Highlights:

- The Cardano price has entered a consolidation phase, with a 4% decline to $0.78.

- The ADA on-chain metrics indicate that holders are realizing a profit, fueling selling pressure.

- Ali Martinez notes that a rebound above $0.80 might rekindle a rally to $0.95.

The Cardano price remains in the red zone, currently down 4% to $0.78. However, the daily trading volume has increased by 13% to $1.27 billion, indicating a rise in trading activity. Cardano (ADA) has experienced a significant decline in prices since the start of September 2025. However, it is now in a consolidation phase, trading between $0.73 and $0.86. Meanwhile, ADA remains above a key support level, at $0.73.

Market Sentiment Shows Intense Selling Pressure

Meanwhile, data from Santiment’s Network Realized Profit/Loss (NPL) metric indicates that Cardano holders are booking some profits after the Cardano price plummeted. This metric calculates the Return On Investment (ROI) daily at a network level, based on the coin’s on-chain transaction volume.

When the NPL of a coin spikes strongly, it indicates that, on average, its holders are selling their bags at a profit. When coin prices take heavy hits, on the other hand, it implies that most holders are selling at losses, signalling panic selling and investor capitulation.

The chart shows that the metric saw significant spikes on Tuesday and Wednesday. This means that, on average, holders are selling their bags at a significant profit. This has caused the selling pressure to surge in the Cardano market.

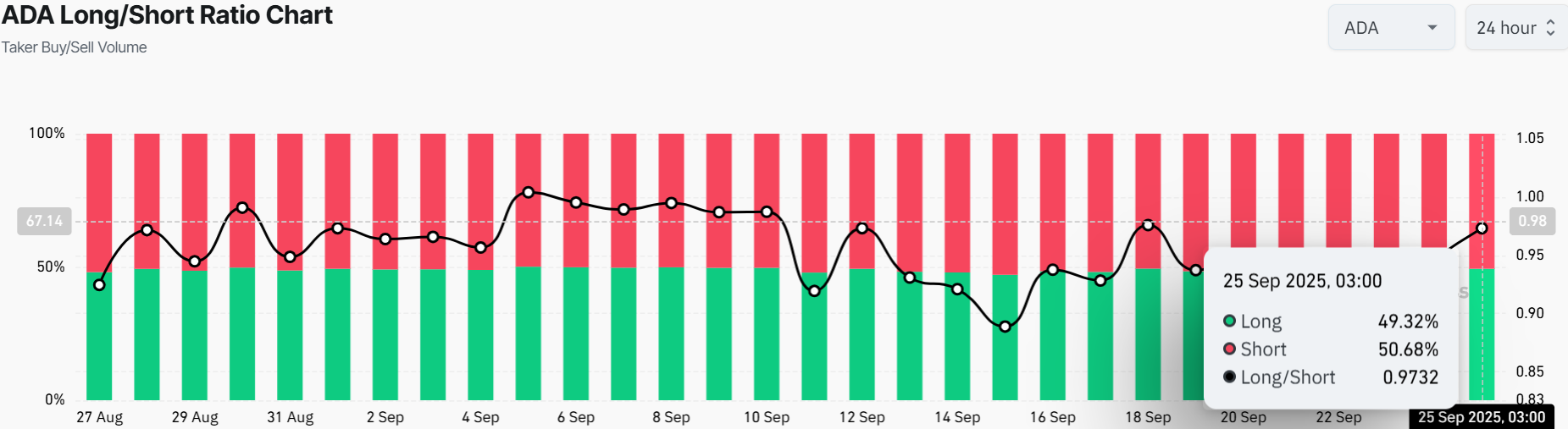

On the other hand, the long/short ratio chart indicates that as of September 25, 2025, a slight majority of traders are positioned short (50.68% shorts vs. 49.32% longs). Due to this close ratio, there are mixed sentiments among traders.

This suggests that some believe a price correction is imminent, while others are anticipating a bullish breakout. This means that if the market turns to favour long positions, a short squeeze for ADA is possible.

Cardano Price Moves Into Consolidation

The Cardano price continues to trade within a defined range, remaining above the 50-day SMA, which indicates that traders are awaiting a breakout or breakdown. Should ADA manage to break the resistance at $0.86 and maintain a position above the support at $0.80, the path to the higher targets of $1.00 and above will be clearer.

Examining the technical indicators, the Relative Strength Index (RSI) of Cardano currently stands at 37.71. This shows that the token is in the oversold territory. In this case, if the bulls initiate a buyback campaign, a break above the 50-mean level will spark a bullish outlook. The MACD, on the other hand, is sitting below the signal line, making a bearish divergence. This indicates that the selling pressure in the Cardano market remains intact unless the MACD indicator changes.

According to CoinMarketCap, the volume is currently up 13%, indicating an increase in recent market activity. Looking ahead, Cardano price could rebound if the market turns overly bullish, pushing it past the $0.80 resistance. A break above $0.80 would target $0.95 to $1.12 in the coming weeks.

As long as Cardano $ADA holds $0.80, a rebound to $0.95 stays on the table. pic.twitter.com/W4lsBftZZa

— Ali (@ali_charts) September 24, 2025

However, if bears capitalize on the sell signal in the market, Cardano’s price might slide back to $0.73 or lower.

Best Crypto Exchange

- Over 90 top cryptos to trade

- Regulated by top-tier entities

- User-friendly trading app

- 30+ million users

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong.