Highlights:

- The Cardano price has kicked off 2026 in the green, soaring 5% to $0.35.

- The derivatives data show the funding rate has flipped positive, adding to the positive sentiment.

- The technical outlook shows bullish strength, as ADA builds recovery towards $0.40.

The Cardano price (ADA) has kicked off the New Year in the green, as it has gained 5% over the past 24 hours to trade at $0.35. The derivatives data are also improving, which is a sign of increasing bullish interest. The technical picture continues focusing on an upside breakout towards $0.40.

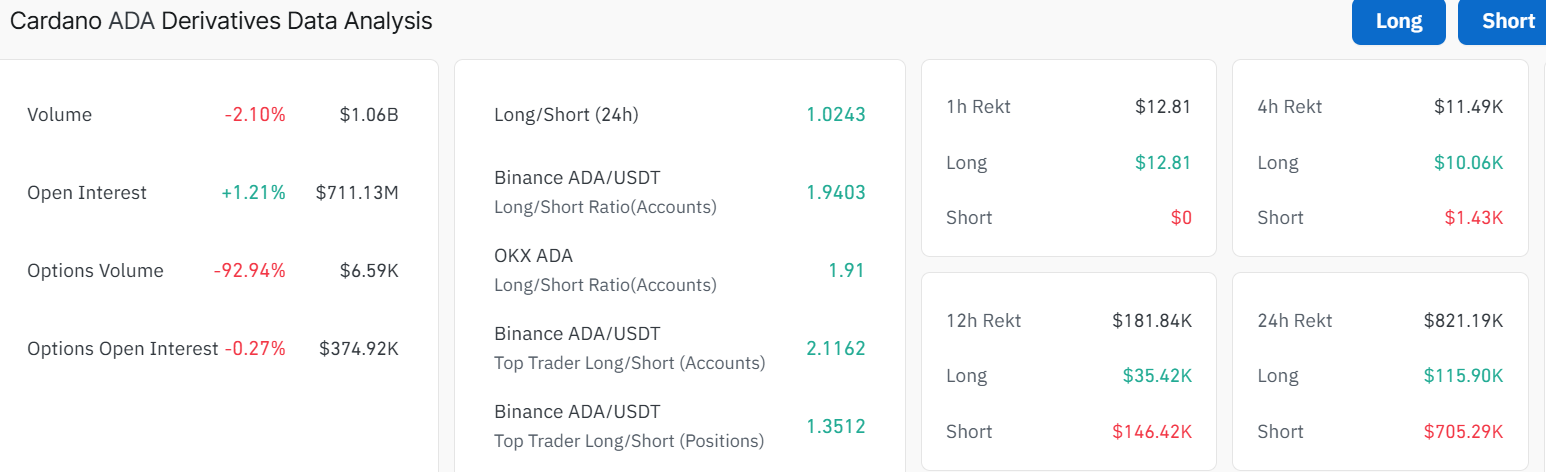

A quick look at Coinglass data, the open interest has improved, rising 1.21% to $711.13 million. This indicates that investors’ interest is growing in the ADA market. However, the volume has slipped 2.10% to $1.06 billion, showing a slight drop in trading activity. Further, the long-to-short ratio has hit 1.0243, tilting the odds towards the bulls.

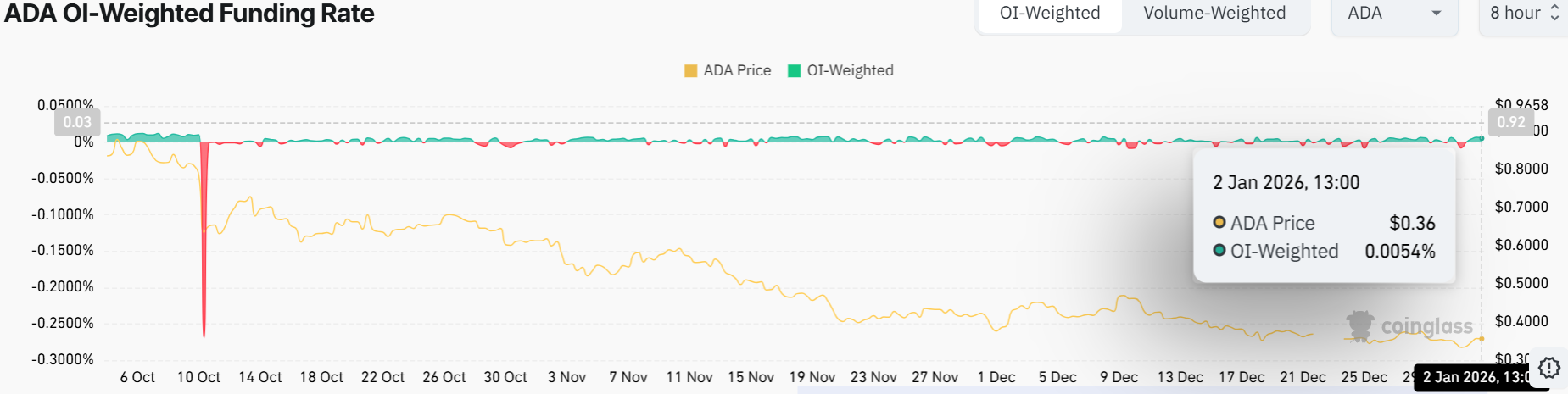

Additionally, the funding rate data of Cardano suggests a possible rally. Based on Coinglass OI-Weighted Funding Rate data, fewer traders expect a decrease in Cardano price than those who expect it to increase.

The metric turned to a positive rate on Thursday and is at 0.0054% on Friday, which means that longs are paying shorts. In the past, ADA soared when the funding rates flipped from negative and shifted to positive.

Cardano Price Builds Recovery Towards $0.40

Looking at the daily price chart, the ADA price is showing significant strength after bouncing from key support levels. The $0.32 price zone has acted as a dependable support, with buyers stepping in multiple times when the price dipped near this level.

ADA is now trading well at $0.35, as the bulls target the immediate resistance zone at $0.40 in the coming days. Recent price action shows that as soon as the coin breaks above the $0.40 mark, new buyers may appear, causing the price to rebound sharply toward the $0.46-$0.60 resistance.

Meanwhile, the Relative Strength Index (RSI) is at 43.15. This suggests momentum is neither overbought nor oversold, leaving room for movement in either direction. The MACD is positive, with the blue line above the orange signal line, showing buyers are building momentum. However, both lines being in the negative territory indicate some shaky outlook, but the odds tilt towards the bulls.

Looking at the bigger picture, resistance is at $0.40. If Cardano price breaks this level, the next target could be at $0.45-$0.60. Meanwhile, the bears have set the long-term resistance at $0.65, which aligns with the 200-day SMA. A close above this zone will flip the market outlook to bullish.

Conversely, support sits at $0.32. If the price falls below this zone, the selling may accelerate, but strong institutional interest suggests buyers are likely to defend this zone. If the current momentum holds, the price could punch through resistance soon, especially if the volume spikes. But a drop under $0.32 could trigger a short correction before buyers return.

Best Crypto Exchange

- Over 90 top cryptos to trade

- Regulated by top-tier entities

- User-friendly trading app

- 30+ million users

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong.