Highlights:

- Despite recent delays by the SEC, Ethereum is poised for growth with the anticipated Ethereum Spot ETF, signaling potential market impact.

- Notcoin demonstrates resilience and potential for high returns, supported by its integration with Telegram and recent price stabilization.

- Solana attracts institutional interest with upcoming ETF filings by major players like BlackRock, enhancing its visibility and investment appeal.

The cryptocurrency landscape has been volatile, with Bitcoin experiencing fluctuations below $60k after peaking over $70k. This instability suggests a possible rebound soon. Due to their smaller market caps and greater growth potential, altcoins tend to surpass Bitcoin in gains during market recoveries. These traits make altcoins more sensitive to positive market shifts.

While Bitcoin forms a fundamental part of a diversified crypto investment strategy, including altcoins could enhance returns in a bullish phase. Their significant potential for larger percentage increases makes them crucial for a well-rounded crypto portfolio, offering a balance between stability and high return possibilities. Let’s discuss 5 altcoins with the most potential in July, including Ethereum, Notcoin, Solana, Toncoin, and Arbitrum.

Altcoins With the Most Potential in July

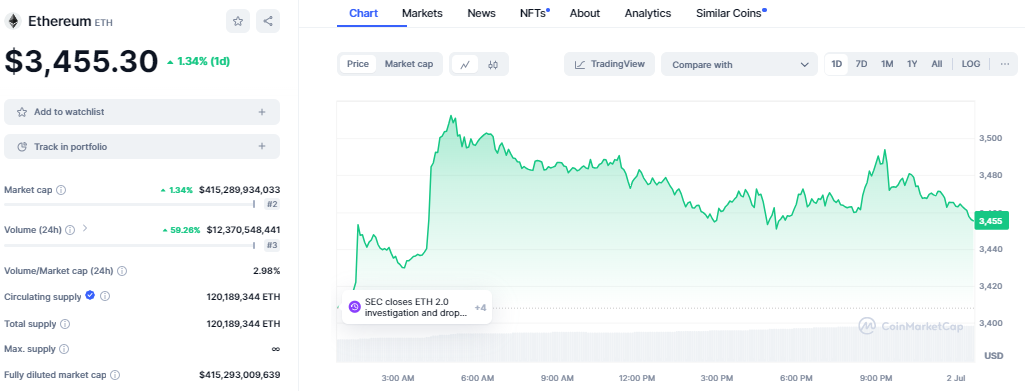

1. Ethereum (ETH)

Ethereum operates as a decentralized network, supporting applications and smart contracts on its blockchain. Despite high transaction fees, its extensive ecosystem and crucial role in supporting various altcoins position it favorably for a potential upturn in July. Ethereum is trading at $3,455 with a market cap of $415 billion and a trading volume of $12.3 billion.

The much-anticipated approval of Ethereum Spot ETF this July adds more potential to Ethereum’s upcoming rally. However, the anticipated launch of spot Ethereum ETFs in the United States has been delayed. Originally slated for early July, the U.S. Securities and Exchange Commission (SEC) has extended the timeline. Following a review of the S-1 forms late last week, the SEC requested resubmissions by July 8, pushing the expected launch to mid-to-late July.

Unfort think we gonna have to push back our over/under till after holiday. Sounds like SEC took extra time to get back to ppl this wk (altho again very light tweaks) and from what I hear next wk is dead bc holiday = July 8th the process resumes and soon after that they’ll launch… https://t.co/0ZQR7yiBLt

— Eric Balchunas (@EricBalchunas) June 28, 2024

According to Bloomberg Senior ETF Analyst Eric Balchunas, this adjustment could see the ETFs debut later in the month. This development follows the successful introduction of spot Bitcoin ETFs, positively impacting Bitcoin’s market dynamics. Similarly, the Ethereum market is poised for potential growth from the anticipated capital inflows once the ETFs go live.

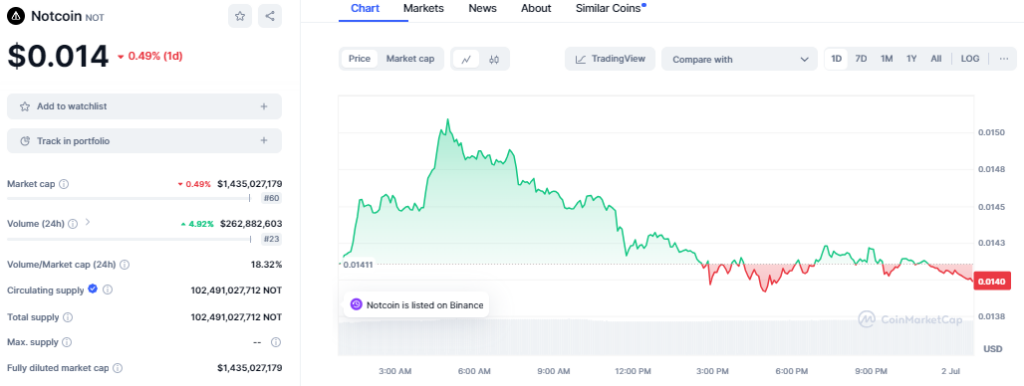

2. Notcoin (NOT)

Notcoin, priced at $0.014, is integrated with the Telegram app, tapping into its vast user base. This lesser-known altcoin draws strength from Telegram’s global reach and active development community. Its growth potential is significant as it facilitates user transactions on the platform, positioning it for increased adoption and value appreciation in the digital currency market.

Notcoin has recently captured the attention of crypto analyst VogueDiva as its value stabilized around $0.01413, following a notable ascent to a peak of $0.035. This development came after a robust uptrend, where the currency showed significant gains, signaling strength within its market dynamics.

$NOT is making waves! ✨

We've seen a strong upward trend followed by a descending channel at $0.01413!

It touched a high of $0.035 and is now consolidating. 🥂

This could be a prime BUYING and HODLing opportunity if it breaks above the channel. 🚀 pic.twitter.com/y3yTsyj4x0

— VogueDiva (@Diva_says1) June 30, 2024

Moreover, current trends depict Notcoin within a descending channel, suggesting consolidation at the present level. Investors should closely monitor this pattern, as a breakout above this channel could indicate a lucrative buying opportunity, enhancing the asset’s prospects for a favorable return.

Additionally, this price consolidation phase serves as the calm before a potential upward storm. Investors considering long-term holdings, commonly called ‘HODLing’, might find this an opportune moment to increase their stakes in Notcoin, provided it breaches the channel resistance.

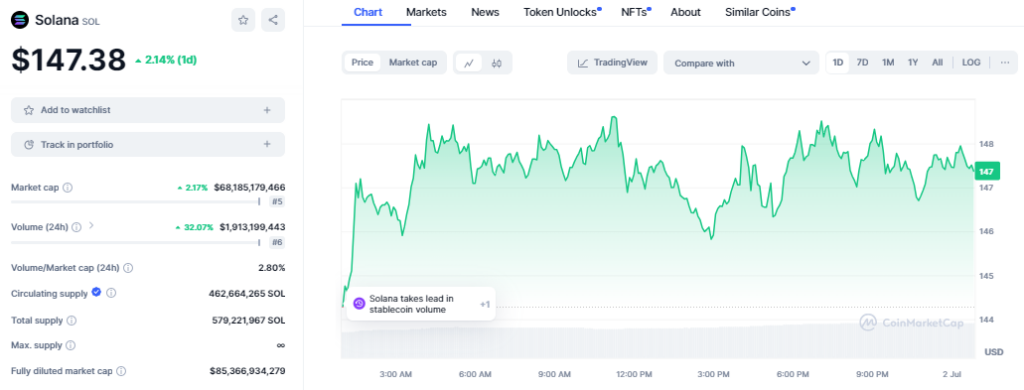

3. Solana (SOL)

Solana, known for rapid transactions and low fees, has become popular among investors. This blockchain platform addresses speed and scalability issues that older technologies face. Recently, Solana hit a two-year peak, stabilizing as a top-five cryptocurrency by market capitalization. Currently priced at $147, Solana has surged 700% over the last year.

The recent announcements by major institutions joining the race to launch the Solana ETF products continue to gain more traction. The filings made by VanEck and 21Shares indicate that institutional investors are becoming increasingly interested in Solana. These developments might potentially set Solana on a potential surge.

Institutions like $SOL

ARK/21Shares & VanEck both

have filed for a spot Solana ETF pic.twitter.com/0ZFiIEPlLb— Altcoin Daily (@AltcoinDailyio) July 1, 2024

Moreover, Wall Street asset management giant BlackRock is getting ready to file an exchange-traded fund for Solana. This follows earlier reports in June that the global asset management had plans to initiate this process in July. BlackRock, 21Shares, and VanEck’s potential entry into the Solana ETF market would be a key moment for Solana.

The regulatory approval of a SOL ETF is poised to attract more institutional and retail investors. This scenario echoes the early days of Ethereum ETFs, which expanded investor bases and elevated ETH’s price. As SOL’s ecosystem advances and its technology evolves, it is well-positioned for a potential surge in the short term.

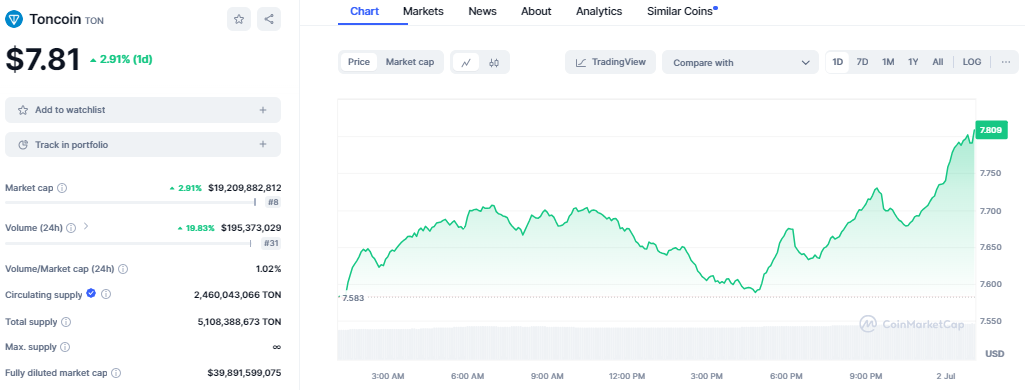

4. Toncoin (TON)

Toncoin, developed by Telegram, utilizes scalable layer-1 blockchain technology. Its market cap is $19.2 billion, and the token price is $7.81. Over the past year, it surged by 447%. Currently approaching its record high of $8.2, TON’s robust uptrend could soon surpass this ATH. This growth, supported by strong market foundations, makes TON one of the best altcoins with the most potential in July.

Over the past week, a notable surge in Toncoin acquisitions by the whales has sparked interest in the cryptocurrency community. According to data from Santiment, the whales have collectively purchased more than 45 million Toncoin tokens, valued at around $346 million.

Whales have bought more than 45 million #Toncoin $TON over the past week, worth around $346.5 million! pic.twitter.com/P3UKHHjHcU

— Ali (@ali_charts) June 30, 2024

This strategic buying spree coincides with Toncoin nearing its all-time high, indicating a bullish sentiment among these holders. Specifically, wallets holding between 10,000 and 100,000 TON have increased to over 150, a significant rise pointing to heightened investor confidence.

Moreover, this accumulation trend suggests that these seasoned investors are capitalizing on the current price levels. Consequently, the increase in whale wallets underscores a robust investor interest, as these key players in the market position themselves for potential further gains.

5. Arbitrum (ARB)

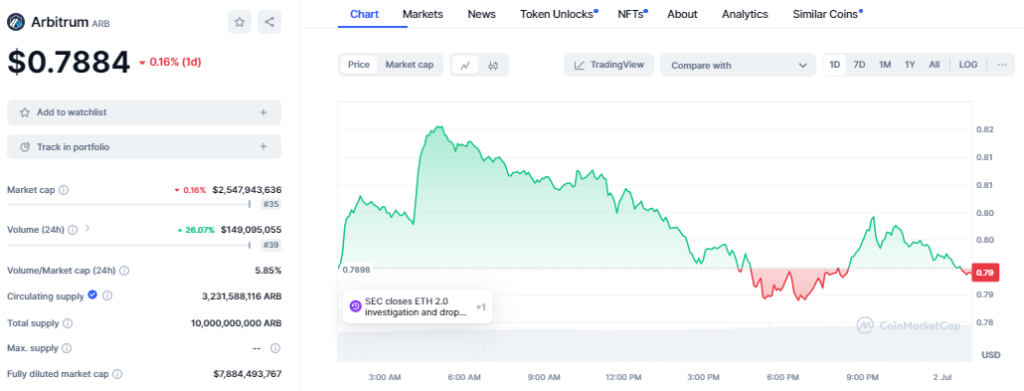

Despite stiff competition in the decentralized finance (DeFi) sector, Arbitrum remains a dominant force, continuously adopting innovative solutions to improve transaction efficiency. ARB has a value of $0.7884, a market cap of $2.54 billion, and a trading volume of $149 million, respectively.

The recent proposal to introduce “Timeboost,” a transaction ordering policy, marks a significant development that could reshape user interactions and network performance. Arbitrum’s strategic deployment of Timeboost has rekindled interest across its network, which has witnessed varied activity levels over time. This policy could enhance efficiency and a smoother user experience, elements crucial for maintaining and expanding Arbitrum’s market share in a bustling ecosystem.

Introducing Timeboost; a new tx ordering policy for Arbitrum chains.

Check out the AIP that just went live on the forums for the inclusion of Timeboost on Arbitrum One and Arbitrum Nova.https://t.co/nTZ9zuAXyZ pic.twitter.com/nd8EH0fSJE

— Arbitrum (💙,🧡) (@arbitrum) June 28, 2024

The enhancement brought about by Timeboost is poised to attract a broader user base, potentially boosting transaction volumes and stabilizing the network’s trading value. By consistently innovating and adapting, Arbitrum is well-placed to sustain its relevance and growth in the DeFi sector. The ongoing success of initiatives like Timeboost will be vital for Arbitrum’s future prospects in retaining a competitive edge.

Conclusion

This month, the focus shifts toward the discussed altcoins, each poised for significant market movements. These altcoins promise substantial returns due to their innovative technologies and strong market positions and offer diverse opportunities for investors looking to expand beyond Bitcoin. Potential regulatory approvals and strategic innovations are set to elevate their market presence and attract both retail and institutional investors.