Sweden has gradually warmed up to become one of the most thriving crypto countries in Europe. Around 550,000 adults are crypto owners. About 46% of the owners are under 30 years old. According to K33 estimates, by 2034, potential Swedish crypto owners will total 1.6 million. This is why many Swedish residents are interested in learning about the best places to buy cryptocurrencies.

In this comprehensive guide to the best crypto exchanges in Sweden we’ll look at the top exchanges and assess them considering several criteria, such as regulatory status, listed of coins, fee structure, and customer support.

So, irrespective of your experience level in crypto trading, this guide is designed to assist you in discovering the most suitable crypto exchanges in Sweden for 2025 that cater to your varied requirements.

The Best Crypto Exchanges in Sweden for 2025

Sweden offers access to several cryptocurrency exchanges. Despite the fact that all digital asset trading platforms provide the same services, they differ in security and product offerings. After taking many aspects of the crypto economy into account, we settled on what we consider to be the 10 best crypto exchanges in Sweden in 2025.

- eToro – Overall best crypto exchange in Sweden in 2025

- Binance – Best Crypto Exchange for Newbies in Sweden

- Bybit – Easy-to-Use Crypto Exchange in Sweden

- Uphold – Low-Cost Crypto Exchange for Swedish Traders

- Coinbase – Top Crypto Exchange with Multiple Products

- Kraken – One of the Most Secure Crypto Exchanges for Swedish Traders

- Crypto.com – The Best Crypto Exchange Offering Visa Cards to Swedish Traders

- Bitget – All-in-One Crypto Trading Platform

- Capital.com – One of the Most-Patronized Multi-Asset Exchanges

- Bitstamp – Leading Crypto Exchange with Reasonable Trading Fees

The Top Bitcoin & Crypto Exchanges in Sweden Reviewed

Making the correct choice of a crypto exchange is crucial as you embark on your cryptocurrency journey. Here is our list of the top crypto exchanges in Sweden, tailored to your unique crypto needs.

1. eToro – Overall Best Crypto Exchange in Sweden

eToro stands out as the top cryptocurrency exchange for Swedish traders. Due to the boom in decentralized finance (DeFi), eToro added support for digital assets in January 2014. eToro, the best crypto exchange, prioritizes quality over quantity. As a result, it endorses the top 20 digital assets by market capitalization that have received positive reviews from analytical companies, such as CertiK. These cryptocurrencies see billions of dollars in daily liquidity.

With eToro, you can be confident that digital assets you invest in will not go extinct anytime soon. This is why, as of July 2024, more than 30 million users worldwide use eToro. For more than 17 years, the trading platform has been extremely reliable. This is due to a lack of scams or hacks. Utilizing some of the best security practices for client money and asset safety has made eToro impenetrable. Crypto traders in over 100 countries can access eToro.

Before you zoom straight into investing in crypto via eToro, let us examine its pros and cons. What are the benefits and drawbacks of investing in cryptocurrency in Sweden using eToro?

- Cryptocurrency Support (More than 100)

- Regulation (having the necessary licenses and certifications)

- Ease of Use (has an easy-to-navigate trading system).

- Security (has impenetrable security amid a multi-factor authentication system)

- Copy Trading Services (you can follow the trading patterns of expert traders)

- Payment Methods (supports a diverse range of methods such as bank cards, bank transfers, Skrill, and others).

- Demo Account (helps beginners learn how to trade using virtual money).

- Accessibility (eToro can be found directly on the web and accessed via the Google and Apple Stores)

- Crypto Exchange Ranking (not an exclusive cryptocurrency exchange)

- Cryptocurrency Market Offerings (limited in many ways)

What we Like:

- Over 100 cryptos to trade

- Minimum deposit only $50

- Regulated by top-tier entities

- User-friendly trading app

Warning: Crypto asset investing is highly volatile and unregulated in some EU countries. No consumer protection. Tax on profits may apply.

2. Binance – The Best Crypto Exchange for Newbies in Sweden

Binance is our second-best crypto exchange for buying digital assets in Sweden. In just seven years, the exchange has outperformed all crypto exchanges operating under the DeFi banner in many critical areas. Among them is trading volume.

Binance has climbed to the apex of the crypto exchange ladder to become the largest in terms of daily trading volume. Binance records a minimum of $10 billion in daily trading volume. Such a statistic demonstrates that regulatory issues have had little impact on the platform’s continued use. Residents of more than 100 countries can access the trading platform. Binance has surpassed more than 170 million users worldwide. Diverse markets offer access to more than 500 cryptocurrencies.

Binance still prioritizes security and accessibility, and it has one of the simplest verification processes in place. This is why many people rate Binance as the world’s go-to crypto exchange. Before signing up for Binance, consider its pros and cons. What are the benefits and drawbacks of using Binance for a Swedish user?

- Crypto Services (supports several markets as well as services such as staking)

- Country Support (Binance can be found in more than 180 countries across the globe)

- Robust Security System (multi-layered security via a range of measures, such as two-factor authentication)

- Growing Customer Base (The next milestone for Binance’s user base is 200 million.)

- Cryptocurrency Support (more than 500 crypto coins and tokens can be found on crypto trading platforms)

- Payment Methods (bank cards, bank transfers, e-service wallets, direct crypto wallet deposits, and P2P services)

- Consistent Upgrades (continues to improve its trading system)

- Trading Fees (among the lowest in the crypto space)

- Regulated in many countries and has a Know Your Customer process

- The company has a history of being mired in regulatory issues

- It could be more complex for novice traders

3. Bybit – An Easy-to-Use Crypto Exchange in Sweden

Bybit is a cryptocurrency derivatives exchange that joined the crypto market in 2018. While many trading platforms face restrictions, Bybit remains accessible in over 200 countries worldwide. Bybit data shows that the exchange continues to grow in terms of usage.

In a little over five years, Bybit users have grown from 10 to 20 million. Statista data show that Bybit is the second-largest crypto exchange by daily trading volume. Millions of people worldwide patronize this exchange, which is great news for Swedish traders. The platform supports over 600 digital assets with at least $4 billion in liquidity. Bybit has been experiencing a significant surge in trading with its zero euro (EUR) fees campaign launched in April. This campaign eliminates EUR trading fees. In the long run, this will make it relatively simple and affordable for all European crypto traders to engage with digital assets.

This explains why inquiries like “Can I use Bybit in Sweden?” have become common on search engines. There are others, like, which Bitcoin app works in Sweden, and can you trade crypto in Sweden? Yes, you can use Bybit in Sweden. The Bybit app allows you to buy Bitcoin and trade numerous digital assets in Sweden. Let us look at the pros and cons of buying crypto via the Bybit exchange in Sweden in 2025.

- Liquid (Bybit is a highly liquid exchange with billions of dollars in daily trading volume)

- Cryptocurrency Support (has a market for more than 650 digital assets)

- Bulletproof Security (conduct regular security audits, two-factor authentication, and cold storage)

- Customer support (provides 24/7 access to company representatives for issue resolution)

- There are more than 80 payment methods available, including popular ones such as bank cards and direct deposits

- Trading Features (offers advanced trading tools)

- Customer service (needs improvement)

- Ease-of-Use (Bybit is regarded as less user-friendly)

Crypto assets are unregulated & highly speculative. No consumer protection. Capital at risk.

4. Uphold – A Low-Cost Crypto Exchange for Swedish Traders

Uphold was primarily a bitcoin platform called Bitreserve in 2014. Sweden is one of the platform’s supported countries. Uphold supports most mainstream payment methods, which makes it an attractive option for traders interested in using centralized systems. Uphold charges less than 3% in fees for European traders across stablecoins, altcoins, and mainstream assets such as BTC and ETH. As a result, millions of people continue to flock to the exchange for their crypto trading needs. The exchange has more than 30 million users worldwide.

As a regulated platform, Uphold has put in place measures to battle money laundering and counter-terrorism financing. Stellar Lumen (XLM) is the subject of Uphold latest news. On July 3, 2024, Uphold announced support for the stablecoin USDC on the Stellar Lumen blockchain. With this, you can trade mainstream assets against USDC and other stablecoins.

What countries is Uphold available in? Which BitCoin app works in Sweden? Fortunately, Uphold is available in Sweden, and it has mobile applications for easy access. Let us consider the pros and cons of Uphold, which make it the right crypto exchange for Swedish traders.

- Cryptocurrency Support (you invest, transfer, send, or receive more than 250 digital assets)

- Staking (Uphold offers this service to help users earn passive income)

- Payment Methods (bank cards and automated clearinghouse)

- Highly Resourceful (offers educational content to its users)

- Security has an impenetrable system that makes it difficult for hackers to break through

- Customer support problems

- The fixed nature of staking offers makes them less flexible than those of competing platforms

- There have been complaints about Uphold not being a user-friendly platform

- Trading fees are relatively high

Crypto assets are unregulated & highly speculative. No consumer protection. Capital at risk.

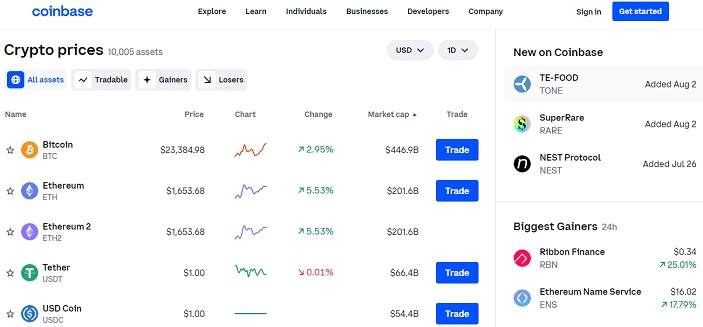

5. Coinbase – A Crypto Exchange with Multiple Products

Coinbase is one of the oldest crypto exchanges in the DeFi space. The exchange’s primary goal is to make cryptocurrencies accessible to people all over the world. Users across Africa, Asia, Europe, North America, Oceania, and South America have access to Coinbase. Coinbase supports hundreds of digital assets. Swedish traders should note that, in addition to BTC, ethereum (ETH), and Solana (SOL), Coinbase supports more than 260 digital assets.

According to Buy Bitcoin Worldwide data, Coinbase has a user base of approximately 73 million. At least eight million people transact on the exchange every month. This is due to the numerous products the exchange offers. Coinbase offers a staking program called EARN. This allows users to stake a portion of their holdings in exchange for annual percentage yields or returns. In addition to this, the platform supports numerous payment methods. You can directly deposit digital assets into your Coinbase wallet, and you can also conduct transactions using bank cards and transfers.

Despite the platform’s primary focus on serving US residents, many individuals globally regard Coinbase as the top exchange.

Does Sweden use Coinbase? Yes, Coinbase supports Sweden. Let’s take a look at the pros and cons of using Coinbase Exchange as a Swedish trader.

- Payment Method (you can select from a range of options such as wire transfers, PayPal, bank cards, direct crypto wallet deposits, and bank transfers)

- Liquidity (highly liquid exchange with billions of dollars in daily volume)

- Staking (offers this service to help users make decent passive income on their idle investments)

- Reliability (has operated in the space for more than 12 years without incident)

- Accessibility (can be downloaded on the App Store and Google Play Store) as well as accessed directly on the World Wide Web

- Security (multi-factor authentication has provided an unassailable defense against cyber attackers)

- A lack of transparency causes unexpectedly high trading fees

- Customer support requires improvement because response times are very slow

Crypto assets are unregulated & highly speculative. No consumer protection. Capital at risk.

6. Kraken – One of the Most Secure Crypto Exchanges for Swedish Traders

Kraken is among the oldest cryptocurrency exchanges worldwide. Sweden is among the countries Kraken supports. In addition to Sweden, traders from more than 190 countries around the world can access Kraken. While Kraken supports the two most popular coins, BTC and ETH, it also lists over 200 others on its platform. With over 10 million users, Kraken boasts products that make it one of the most vibrant ecosystems in the industry. Kraken’s low trading fees, user-friendliness, and accessibility are among its positive traits.

In February 2024, Kraken started a unit for institutional customers. This offers trading, custody, and staking services. As a result, the exchange looks forward to diversifying revenue, which will grow its business exponentially. In crypto, staking is one of the primary drivers of an asset’s price. Many traders also patronize platforms that can help them make consistent passive income.

Kraken is one of the most attractive crypto exchanges for Swedish traders in 2025 because of its Staking feature. Since Kraken supports Scandinavian countries such as Sweden and Norway, let us examine its positives and negatives in depth.

- Fees (low trading fees for advanced and experienced traders)

- Cryptocurrency Support (more than 200 crypto coins and tokens can be traded on Kraken)

- Minimum Trading Amount (around $10 can be used for starters)

- User-friendliness (has a simple user interface)

- Trading Volume (it is a highly liquid exchange with at least $500 million in daily trading volume)

- Customer Support (reach representatives via chat through mobile applications)

- Security (It has currently upgraded its security system due to past breaches)

- Resources (the platform offers educational resources that inform users about the current state of the crypto economy).

- Payment Method (bank cards, bank transfers, Apple Pay, or Google Pay)

- Crypto Services (staking is available for consistent passive income)

- Relatively high trading fees

- Past hacks have caused security problems

Crypto assets are unregulated & highly speculative. No consumer protection. Capital at risk.

7. Crypto.com – The Best Crypto Exchange Offering Visa Cards to Swedish Traders

Crypto.com is a crypto finance platform that offers a variety of services in this rapidly expanding industry. The leading exchange was founded in June 2016. Its popularity has soared over the years. This came about after Crypto.com became the headline sponsor for the multi-purpose arena used by basketball teams Los Angeles Lakers and Clippers.

Crypto.com is available in more than 90 countries worldwide. Swedish traders will discover more than 300 digital assets on the platform. Crypto.com is rated highly on numerous essential features that make it a great exchange. Many analysts rate its fee structure 4.75 out of 5. Analysts have also rated ethics, customer service, accessibility, security, and investment selection between 4 and 5, with 5 being the highest rating.

The Crypto.com App offers answers to questions like which cryptocurrency app is the best in Sweden and which countries are supported. Its mobile apps grant you access to Visa Card perks, the Crypto.com website, and the passive income program Crypto Earn.

With millions of monthly users, Crypto.com sees huge monthly volumes. The exchange trades about $500 million in minimum daily trading volume. This places it above Bitrue, MEXC, Hotcoin, Upbit, LBank, and DigiFinex, among others. Let us examine the pros and cons of using the Crypto.com exchange.

- Cryptocurrency Support (more than 300 crypto coins and tokens)

- Accessibility (Crypto.com App can be downloaded by Android and iOS-powered devices)

- Staking (Crypto.com triggered this service, with users earning up to 16% in annual percentage yields

- Customer Support (you can access representatives by phone and through email)

- Security (has the latest security encryptions, which protect digital assets)

- Volume (Crypto.com is among the centralized exchanges that sees more than $1 billion daily)

- Customer support needs improvement

- Complaints of high trading fees

Crypto assets are unregulated & highly speculative. No consumer protection. Capital at risk.

8. Bitget – An All-in-One Crypto Trading Platform

Bitget, a Seychelles-based company, is present in more than 100 countries. Over 20 million users across the globe pour liquidity into digital currencies supported by the exchange. Bitget is a high-volume exchange that records a minimum of $1 billion in daily trading volume. Asia, Africa, South America, North America, and Europe (including Sweden) all experience Bitget’s presence.

Bitget has a user-friendly interface. Many users have reported a great experience, especially its copy trading feature, which allows novices to follow the trades of experienced traders. Aside from that, there is the integration of a Web3 wallet, which makes it easy for traders to experiment with all the facets of the Web3 economy. This is why we selected Bitget as one of the best crypto exchanges in Sweden in 2025.

The extensive use of Bitget answers questions such as Can I buy Bitcoin in Sweden? Bitget is considered one of the most effective methods for purchasing USDT in Sweden, providing a solution to the question of how to buy USDT in Sweden. Let us assess the pros and cons of using Bitget.

Pros and of the Bitget crypto exchange

- Payment Methods (bank cards, direct crypto wallet deposits, Banxa, Mercuryo, Google Pay, Apple Pay, and bank transfers)

- Cryptocurrency Support (more than 500 digital currencies can be traded)

- Regulation (has necessary certifications and licenses of operation in some European countries).

- Insurance (maintains an insurance fund to support customers should events like crypto winter happen in the future)

- Scalability (processing thousands of transactions per second)

- Security (a bulletproof system that safeguards your digital assets)

- low transactional and withdrawal rates

- Customer Support (you can call Bitget or use tools such as frequently asked questions, submit a ticker, or send emails)

- Bad experiences with copy trading

- Withdrawal difficulties

Crypto assets are unregulated & highly speculative. No consumer protection. Capital at risk.

9. Capital.com – One of the Most-Patronized Multi-Asset Exchanges

Capital.com has seen significant growth over the past eight years. With global offices in the Bahamas, Lithuania, Bulgaria, Poland, Gibraltar, Cyprus, Australia, and the United Kingdom, Capital.com is a highly respected cryptocurrency exchange. The trading platform is present in more than 180 countries. The Cyprus Securities and Exchange Commission (CySEC) and the Financial Conduct Authority (FCA) are among the authorities that are currently regulating Capital.com.

As one of the best crypto exchanges to buy digital assets in 2025, it provides regular live updates and price alerts for supported markets. Unlike other platforms, it does not charge fees on deposits, withdrawals, or inactivity. Scalability has been one of the issues plaguing the blockchain-backed economy. With its fast order execution feature, Capital.com has solved this problem. There is also a demo account that makes it simple for novice traders to learn how to play with virtual funds. Aside from that, it provides research and educational resources to support its six million traders. Capital.com’s customer support has also been ranked as one of the best in the industry.

Before you throw money behind any cryptocurrency on the exchange, let us consider its positives and negatives.

Pros and cons of the Capital.com crypto exchange

- Payment Methods (PayPal, Apple Pay, Sofort, Trustly, Skrill, and bank cards)

- User-Friendliness (mobile applications on the Google Play Store and Apple Store as well as directly on the World Wide Web)

- Customer Service (multi-language support system for clients)

- Resourcefulness (highly resourceful will education material and advanced trading instruments)

- Regulation (highly regulated crypto exchange)

- Price alerts are not on the platform

- High average risk

- No copy trading services

Crypto assets are unregulated & highly speculative. No consumer protection. Capital at risk.

10. Bitstamp – Crypto Exchange with Reasonable Trading Fees

Bitstamp, along with Coinbase and Kraken, are among the oldest cryptocurrency exchanges in the industry. It supports almost every country on earth. According to Bitstamp, the exchange has around five million users. These users cumulatively pour millions of dollars in daily trading volume into the exchange. Bitstamp supports about 80 digital currencies.

Bitstamp’s cutting-edge trading platform made it one of the best crypto exchanges we considered. It is very user-friendly and comes with an advanced platform. Based on our own experiences, customer service is extremely responsive via phone and email. There is an abundance of charting tools to simplify trading. Staking can also be used by passive income seekers. Many users can also take advantage of a wide range of the platform’s numerous payment methods. These and others are why you should consider investing in crypto through Bitstamp.

While Bitstamp is among the best crypto exchanges to buy digital currencies in Sweden, let us consider its pros and cons.

Pros and cons of buying crypto with Bitstamp in Sweden

- Bitstamp has an ‘A’ score from CertiK, which is about 81/100 based on cybersecurity, fundamental, operational, community, market, and listing security

- Supports staking

- 80 digital coins and tokens that can be traded in many markets

- Bank cards, bank transfers, SEPA, direct crypto wallet deposits, ACH

- Customer support representatives can be reached via phone, email, and through the help page

- Easy-to-navigate for newbies and experienced traders

- Relatively cheap fees when compared with competitors

- Customer support response times need improvement

- About 80 cryptocurrencies are relatively small in the current crypto exchange landscape

- Few cryptocurrencies are included in the staking program

Crypto assets are unregulated & highly speculative. No consumer protection. Capital at risk.

How to choose the best cryptocurrency exchanges in Sweden

Sweden was supported by over 100 centralized exchanges (CEXs) and decentralized exchanges (DEXs). These exchanges exhibit variations in their characteristics, despite the fact that they serve comparable functions. Based on a variety of criteria, our team has identified and prioritized the most exceptional cryptocurrency exchanges in Sweden for 2025. Therefore here are several key factors that will help ensure that the best crypto exchange in Norway is selected.

Ease-Of-Use

Our experts have spent over a decade in this growing industry and do not want you to use a difficult exchange. We also don’t want you to be unable to trade after choosing one of Sweden’s best crypto exchanges.

The mentioned exchanges are exceptionally user-friendly. A careful scroll through all the exchange reviews will give you a direct link to their trading platforms. It is evident that the homepages are user-friendly when searched on all the popular search engine platforms. Furthermore, each of them has a mobile application for smart devices.

Consequently, we meticulously selected exchanges that have integrated the requisite trading tools to assist you in your trading endeavors.

Additionally, the correlation between user friendliness and seamless verification is adaptable. The verification process can be completed in a matter of minutes, contingent upon the level of cooperation you exhibit as a client. The verification procedure for the majority of the exchanges remains consistent. It is identical to the government-issued identification document and proof of residence.

We refrain from making light of user-friendliness, as it has the potential to influence your interest in trading digital currencies. Additionally, some of the recommended exchanges have copy-trading features. This could help a novice Swedish trader follow experts’ trades and make decent gains in a short period of time.

Regulation

As of July 11, CoinMarketCap data indicates there are over 790 exchanges that are accessible. Although certain exchanges are subject to regulation, the majority (including CEXs) are not. The anonymous individuals who operate the trading platforms have the ability to capitalize on your hard-earned money in the absence of any standards of practice or regulations.

This has affected thousands of people who locked their funds in unregulated CEXs and DEXs. This is the basis for our selection and ranking of eToro, Binance, Uphold, Kraken, Coinbase, Crypto.com, and other platforms. These digital asset trading platforms have been available on the market for an extended period of time.

The majority of them have operated successfully without incident for more than 10 years. Hacks or fraudulent controversies have not impeded the operations of many digital asset trading platforms. This is a result of their regulation and the possession of the necessary licenses to operate in globally regulated markets.

The exchange and its traders are both safeguarded by regulation. Traders have the authority to alert the relevant authorities in the event of any incidents. Similarly, exchanges have designated authorities, such as the Financial Conduct Authority (FCA) and the Securities and Exchange Commission (SEC), to whom they can report any instances of nefarious activity on a specific account.

Cryptocurrency endeavors to decentralize the financial sector; however, regulation has become increasingly necessary. This is because numerous third parties are exerting themselves to capitalize on the highly decentralized nature of this expanding asset class.

Monitor the latest regulatory trends to avoid engaging in transactions with anonymous representatives.

A wide variety of payment mechanisms

The trading of centralized and decentralized financial instruments necessitates the implementation of payment methods. Swedish traders have the ability to obtain bank cards such as American Express, Diners Club, Eurocard, MasterCard, and Visa.

Additionally, they are capable of processing transactions through bank remittances. Skrill, a widely accepted payment method, is also available in Sweden. Most of the top-ranked crypto exchanges also support PayPal, one of the first e-service wallets. Sweden is one of the countries that PayPal supports.

Crypto devices are accessible to all individuals, regardless of their location. Consequently, Swedish traders are able to effortlessly interact with cryptocurrencies by utilizing exchanges that facilitate wallet deposits and withdrawals. Do not disregard payment methods, as they may impede your ability to engage with your preferred trading platform.

Customer Service

One of the most detrimental experiences that an individual can endure is being unable to communicate with representatives of a specific cryptocurrency exchange. Millions of people have experienced this.

Deposits, withdrawals, and verification are among the most urgent problems that require resolution. We prioritized and selected exchanges that are accessible via email, live chat, and phone. In addition to this, we also chose platforms with frequently asked questions (FAQs) and other resourceful information that can guide traders.

Most of the recommended exchanges are exceedingly responsive. This will assist Swedish traders in resolving any issues that may arise as a result of their interactions with their trading platforms.

Speed of processing transactions

Scalability is of paramount importance in the cryptocurrency industry. This is due to the high volatility that can result in multiple percentage changes within a short period. Scalability’s importance transcends exchanges.

A wonderful example of this was Ethereum’s transition to a Proof-of-Stake (PoS) from a Proof-of-Work (PoW) network. Due to our experience, we do not want you to experience a scenario in which you initiate transactions that fail to execute at the price you have in mind. This is the reason we meticulously selected the exchanges mentioned above.

All of them handle millions of transactions each day. When selecting an exchange or blockchain technology to host your decentralized applications (dApps), it is crucial to consider the pace of the service you are opting for. It is very important.

Insurance

We have many types of insurance, but crypto insurance is the one that is unpopular with novice DeFi traders. Insurance packages are indispensable in the event of unfavorable market sentiment. In spite of the extensive security measures implemented by the crypto trading platforms, unforeseen events may still transpire.

Take, for example, Crypto Winter, which gripped the market in 2022. Third parties did not intentionally cause the market’s destabilization. Despite this, it resulted in a significant decrease in the aggregate market capitalization of the crypto asset market. As a result, millions of crypto enthusiasts suffered substantial losses.

In an attempt to take advantage of the situation, hackers exploited certain customers and made off with their balances. This is why insurance is crucial in compensating clients for losses resulting from a custodial account breach. Prioritize insurance, and it may save you your crypto-investing capital someday.

Transactional fees

Fees are associated with each cryptocurrency exchange. Fees are typically transactional and are one of the methods by which exchanges generate revenue.

We meticulously evaluated and prioritized exchanges according to the fees they impose on their clients. Although some are more expensive than others, their fees are within the parameters of the crypto trading industry. Additionally, we selected exchanges that we anticipate will impose minimal fees that are consistent with your investment budget.

We are aware that this will enable you to optimize profits and minimize losses. Don’t take your eyes off the fees. Understanding the fee structure of a crypto trading platform is a key part of using it.

Impenetrable Security

Scams, breaches, and exploits resulted in approximately $2 billion in losses for crypto users in 2023. This figure was approximately $4.2 billion in 2022. The majority of these incidents transpired on cryptocurrency exchanges, while others involved direct breaches of non-custodial accounts through crypto wallets.

Exchanges such as eToro, Binance, Kraken, and Coinbase have implemented robust security measures. Consequently, their trading platforms have become exceedingly difficult to penetrate. We advise users to enable multi-factor authentication on the platforms. This is exemplified by Binance. In order to access Binance, credentials are necessary. Furthermore, on a regular basis, Binance sends codes to registered email addresses for confirmation.

Furthermore, Binance recommends that clients utilize Google Authentication accounts as an additional layer of security. This is the reason why Binance and other companies have endured the measure of time, despite the negative market events. We consistently monitor the 2FA and other entities. Without them, unknown third parties or close associates may compromise your account.

Liquidity

Fundamental and technical analysis incorporate liquidity (trading volume) as an essential variable. They are essential in predicting the prospective price of assets. Furthermore, a cryptocurrency exchange’s effectiveness is based on its trading volume. We chose exchanges that record minimum daily trading volumes of about $500 million.

The resultant effect is that millions of individuals invest millions and billions of dollars in cryptocurrencies on these exchanges. Due to their high volume, we do not expect the exchanges to vanish in the near future. A lack of funds during the peak days of the crypto winter rendered many crypto companies insolvent.

Just a few examples include Celsius Network, Voyager Digital, Three Arrows Capital (3AC), Blocks, and FTX. Our selected exchanges will be the most effective crypto exchanges in Sweden by 2025 due to their appropriate volume metrics. Others may be great too, but these are the best crypto exchanges to buy digital coins and tokens within Sweden.

Crypto Regulation in Sweden

Sweden’s legal framework for cryptocurrencies is characterized by a variety of conflicting laws and policies. Some government authorities in the country have issued warnings regarding the risks associated with cryptocurrency. Despite this, some Swedish authorities have officially acknowledged the advantages of the new technology.

Among them is Finansinspektionen (FI), Sweden’s financial regulator. The agency cautioned the public about the significant risks and insufficient consumer protections associated with cryptocurrency investments. The latest of such warnings came in October 2023, when BTC fraud soared in the third quarter of that year.

In spite of their potential, FI has further clarified that cryptocurrency investments are “unsuitable for the majority of consumers” due to their “difficult, if not impossible, value on a credible basis.” It is possible to argue that cryptocurrency is difficult to value on a credible basis because it lacks true intrinsic value. We can all agree that it lacks backing from gold, silver, or a national government. Therefore, FI suggests that evaluating its true value in a centralized, finance-dominated world could be challenging.

Despite FI’s efforts, other government officials have emphasized the inadequacy of Sweden’s consumer protection regulations. This inadequacy makes it difficult for the appropriate authorities to protect Swedish investors from the risks associated with cryptocurrency investments. For instance, the Swedish Financial Supervisory Authority (SFSA) issued a warning that the majority of initial coin offerings (ICOs) are not subject to regulation.

Sweden and the Problem of Initial Coin Offerings (ICOs)

The SFSA defines “ICO” as a “term used as the designation for launching a new token or another form of digital asset based on crypto.” While many upcoming crypto projects continue to rely on ICOs, there are no assurances that the ICO-related tokens are legitimate. It is also impossible to prove that these tokens grant any rights to investors. In reality, numerous ICO schemes have provided investors with vaporware or tokens of no value.

This was exemplified by a project named Starflow. Swedish authorities viewed Starflow as the epitome of an ICO scam. According to them, Starflow included a whitepaper that contained false narratives but appeared to be legitimate in the company’s ICO offering. Furthermore, the majority of Starflow’s social media followers were fraudulent users. Fake users are those who purchase Twitter accounts to artificially inflate the number of followers displayed on a specific profile. Such projects are normally associated with a credible investor to keep the scam going. Johan Staël von Holstein, a “notorious serial entrepreneur,” was one of Starflow’s earliest advisors.

To curb this growing trend, the SFSA cautioned that there is no assurance that investors will be able to sell their ICO tokens in the future. This is due to the country’s lack of a market that provides full legal protections for cryptocurrency trading. Furthermore, the SFSA cautioned that numerous ICO advertisements may be deceptive. For these reasons, the SFSA believes that ICOs pose a significant risk of investment loss for Swedish investors.

Regulations not affecting Sweden’s status as a crypto-friendly country

The Swedish central bank, Riksbank, has acknowledged the potential advantages of cryptocurrency. Specifically, Riksbank requested that the Swedish parliament allocate 30 million Swedish Kronos (or approximately $3.1 million) annually for a period of five years in order to establish Sweden as a digital currency innovation center. Sweden will invest $15.5 million to finance and host cryptocurrency conventions over a five-year period if the Swedish government approves.

In doing so, Riksbank aspires to become a member of the Bank for International Settlement (BIS) innovation center for cryptocurrency. Switzerland, Singapore, and Hong Kong currently host events. Furthermore, Riksbank implemented a CBDC initiative to enable Swedish citizens to utilize an “e-krona” as a payment method. These favorable cryptocurrency policies and initiatives directly contradict the warnings issued by the FI and the SFSA.

The fact that the Swedish public broadly accepts digital currency is also in direct contradiction with the overall hostile legal environment for cryptocurrency. Initially, Sweden is the most cashless society in the world. Since the pandemic, less than 10% of transactions have used cash as a payment method. Therefore, over 90% of payments use methods other than cash, contradicting Sweden’s stringent cryptocurrency regulations.

Furthermore, Sweden’s laws regarding cryptocurrency conflict with the fact that Swedes can indirectly engage in Bitcoin through the state’s pension plan.

For the aforementioned reasons, the Swedish legal environment for cryptocurrency is contradictory. There is a disagreement among various government agencies in Sweden regarding whether the advantages of cryptocurrency outweigh the risks. However, the Swedish public has arguably embraced cryptocurrency as a valid innovation and a technology with long-term value.

How to Buy Cryptocurrency in Sweden Walkthrough

This section will instruct you on the process of establishing an account with a cryptocurrency exchange in Sweden. We will guide you through five stages that will initiate your crypto trading journey. eToro is our preferred cryptocurrency exchange for purchasing digital assets in Sweden in 2025 and beyond. Nevertheless, the procedure outlined below is applicable to all of the other nine aforementioned cryptocurrency exchanges.

1. Step one: Set up an account

Begin by conducting an online search for eToro’s website. Additionally, Android users may obtain the application from the Google Play Store. iOS-powered devices can download the eToro app from the Apple Store.

You will be required to input an active email address on the website or via the mobile applications. You must submit a unique username to set your account apart from others. To access your new trading account, you must generate and use a password.

eToro will ask for your complete legal identity. Your postal code, date of birth, and active phone number will be next. The subsequent page will request a verifiable home address.

2. Step two: Verification

Documents will be required by eToro and the other exchanges to ensure compliance with Know Your Customer (KYC) regulations. Exchanges devised KYC to enhance anti-money laundering (AML) regulations and combat terrorism financing (CFT). You can verify your identity by submitting the following documents:

Government-issued identification cards are typically required by eToro and other trading platforms to validate previously submitted information. This pertains to Swedish passports. For verification purposes, we may also accept additional national IDs and driver’s licenses.

Furthermore, eToro requires bank statements, utility invoices, or credit card statements to be no older than six months. We use this to verify your residential address. After completing this phase, we can proceed to step three.

3. Step three: Deposit funds

eToro imposes a minimal deposit requirement on new accounts in the United States and abroad. Residents of the United States are required to submit a minimum deposit of $10 to eToro. A minimum deposit of $50 (approximately 47 euros) is required from non-U.S. residents, including those in Sweden.

eToro accepts a diverse array of payment methods, such as bank cards (VISA, MasterCard, and Maestro), bank transfers, and online financial services wallets (Skrill, PayPal, Neteller, and others). Swedish traders should be aware that a minimum deposit of $500 is necessary for bank transfers on eToro.

4. Step four: Search for the digital assets of your preference

Locate the dashboard on the crypto exchanges. Navigate to the search field situated at the top of the page. Please enter the ticker symbol of any coin or token of your choosing, including SOL, ATOM, AVAX, BTC, ETH, PEPE, DOGWIFHAT, APE, USDT, DOGE, SHIB, and others. When you find the asset you’re looking for, select “Trade.” As a result, a new order form will be created.

5. Step five: Buy cryptocurrency

Enter the amount value of the crypto coin or token you wish to purchase. Your account will receive and display the value of all the digital currencies you purchase.

Crypto assets are unregulated & highly speculative. No consumer protection. Capital at risk.

Conclusion

This guide has given you a comprehensive understanding of the top cryptocurrency exchanges in Sweden for the year 2025. In addition, it has provided you with in-depth knowledge about the state of the country’s regulations. Regardless of the situation, as a Swedish trader, you should be aware that the top 10 exchanges offer the most reliable trading platforms. While crypto is on the rise, it is still considered a highly risky asset class. As a result, diversify your portfolio. Invest in cryptocurrencies for an amount of money you can write off as bad debt.

Conduct independent research about the ways to buy crypto in Sweden. You can utilize the gathered information to enhance the insights from this article. Always remember that having time as a crypto trader is better than trying to time this unpredictable market.

Crypto assets are unregulated & highly speculative. No consumer protection. Capital at risk.

Crypto Exchange Guides For 2025

We have made sure to cover an extensive range of countries as they have focused on producing the best crypto exchange sites. Check out some of our other fantastic guides below:

- Best Crypto Exchanges in Norway 🇳🇴

- Best Crypto Exchanges in Sweden 🇸🇪

- Best Crypto Exchange In Germany 🇩🇪

- Best Crypto Exchange In Finland 🇫🇮

- Best Crypto Trading Platforms In Ireland 🇮🇪

- Best Crypto Exchanges In Australia 🇦🇺

- Best Crypto Trading Platforms In The UAE 🇦🇪

- Best Crypto Trading Platforms In The UK 🇬🇧

- Best Crypto Trading Platforms In The USA 🇺🇸

References:

- https://assets.ey.com/content/dam/ey-sites/ey-com/sv_se/news/2024/ey-swedish-crypto-adoption-survey-2024.pdf

- https://www.statista.com/statistics/864738/leading-cryptocurrency-exchanges-traders/

- https://www.binance.com/en/square/post/1920567857217

- https://www.bybit.com/en/press/post/bybit-celebrates-5-years-of-disrupting-the-game-with-20-million-users-milestone-blt78c7402f6b3c768c?ref=localhost

- https://uphold.com/blog/crypto-basics/what-is-xlm

- https://buybitcoinworldwide.com/coinbase/stats/

- https://backlinko.com/coinbase-users

- https://news.bloomberglaw.com/securities-law/kraken-crypto-exchange-starts-unit-for-institutional-customers

- https://www.financemagnates.com/cryptocurrency/swedish-financial-regulator-signals-surge-in-bitcoin-fraud-during-q3/

- https://news.bitcoin.com/ico-scam-train-arrives-sweden-meet-starflow/

FAQs

Is Bitcoin machine available in Sweden?

According to the Bitcoin ATM Map, there are no BTC machines in Sweden.

Is Crypto.com available in Sweden?

Yes, Crypto.com is available in Sweden. Traders can access the platform directly on the web, as well as via mobile applications on the Google Play Store and the App Store.

How do I purchase Bitcoin in Sweden?

You can make a purchase by creating an account on eToro. Go through the verification process and buy BTC.

Is it legal to buy crypto in Sweden?

No, Sweden has not made cryptocurrency a legal tender. Despite this, you can access cryptocurrencies on exchanges such as eToro, Binance, Crypto.com, Uphold, and BitMart, among others.