Highlights:

- Bitcoin and Ethereum ETFs sustained their impressive streaks to conclude the week profitably.

- ETH and BTC prices stabilize around crucial levels as the bull run continues.

- Bitcoin and Ethereum ETFs’ cumulative net inflows continue to trade above the $1 billion range.

Bitcoin (BTC) and Ethereum (ETH) exchange-traded funds (ETFs) flow data for December 6 revealed that the entities concluded the week with net profits. According to SosoValue’s statistics, BTC ETFs recorded their seventh consecutive gain with a fresh $376.59 million input. With the latest contribution, Bitcoin ETFs’ weekly profit soared considerably, hitting about $2.73 billion.

Bitcoin spot ETF had a total net inflow of $377 million on December 6, and continued to have net inflow for 7 consecutive days. BlackRock ETF IBIT had a net inflow of $257 million per day, and Fidelity ETF FBTC had a net inflow of $120 million per day. https://t.co/59u0BnEqLG pic.twitter.com/aeKNLzRPoy

— Wu Blockchain (@WuBlockchain) December 7, 2024

On the other hand, their Ethereum counterparts’ gainful streak continued, extending into a tenth straight day. The on-chain tracker noted that the ETH commodities attracted $83.76 million in cash inflows on December 6, bringing their weekly gains to about $836.69 million. The over $800 million profits marked the entity’s highest-ever weekly gain since it graced the crypto market.

Ethereum spot ETF had a total net inflow of $83.7587 million on December 6, and continued to have net inflow for 10 consecutive days. Fidelity ETF FETH had a net inflow of $47.8829 million per day, and BlackRock ETF ETHA had a net inflow of $34.5594 million per day.… pic.twitter.com/JuDfznZRhW

— Wu Blockchain (@WuBlockchain) December 7, 2024

Ethereum ETFs Surged Significantly as its Cumulative Net Inflows Hit Over $1 Billion

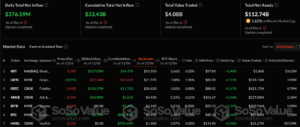

December 6 was an eventful date for Ethereum ETFs, with seven active commodities. Only Franklin Bitcoin ETF (EZET) and Invesco Bitcoin ETF (QETH) registered zero flows. Meanwhile, five ETFs saw inflows, while two registered losses.

Grayscale Ethereum ETFs (ETHE) led the losses chart with about $29.59 million in outflows. Similarly, 21Shares also recorded losses of about $6.93 million. In profits, four entities recorded gains above $10 million. Fidelity Ethereum ETF (FETH), BlackRock Ethereum ETF (ETHA), Grayscale Mini Ethereum ETF (ETH), and Bitwise Ethereum ETF (ETHW) registered profits of about $47.88 million, $34.56 million, $22.9 million, and $13.45 million, respectively.

VanEck Ethereum ETF (ETHV) also recorded cash inflows valued at approximately $1.49 million. Consequently, the cumulative net inflow spiked from about $1.33 billion to $1.41 billion. The total value traded was roughly $992.49 million, while total net assets reflected $13.36 billion.

Like the ETFs, Ethereum market actions have remained consistently positive. Recently, the token struck the $4,000 price mark, with market participants speculating that the altcoin season might seem imminent. However, while the coin has retraced to about $3,999, it has continued fluctuating between the $3,000 and $4,000 levels.

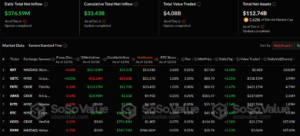

Bitcoin ETFs Record Net Gains Amid Reduced Market Activeness

Unlike Ethereum, only five commodities were active, and the remaining six recorded zero flows. Notedly, Fidelity Bitcoin ETF (FBTC) recorded the only outflow worth approximately $32.26 million. For the profitable commodities, two recorded gains above $100 million. BlackRock Bitcoin ETF (IBIT) topped the profits charts with about $257.03 million. Fidelity Bitcoin ETF (FBTC) followed closely with roughly $120.17 million.

Other profitable entities include ARK 21Shares (ARKB) and Grayscale Mini Bitcoin ETF (BTC). Both commodities attracted about $24.90 million and $6.75 million, respectively. Following the latest contributions, Bitcoin ETFs’ cumulative net inflows spiked to about $33.43 billion. The total value traded and net assets reflected approximately $4.08 billion and $112.74 billion, respectively.

Whales Capitalize on BTC’s Price Dip to Accumulate the Token

It is no longer news that BTC has sustained a wild run this week, eventually culminating in breaking above $100K for the first time and establishing $103,679 as its current all-time high (ATH). At the time of writing, BTC is changing hands at about $99,500, reflecting a 1.6% upswing in the past 24 hours.

Within the short daily timeframe, BTC fluctuated between $97,808.83 and $102,034. Hence, it provided a buying window for investors hoping to accumulate the token below $100K. A renowned market chartist, Ali Martinez, reported that whales have capitalized on the subtle price drop to accumulate massive BTC holdings. Per the chartist, large investors spent about $2 billion to accumulate 20,000 BTC in the past 24 hours.

#Bitcoin whale accumulation is going parabolic. They just bought another 20,000 $BTC in the last 24 hours, valued at $2 billion! pic.twitter.com/jkbTPvr0rt

— Ali (@ali_charts) December 6, 2024

Best Crypto Exchange

- Over 90 top cryptos to trade

- Regulated by top-tier entities

- User-friendly trading app

- 30+ million users

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong.