in line with the spot price. A positive funding rate indicates a bullish market, while a negative rate points to a bearish one.

The negative funding rate in futures contracts reflects investor caution about the sustainability of BONK’s recent rally. Despite bullish signals from spot market indicators such as the Parabolic SAR, many investors are hedging against potential downside risks, indicating a cautious market sentiment.

BONk Shows Strong Upward Price Momentum Before Going Down

The Solana-based meme has demonstrated notable resilience amid the early July sell-off. Over the past three weeks, the coin has twice rebounded from the $0.000018 horizontal support, indicating active buyer interest in purchasing this dip. On July 9, BONK’s price surged over 25%, accompanied by a notable increase in its coin market cap. This increase is probably due to the treasury’s announcement of a substantial token burn.

BONK DAO has received a proposal to BURN ~84B BONK from its Treasury representing the Q2 amount of BONK sent to the DAO from BONKBot.

All BONK locked on BonkRewards is now able to vote on community proposals.

Voting:https://t.co/akvJAfpCcM

— BONK DAO (@bonk_dao) July 8, 2024

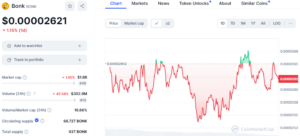

At the time of writing, BONK is trading at $0.00002621, marking a decrease of 1.15% over the past 24 hours. This decline in price reflects shifting investor sentiment, influenced significantly by Bitcoin’s recent price downturn, which is impacting the broader market.

BONK Price Prediction: Hovering Above Crucial Support

Currently, BONK’s price is holding above a critical support level of $0.00002721, a level that has previously acted as both support and resistance. The likelihood of a drop below this threshold is significant, potentially pushing the price down to $0.00002153. These market conditions indicate a further decline, but analysts expect the $0.00002000 level to offer substantial support, potentially preventing a deeper fall.

However, if the broader market conditions improve, BONK could recover. If the current downtrend reverses or stabilizes, BONK’s price might rebound to $0.00003000, invalidating the bearish outlook.

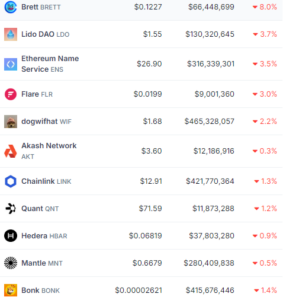

BRETT, FLOKI, and BONK – Worst Performers in Top 100 Cryptos

On June 10, 2024, the largest meme coins are experiencing significant losses despite a stable overall cryptocurrency market. “Based Brett” (BRETT), a prominent meme coin on Coinbase’s Base platform and marketed as “Pepe’s friend on Base,” stands out as the only top 100 cryptocurrency to have dropped over 10% overnight.

BRETT has plunged 10.2% in the past 24 hours. Similarly, Floki (FLOKI) has experienced a 5.2% decrease, according to CoinGecko data, and is at risk of being surpassed by The Graph (GRT) as the 50th largest cryptocurrency by market capitalization.

Meanwhile, amidst news of Base (BASE) surpassing OP Mainnet in total value locked (TVL), some of its meme coins have seen substantial gains. ChompCoin (CHOMP) surged over 40% in a single day, while Basenji (BENJI) increased by 14%, aiming for a $90 million valuation for the first time.

AI Coins Are Not Doing Well

Overall, the category of Base meme coins has grown by 12.1% overnight, CoinGecko reports. However, the segment of AI cryptocurrencies is also struggling today. With waning interest in AI crypto, many are losing market capitalization.

Leading AI coin Fetch.AI (FET) is down by 2.6%, along with its competitor Oraichain (ORAI), while the Cardano-associated AI protocol Singularity.NET (AGIX) has dropped by 4%, priced at $0.71 on Gate.io. In contrast, Bitcoin (BTC) is trading at $69,510, up by 0.8% over the last 24 hours.

Markets Down

The recent downturn in the cryptocurrency market can be attributed to several key factors:

- Macroeconomic Uncertainty: The U.S. labor market report for May showed stronger-than-expected job growth, which suggests the economy is handling the tight fiscal policies better than anticipated. This has reduced the likelihood of the Federal Reserve cutting interest rates soon, which is essential for increased liquidity in risk assets like cryptocurrencies.

- Regulatory Concerns: Continued delays by the U.S. Securities and Exchange Commission (SEC) in approving Bitcoin and Ethereum exchange-traded funds (ETFs) have dampened investor enthusiasm. Additionally, legal actions against major crypto entities, such as the recent charges against the founders of Samourai Wallet for money laundering, have heightened regulatory scrutiny, adding to market uncertainties.

- Market Dynamics and Liquidations: There has been significant liquidation of long positions across the crypto market. Recent liquidations of over $380 million in long positions have significantly pressured prices downward. This is compounded by a general reduction in trading volumes and total value locked (TVL) in the market.

- Technical Indicators: Technical analysis indicates a bearish divergence in the market’s relative strength index (RSI), suggesting that despite recent price increases, the momentum is weakening, which often precedes a price decline.

These factors collectively contribute to the current bearish trend in the cryptocurrency market. However, based on historical data, the market can return back to its forte much faster than we think.

Read More

- Next Cryptocurrency to Explode in July 2024

- Crypto Price Predictions

- Best Solana Meme Coins to Buy In 2024

- XRP Price Prediction: XRP Could Soon Test $0.54 as Broader Market Sentiment Improves