Highlights:

- The XRP price continues to dip, currently trading at $2.70, representing a 3% decline.

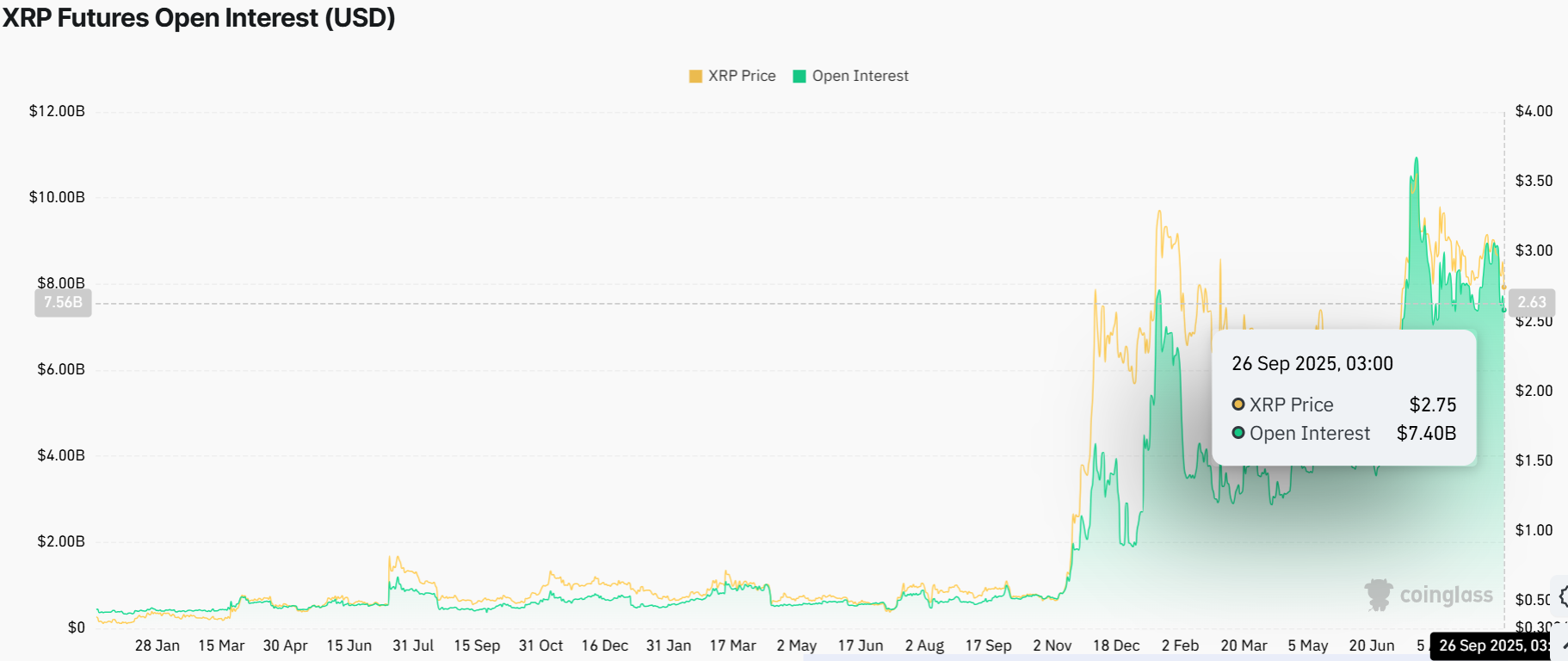

- The XRP open interest has dropped to $7.40 billion, indicating weakening momentum.

- Ali Martinez notes that if XRP holds above the $2.70 support level, a rebound to $3.20 is likely.

Over the last two days, the XRP price has been in a dip due to weak market sentiment. The cross-border payment token is testing support at $2.70 as of Friday’s writing. Markets fear that the weekend may extend the downtrend if the bulls fail to hold this support zone. Over the last couple of weeks, interest in digital assets has declined significantly, as analysts believe that September is typically a bearish month for crypto.

XRP Derivatives Market Shows Mixed Signals

According to Coinglass data, XRP open interest has slipped to $7.40 billion, from the September highs of $8.85 billion. Open interest refers to the total value of futures contracts that are actively traded.

Over the last year, the chart shows significant peaks, particularly during periods of high volatility. However, with the recent dip, it could indicate that bets on higher XRP prices are on a free fall, increasing the chances of an extended downtrend.

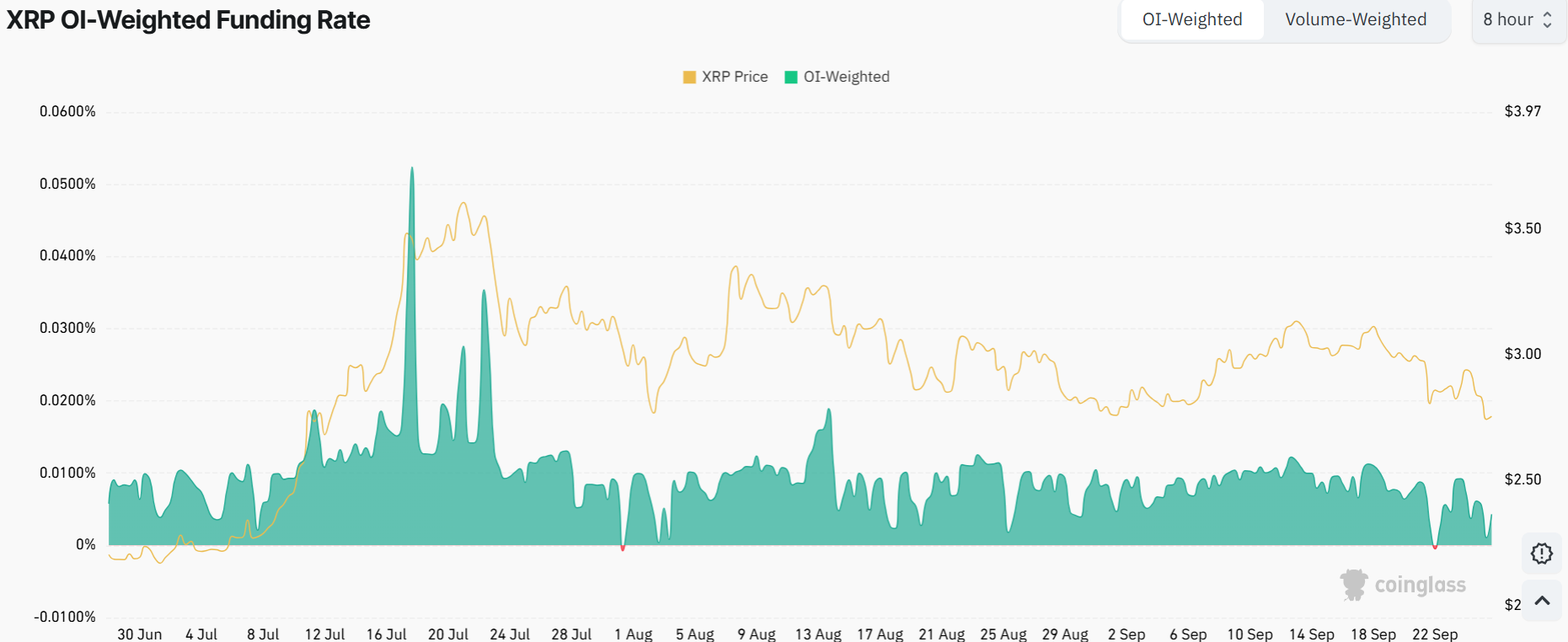

On the other hand, the OI-weighted funding rate remains intact with positive momentum at 0.0043%. This indicates that more traders are willing to invest in XRP, suggesting a short-term recovery outlook. If this metric continues its upward trend, bullish sentiments will build, and bulls will begin to push for a breakout toward the $3.00 mark.

XRP Price Outlook: Can Bulls Overcome the $2.98 Resistance?

XRP/USD is currently in a consolidation phase on the daily chart. Currently, the XRP price is sandwiched between the 50-day moving average at $2.98 and the 200-day moving average at $2.5415. XRP is currently at $2.71, which is a key support and resistance level, allowing it to accumulate before the next move.

The RSI of 36.86 indicates that the asset is slightly oversold and may undergo a mild correction. However, bulls can also initiate a buy-back strategy at this level, driving the RSI above the 50-mean level.

The MACD indicator is negative as the histogram remains in the red, reaffirming consolidation. This means that traders watching this setup could either see a breakout above $2.98, continuing the bullish momentum, or a breakdown below $2.54, signaling a renewed bearish trend.

If XRP price maintains the 2.70 support zone, it may break through $2.98 and test the $3.20 resistance next. However, the current market structure suggests that the XRP price may move in one of two directions. Meanwhile, Ali Martinez speculates that if the XRP price holds above $2.70, a rebound to $3.20 is imminent.

$XRP must hold $2.70 support to keep the chance of a rebound to $3.20 alive! pic.twitter.com/RZGL4DtJV9

— Ali (@ali_charts) September 26, 2025

On the other hand, if the $2.98 resistance proves too strong, the XRP price could move to the downside or remain in the consolidation channel. In short, XRP is at a critical point. Holding above current levels could fuel a fresh rally, but traders should watch closely to confirm whether this breakout has real strength or is just a false start.

Best Crypto Exchange

- Over 90 top cryptos to trade

- Regulated by top-tier entities

- User-friendly trading app

- 30+ million users

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong.