Highlights:

- The Solana price has rebounded to $197 from the $172 lows.

- Its DeFi TVL has soared 8% to $11 billion, showing growing interest.

- The technical outlook shows a potential rally if the Solana price breaks above the $216 resistance.

The Solana price is showing a strong recovery, rebounding 9% to $197, following the market crash that saw it plunge to $172. Accompanying the price movement is its daily trading volume, which has soared 16%, indicating intense trading activity in the market. In recent months, Solana has experienced a massive upswing in its blockchain and recently minted 250 million USDC within 60 minutes.

🚨NEW: @Circle minted ~250M $USDC on @solana in the last 60 minutes. pic.twitter.com/GE5g6ICo1T

— SolanaFloor (@SolanaFloor) October 13, 2025

The recent success in the USDC minting by Solana proves the strength of the infrastructure created by the network. The low fees and minimal production of minting mean that Solana is able to accommodate high volumes of operations simultaneously, remaining efficient and lowering the operations cost. The recent news reflects Solana’s capability to be a valuable hub of decentralized applications (dApps) that can support the most critical DeFi projects.

Market Position and DeFi Growth of Solana

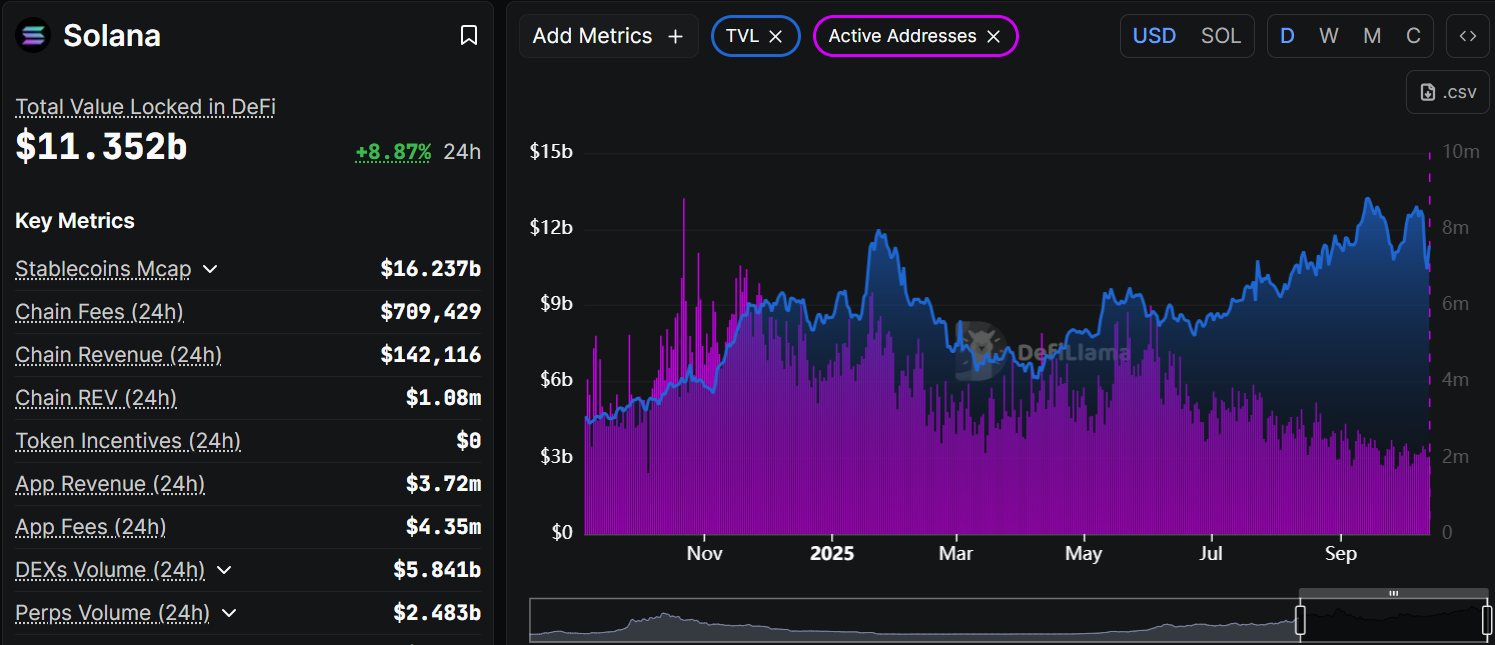

Meanwhile, the total value locked (TVL) of Solana has increased to 11.352 billion from $10.93 billion, recorded on October 10. This marks a remarkable 8.87% increase over the past 24 hours, hence growing confidence. The liquidity and speed of transactions enhance the decentralized finance value of Solana, making it an attractive option for decentralized exchanges (DEX) and other decentralized finance (DeFi) infrastructure.

Besides, the active addresses of the platform are also increasing. Currently, the Solana blockchain has 2.3 million active users, indicating growth among both retail and institutional users.

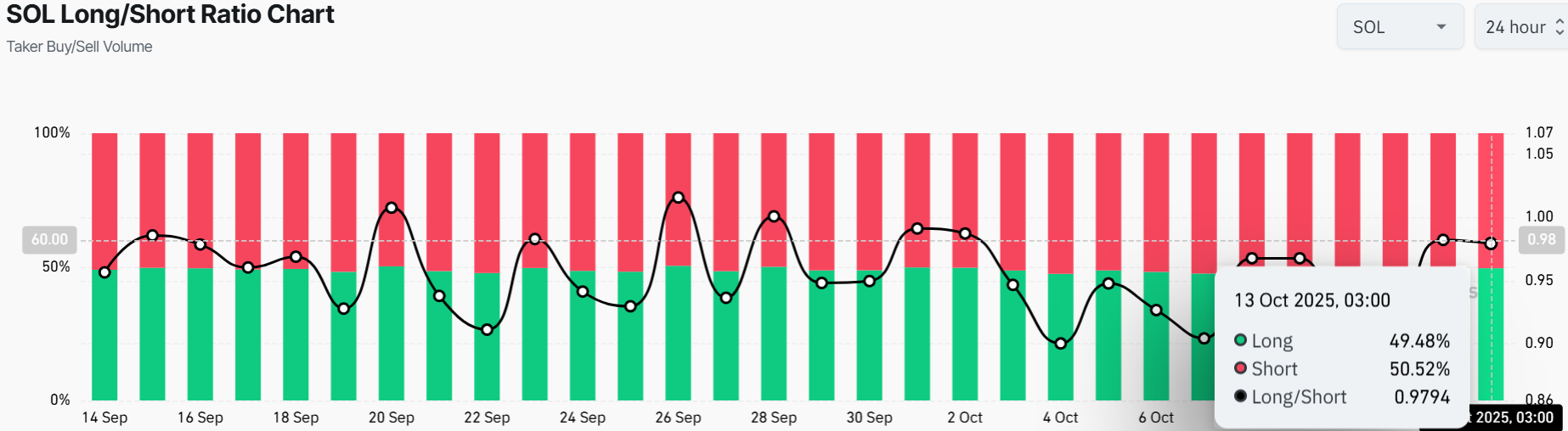

Also, the long/short ratio chart of Solana, which represents the ratio of the long and short positions, shows that there is a balance between the long and short forces. This indicates that the investors are bullish yet cautious as they know the power of the network and appreciate the instability of the cryptocurrency environment.

The shorts positions have the lion’s share of 50.52% while the longs take the rest at 49.48%. The long-to-short ratio sits at 0.9794, indicating that the bulls need momentum and break above the 1 mark.

Can Solana Price Break Above $216 Resistance Soon?

The 1-day chart timeframe for SOL/USDT shows a wild ride. The price recently dipped to a low of $172, the support zone, before staging a solid bounce and currently hovering around $197. That’s a 9% pump.

The 50 SMA (Simple Moving Average) at $216.30 is acting as a resistance level, while the 200 SMA (blue line) at $172 suggests a longer-term upward trend. The Relative Strength Index (RSI) at 42.45 is headed upward, and a surge past 50 could stir an upside movement.

Looking ahead, the Solana price broke below the falling channel, signaling bearish strength. If bears stage a campaign, the SOL price might fall back to the recent low of $172. However, if the 200-day SMA holds firm as support, a break above $216 resistance may ignite a rally. The ecosystem growth promises scalability and could potentially drive institutional FOMO. In the short term, Solana price may test that $216 resistance, and a break above with strong volume could ignite a rally.

Best Crypto Exchange

- Over 90 top cryptos to trade

- Regulated by top-tier entities

- User-friendly trading app

- 30+ million users

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong.