Highlights:

- The Near Protocol price has shown a strong bullish momentum, rising 11% to $3.19.

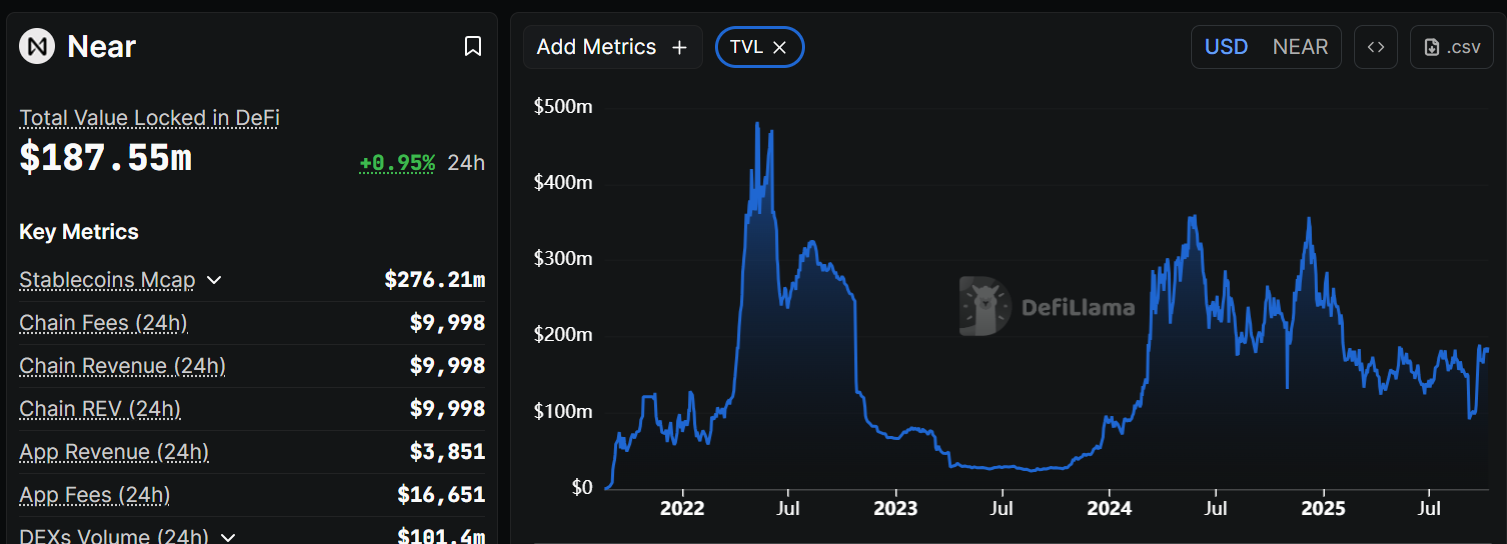

- Its DeFi TVL stabilises around $187.55 million, indicating steady user adoption.

- NEAR Open Interest spikes as bulls target $3.55-$4.00 levels if the momentum holds.

The Near Protocol price is showing a strong bullish set-up, as it soars 11% to $3.19. The daily trading volume has substantially spiked 71% indicating intense hype and confidence among investors. Meanwhile, Near Protocol users can now make private Zcash (ZEC) transfers from Solana to Zcash, thanks to NEAR Intents.

NEAR Intents allows for bridging transfer, where, instead of transparent transactions, users can transfer their funds privately and keep their previous transaction history unknown. The most current private transfer is for ZEC, allowing Solana users to privately transfer their ZEC holdings on the Solana network. To use the bridge between Solana and Zcash, users are encouraged to use SOL or USDC.

Private Zcash transfers from Solana to Zcash are now possible through NEAR Intents 🛡️

Don't wait to shield your ZEC. Buy privately with SOL or USDC. More details below 👇 https://t.co/JkhjYduyBy

— NEAR Protocol (@NEARProtocol) October 10, 2025

NEAR Intents is a cross-chain decentralized protocol that enhances privacy for all involved in a transaction. This is especially the case for private Zcash transfers, which aim not only to protect the value of Zcash holdings from an outside perspective. It also prevents those within the network from viewing transaction details.

Solana now integrates with the privacy network, Zcash, which supports a powerful new upgrade in the decentralised finance (DeFi) arena. This is a massive new development for DeFi transactions, where anonymity is usually favoured over transparency.

NEAR Rising Interest Amid Stabilizing DeFi TVL

Near Protocol continues to expand rapidly, as its Total Value Locked (TVL) sits at $187.55 million, marking a 0.95% increase in the last 24 hours. This shows that NEAR is stable. This increase in user deposits on the network so far this month suggests a regular demand. This could boost the price of its native token, NEAR.

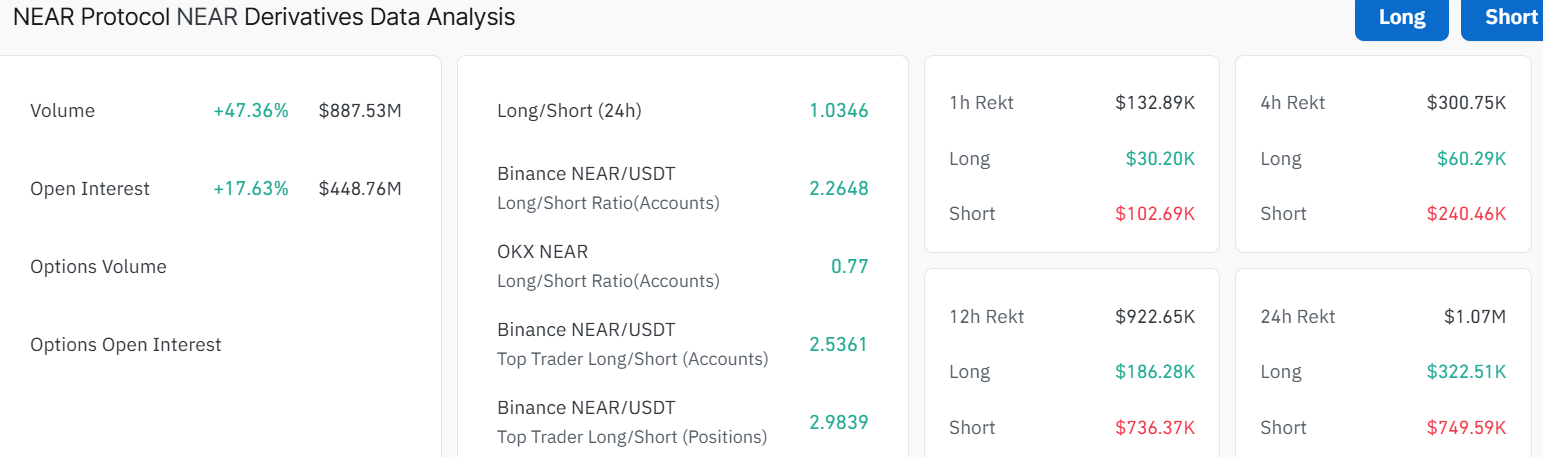

On the other hand, Near’s derivatives data shows a 47.36% increase in derivative volume to $887.53 million and a 17.63% increase in open interest (up to $448.76 million) in Near derivatives over 24 hours. This sudden inflation in OI refers to an increase in positive sentiment among traders, leading to the accumulation of long positions.

Near Protocol Price Outlook: Can the Bulls Sustain the Momentum?

The 1-day chart shows the NEAR/USD price recently spiked to an intraday high of $3.19. The outlook shows that the bulls are in full control, as they aim to break above the asymmetric triangle. The key support zones around $2.74 (50-day SMA) and $2.55 (200-day SMA) give buyers strength for further upside.

The relative strength index (RSI) sits at 61.01, flirting with overbought territory after bouncing from the 50-level. This signals the bull may be pushing for higher gains as the RSI is facing upward. The MACD shows it’s turning bullish and may cross above the signal line, but it hasn’t done so yet. This RSI/MACD combo signals Near Protocol price has bullish momentum, but seasoned investors know that overextension can lead to a pullback.

In the meantime, new buyers risk losing liquidity if early investors cash out. If the price stays above $3 with strong trading volume, it could rise to $3.55-$4.00. But if it falls, the token falls below $3, and more downside is possible towards $2.92.

Best Crypto Exchange

- Over 90 top cryptos to trade

- Regulated by top-tier entities

- User-friendly trading app

- 30+ million users

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong.