Highlights:

- Cathie Wood believes Bitcoin’s future is brighter than gold, with BTC’s market cap growing significantly.

- Fed chair Powell called BTC “virtual gold,” seeing it as a competitor to gold, not the United States dollar.

- Coinbase CEO suggests governments should add BTC to reserves due to its growth potential.

In a recent post on Dec. 5, Cathie Wood, founder and CEO of ARK Investment Management, stated that Bitcoin’s (BTC) future remains bright, even after it surpassed $100,000. She emphasized that ARK Investment Management views Bitcoin as “a much bigger idea than gold”. Wood also drew a comparison between the values of gold and Bitcoin.

Indeed, @ARKInvest believes that bitcoin is a much bigger idea than gold!

— Cathie Wood (@CathieDWood) December 5, 2024

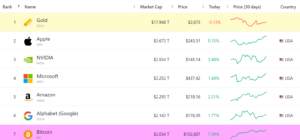

Gold, a commodity with a much longer history than BTC, currently holds a market cap of approximately $18 trillion. On the other hand, Bitcoin’s market cap has recently reached $2.04 trillion. Wood believes BTC is still in its early stages and can potentially exceed gold’s market value.

Bitcoin now ranks seventh, surpassing companies like Saudi Aramco, Tesla, and Meta. It could soon surpass Alphabet and Amazon, with valuations of nearly $2.1 trillion and $2.3 trillion, respectively.

Wood also congratulates the industry on Donald Trump nominating pro-crypto Paul Atkins to replace Gary Gensler as the new SEC chief.

Today, Fed Chair Powell described bitcoin as a virtual, digital version of gold. At $2,700, gold is a ~$15 trillion market, compared to bitcoin at only ~$2 trillion. Even after breaking through $100,000, bitcoin still is in early innings.

— Cathie Wood (@CathieDWood) December 5, 2024

Just before Bitcoin’s rise to $100,000, Fed Chair Jerome Powell called Bitcoin “virtual gold.” He highlighted Bitcoin’s role as a store of value, similar to gold. He sees BTC as a competitor to gold, not the United States dollar. When asked about owning crypto, Powell said he can’t hold such assets because of his position.

During his speech at the New York Times DealBook Summit on Wednesday, he stated:

“People use Bitcoin as a speculative asset. It’s like gold, it’s just like gold—only it’s virtual, it’s digital. People are not using it as a form of payment or a store of value. It’s highly volatile. It’s not a competitor for the dollar; it’s really a competitor for gold.”

Governments Should Consider Adding Bitcoin to Reserves: Coinbase CEO

CEO of Coinbase exchange Brian Armstrong shared his thoughts on BTC’s success. He noted that a $100 investment in BTC in 2012, when Coinbase was first established, would now be worth about $1.5 million. Armstrong also pointed out that $100 in fiat currency doesn’t go as far today, making Bitcoin a valuable asset for protecting against inflation.

If you bought $100 of Bitcoin when Coinbase was founded in June 2012, it would now be worth about $1,500,000.

If you kept the $100 USD you'd only be able to purchase about $73 worth of goods today.

Bitcoin is the best performing asset of the last 12 years, and it's still early… pic.twitter.com/dvBgX5K7or

— Brian Armstrong (@brian_armstrong) December 5, 2024

He also suggested that governments should consider adding Bitcoin to their reserves. Bitcoin has led the market in performance over the past 12 years and has significant potential for further growth, as it is still in the early phase of adoption.

Regarding Coinbase’s Bitcoin holdings, CEO Brian Armstrong referred to the company’s publicly available financial disclosures. According to the most recent report, Coinbase owns $1.26 billion in crypto assets, which includes 9,363 BTC valued at approximately $959.94 million and 119,696 ETH worth around $462.03 million. The firm’s crypto holdings have increased by 12%, or $161.97 million, in just two months.

Crypto Figures Celebrate Bitcoin’s $100K Milestone

Other crypto figures marked Bitcoin’s $100K milestone with celebrations. MicroStrategy CEO Michael Saylor, a strong proponent of Bitcoin’s corporate adoption, announced plans for a $100,000 party.

There is going to be a 100K Party. 🚀https://t.co/Vo52KQZRe5

— Michael Saylor⚡️ (@saylor) December 5, 2024

Silicon Valley investor and cryptocurrency advocate Balaji Srinivasan remarked that reaching the first $100,000 milestone is the toughest. Several well-known pro-Bitcoin politicians also took part in the celebrations. Senator Cynthia Lummis, who introduced a bill to create a strategic BTC reserve, celebrated Bitcoin reaching $100,000 by tweeting, “Don’t stop ₿elieving.”

Don’t stop ₿elieving. Bitcoin reaches $100k!

— Senator Cynthia Lummis (@SenLummis) December 5, 2024

Best Crypto Exchange

- Over 90 top cryptos to trade

- Regulated by top-tier entities

- User-friendly trading app

- 30+ million users

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong.