Highlights:

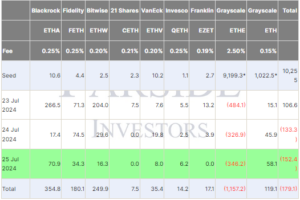

- Spot Ethereum ETFs saw $152.3 million in net outflows on July 25.

- Grayscale’s ETHE saw $346.2 million in outflows, while other funds reported inflows.

- Ethereum’s trading volume fell below $900M, with the price at $3,248.

US-based spot Ethereum exchange-traded funds (ETFs) experienced $152.3 million in net outflows on July 25, their third day of trading. This follows the $133.3 million in outflows on the second day.

The new ETFs facing challenges due to ongoing heavy selling from the recently transformed Grayscale Ethereum Trust. The Grayscale Ethereum Trust (ETHE) had $346.2 million in net outflows, the only ether fund with losses, according to Farside Investors. ETHE’s assets under management fell sharply from over $9 billion to $7.4 billion since the launch of US spot ETH ETFs.

In contrast, BlackRock’s iShares Ethereum Trust (ETHA) led inflows on Thursday with $70.9 million. Grayscale’s Ethereum Mini Trust (ETH), a spinoff of Grayscale’s Ethereum Trust, followed with over $58.1 million in net inflows. Other funds, including Bitwise’s Ethereum ETF (ETHW), VanEck’s Ethereum ETF (ETHV), Fidelity’s Ethereum Fund (FETH), and Invesco/Galaxy’s Ethereum ETF (QETH), also reported inflows. The remaining ETFs experienced zero flows.

Grayscale’s ETHE Outflows Exceed $1B Since Debut

Launched in 2017, Grayscale’s ETHE lets institutional investors buy and hold Ethereum with a six-month lock-up period. Since converting to a spot Ethereum ETF on July 22, investors can now sell their holdings more freely.

Moreover, ETHE’s 2.5% fee makes it costly for investors seeking Ethereum exposure. Consequently, investors are selling ETHE shares, favoring newer, lower-fee options. Total outflows since its conversion now exceed $1.15 billion. The situation mirrors Grayscale’s Bitcoin ETF (GBTC) experience, where outflows exceeded $5 billion in its initial trading month, Bloomberg data shows.

In contrast, Grayscale’s Ethereum Mini Trust might break the pattern this time. With a 0.15% fee, it’s one of the lowest-cost spot Ethereum funds in the US, and its inflows have steadily increased since its ETF conversion.

Spot Ethereum ETFs Volume Fall Below $900 Million on Day Three

Spot Ethereum ETFs saw about $850 million in trading volume on Thursday, down from $937 million on the second day of trading, according to Yahoo Finance data from The Block Pro Research. The trading volume was just over $1 billion on July 23 when Ethereum ETFs started trading on major US stock exchanges, including the Chicago Board Options Exchange (CBOE), Nasdaq, and the NYSE Arca.

Amid market movements, rumors on X speculated about a potential sale involving an Ethereum Foundation-related wallet transferring 92,000 ETH, worth around $289 million. This sparked speculation about a potential Ethereum price drop. On-chain tracking shows the wallet first received ETH from the Ethereum Foundation on September 1, 2015, and transferred to a new wallet for the first time in nearly 6.6 years. At the time of writing, Ethereum, the largest altcoin, was trading at $3,248, a 2.65% increase from the previous day.

👀 JUST IN: $289 Million In ETH Moved After 7 Years.

92,000 ETH worth $287.7M was moved for the first time in 7 years, and no one knows why.

Initial speculations tied it to the Ethereum Foundation, but a source denied this, saying, "This is not an EF wallet."

Data shows the…

— JAKE (@JakeGagain) July 26, 2024

Read More

- Next Cryptocurrency to Explode in July 2024

- Crypto Price Predictions

- Best Solana Meme Coins to Buy In 2024

- South Korea Enacts First Crypto Law for Investor Safety

- Is it Too Late to Buy PIXFI? PixelVerse Price Soars Over 200% as it Obtains Several Listings from Centralized Exchanges

- Russian Lawmaker Calls for Ban on Telegram’s Hamster Kombat Game

- Expert Forecasts Daunting Bitcoin Buying and Selling Strategy Based on Historical Trends

- BitForex Approved to Resume Withdrawals Post Police Investigation