Highlights:

- Bitcoin has soared past the $100K status for the first time.

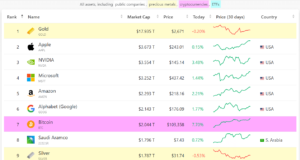

- The flagship cryptocurrency now ranks as the seventh most valuable asset in global rankings.

- Coinbase CEO suggests strategic Bitcoin reserve as a solution to counter inflation.

After a few days of consolidating with price movements below the $100K price status, Bitcoin is finally back on track with significant increments that aided it break above $100,000 for the first time.

In the past 24 hours, the flagship cryptocurrency skyrocketed by about 8.1% and boasts roughly $103,540 in selling price. Within the short-term timeframe, BTC displayed price extremes ranging between $94,870.26 – $103,679.

While the minimum and maximum price levels above signify a significant jump within a daily interval, it is worth noting that the upper limit mark represents BTC’s new all-time high (ATH). The pioneer cryptocurrency attained its latest price peak a few hours ago. It could break above the ATH if Bitcoin sustains its current momentum.

Following the recent spikes, Bitcoin market capitalization also attained new heights, surpassing the $2 trillion market for the first time. It has a current valuation of about $2.049 trillion, with Bitcoin dominance at 56.79.

Considering previous levels, the dominance retraced from about 60%, which invariably implies altcoins’ surge. Moreover, Bitcoin’s 24-hour trading volume displayed a considerably active network, with its valuation at approximately $106.7 billion.

MicroStrategy’s Stock Soars

It is no longer news that Michael Saylor’s MicroStrategy (MSTR) has emerged as one of the biggest winners of the bull run. In a tweet circulating, The Kobeissi Letter, representing the official handle dedicated to the global capital markets commentary, relayed to its over 600K followers that MicroStrategy’s stock has spiked overnight.

In the tweet, the global market commentator stated, “MicroStrategy stock, MSTR, surges 10% in overnight trading as Bitcoin hits $100,000.” Additionally, it revealed that with the tremendous surge, the American-based investment firm’s Bitcoin position has exceeded $40 billion for the first time.

BREAKING: MicroStrategy stock, $MSTR, surges 10% in overnight trading as #Bitcoin hits $100,000.

MicroStrategy's Bitcoin position is now worth over $40 billion for the first time in history.

CEO @Saylor says Bitcoin is just getting started. pic.twitter.com/FnVMPVHdRi

— The Kobeissi Letter (@KobeissiLetter) December 5, 2024

While Bitcoin has continued to soar, its co-founder Saylor has remained vocal on BTC’s accumulation even up to the next few years. In one of his numerous tweets, captured by Crypto2Community, Saylor revealed that MicroStrategy plans to raise $42 billion over three years. He said the investment platform will spend the funds on only accumulating more BTC.

Bitcoin Now Ranks as the Seventh Most Valuable Global Asset

While Gold maintained its position as the world’s most valuable asset, with a market capitalization of roughly $17.935 trillion, Bitcoin has continued to rise gradually. Following its recent upswing, BTC’s ranking has increased. It is now the seventh most-priced asset, with a valuation of $2.044 trillion.

The pioneer cryptocurrency valuation exceeded leading companies, including Saudi Aramco, Silver, Meta Platforms (Facebook), Tesla, etc. None of the listed firms has a market capitalization of $2 trillion. Saudi Aramco is the closest to $2 trillion, with about $1.796 trillion.

Meanwhile, considering Alphabet (Google) and Amazon’s net worths relative to Bitcoin’s current market actions, chances abound that BTC could soon displace both to assume the fifth spot. For context, Alphabet (Google) boasts approximately $2.14 trillion in market capitalization, while Amazon has a total valuation of $2.293 trillion.

Coinbase CEO Advocates for Bitcoin Reserves as a Weapon Against Inflation

Reacting to BTC’s latest feat, Brian Armstrong, the Chief Executive Officer (CEO) and co-founder of American-based exchange Coinbase, asserted that BTC remains the best-performing asset over the past twelve years. He also stated that Bitcoin has achieved tremendous feats despite still existing in its early days.

Backing his claims, the CEO painted an analogy: “If you bought $100 of Bitcoin when Coinbase was founded in June 2012, it would now be worth about $1,500,000. If you kept the $100, you’d only be able to purchase about $73 worth of goods today.” Additionally, the founder spoke on how government bodies can fight against inflation, citing strategic Bitcoin reserves as a possible solution.

If you bought $100 of Bitcoin when Coinbase was founded in June 2012, it would now be worth about $1,500,000.

If you kept the $100 USD you'd only be able to purchase about $73 worth of goods today.

Bitcoin is the best performing asset of the last 12 years, and it's still early… pic.twitter.com/dvBgX5K7or

— Brian Armstrong (@brian_armstrong) December 5, 2024

Best Crypto Exchange

- Over 90 top cryptos to trade

- Regulated by top-tier entities

- User-friendly trading app

- 30+ million users

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong.