Highlights:

- Bitmine significantly increased its Ethereum holdings, now owning approximately 1.95 million ETH.

- Large ETH transfers worth $69 million occurred in under an hour via Galaxy Digital.

- Ethereum-focused firms continue expanding treasuries, positioning themselves strongly amid market and price pressures.

Bitmine, a cryptocurrency firm led by Wall Street veteran Tom Lee, has significantly increased its Ethereum holdings. The company now holds approximately 1.95 million ETH, valued at around $8.66 billion, according to Arkham data.

Blockchain records reveal multiple large transfers between Galaxy Digital and Bitmine in recent hours. Notable transactions include 3,247 ETH ($14.55 million), 3,258 ETH ($14.6 million), 4,494 ETH ($20.06 million), and 4,428 ETH ($19.77 million). In total, 15,427 ETH, worth roughly $69 million, was moved in under an hour via Galaxy Digital’s private trading desk.

TOM LEE IS BUYING EVEN MORE $ETH

Tom Lee’s Bitmine just bought another $69M of ETH from Galaxy Digital. They now hold $8.66 BILLION of ETH.$BMNR is bullish on $ETH. pic.twitter.com/t9BWh9btPR

— Arkham (@arkham) September 19, 2025

Bitmine’s new purchase comes after several big buys in recent weeks. On September 11, it received 46,255 ETH worth $201 million from a BitGo wallet. A week earlier, on September 4, it bought 80,325 ETH worth $358 million from Galaxy Digital and FalconX. These deals have pushed Bitmine’s total to over 2 million ETH, about 1.8% of all Ethereum in circulation.

Bitmine Follows Strategy’s Institutional Approach

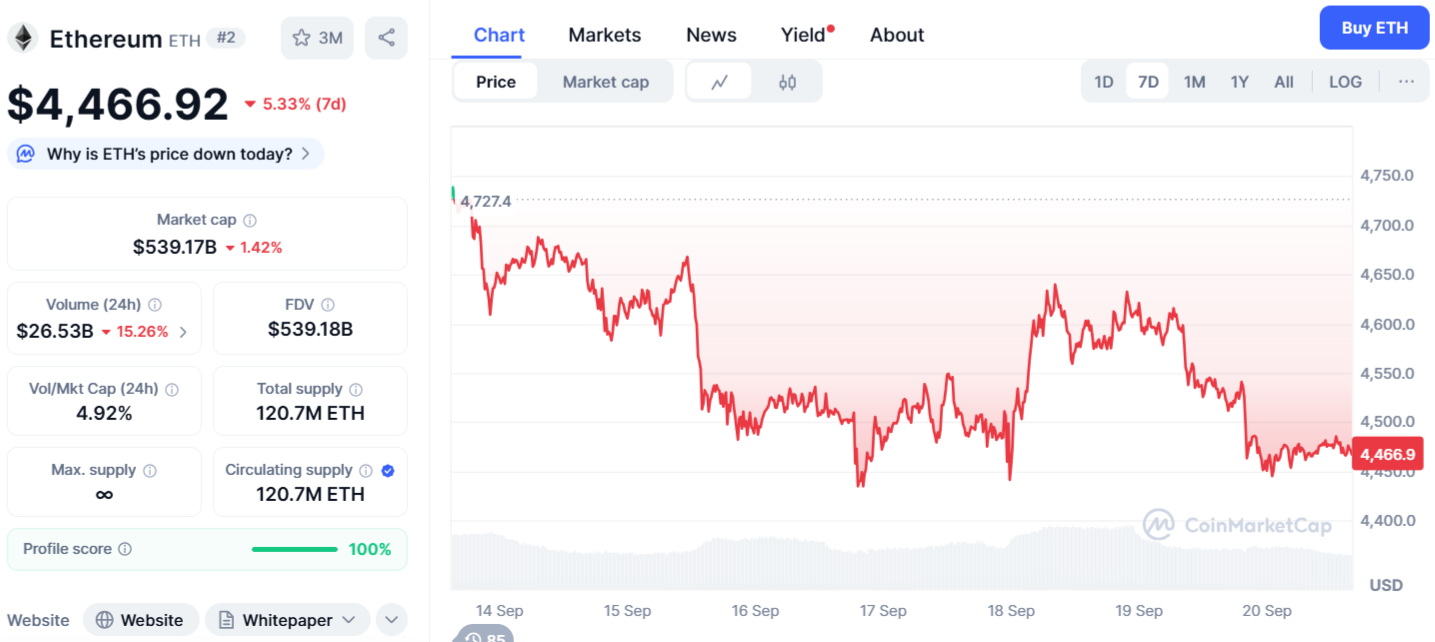

Bitmine’s huge stash is drawing comparisons to Michael Saylor’s company, Strategy, which built a massive Bitcoin reserve to promote institutional adoption. Bitmine seems to be doing something similar with Ethereum, creating a multi-billion-dollar ETH reserve for the long term. Meanwhile, Ethereum’s price has been under pressure. It is trading at about $4,466, down 1.42% in the last 24 hours and 5.33% over the past week.

Ethereum-Focused Firms Lead Treasury Growth

Bitmine now holds the largest corporate Ethereum reserve, far ahead of SharpLink Gaming with 838,000 ETH and The Ether Machine with 495,000 ETH. Other assets, like MakerDAO’s MKR and experimental tokens, remain minimal compared to its ETH holdings.

Overall, companies and institutions now hold around 4.99 million ETH worth $22.2 billion, or about 4.13% of the total supply. Analysts say Ethereum is becoming the main winner in the growing digital asset treasury (DAT) trend.

In a report this week, Geoffrey Kendrick, head of digital assets research at Standard Chartered, said treasuries focused on Ethereum are in a stronger position than those holding Bitcoin or Solana. Unlike Bitcoin, both Ethereum and Solana offer staking rewards, which can boost value and help long-term growth. With many DATs facing price pressure, more mergers or takeovers are likely, but firms centered on Ethereum seem to be leading.

🚨 Standard Chartered says Ethereum to benefit more from Digital Asset Treasury buying than Bitcoin or Solana

Here's why:

– ETH treasuries stand out because of staking yield + stronger adoption

– Ethereum treasuries are more resilient

– Bitcoin treasuries face saturation & less… pic.twitter.com/UJRVSXNNT1— Crypto-Gucci.eth ᵍᵐ🦇🔊 (@CryptoGucci) September 16, 2025

Ethereum Whales Drive Major Accumulation

Ethereum maintains its dominance in the decentralized application (DApp) sector, commanding 64.5% of the total value locked (TVL) across all chains, including Layer-2 solutions. In contrast, its closest competitor, Solana, holds less than 9% of the industry’s $169.4 billion TVL, according to DefiLlama data.

This dominance is further supported by the growth of spot Ether exchange-traded funds (ETFs), which have amassed $24.7 billion in assets under management. These ETFs offer institutional investors a regulated and accessible means to gain exposure to ETH, reinforcing Ethereum’s lead over rivals. Analysts suggest that these factors could drive ETH’s price to new highs, potentially reaching $5,000 in the near term.

Best Crypto Exchange

- Over 90 top cryptos to trade

- Regulated by top-tier entities

- User-friendly trading app

- 30+ million users

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong.