Highlights:

- Bitcoin ETFs attracted significant inflows, surpassing $1.04 billion this week.

- US Bitcoin ETFs now hold a record high of 888,607 BTC.

- Despite Germany’s BTC sales, institutional demand for Bitcoin ETFs remains strong globally.

Despite active selling of BTC by the German government, US-based spot Bitcoin (BTC) exchange-traded funds (ETFs) witnessed significant accumulation, leading to inflows surpassing $1.04 billion this week. As a result, Bitcoin’s price has remained stable, currently trading up 2.15% at $58,559, with a market cap of $1.155 trillion.

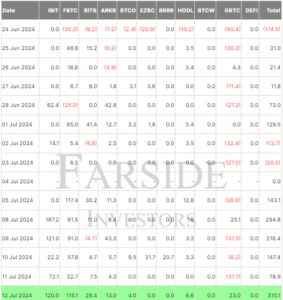

Bitcoin ETFs See $310M Net Inflow on July 12

On July 12, spot Bitcoin ETFs recorded net inflows of $310.1 million, marking this week’s fifth consecutive day of net inflows. This was the largest inflow since June 5, when ETFs saw inflows of $488.1 million. According to Farside Investors, BlackRock’s iShares Bitcoin Trust (IBIT) attracted $120 million in investments, closely followed by Fidelity’s Wise Origin Bitcoin Fund (FBTC) with $115.1 million.

The Bitwise BTC ETF (BITB) secured the third position with investments amounting to $28.4 million. Meanwhile, the Grayscale Bitcoin Trust (GBTC experienced another notable inflow day, attracting $23 million.

The VanEck Bitcoin Trust ETF (HODL) and Invesco Galaxy BTC ETF (BTCO) received $6 million and $4 million in inflows, respectively. Meanwhile, spot BTC ETFs issued by Hashdex, Franklin Templeton Valkyrie, and WisdomTree did not attract inflows on the day. Since their launch just over six months ago, spot BTC ETFs have accumulated $15.8 billion in net inflows.

Bitcoin ETF Holdings Hit All-Time High

US spot BTC ETFs have seen inflows for six consecutive trading sessions. Remarkably, this marks the highest weekly inflow for BTC ETFs since May. According to HODL15Capital data, BTC holdings by US ETFs have reached a record high of 888,607 BTC.

🧮 Updated USA Bitcoin ETF holdings (including today's inflows).

New all-time high of 888,607 BTC held by the U.S. ETFs 👇 https://t.co/WsdwjZnaN2 pic.twitter.com/HUrEBSNzvi

— HODL15Capital 🇺🇸 (@HODL15Capital) July 13, 2024

Not only US-based but also global BTC ETFs have seen their holdings hit an all-time high of 1,051,569 BTC. Hong Kong-based Bitcoin ETFs continue to rally, reaching a new record high, with total BTC holdings now at 4,941 BTC.

✅ Bitcoin held by the Hong Kong 🇭🇰 Bitcoin ETFs hits record high👇 pic.twitter.com/3GZmN1PlR0

— HODL15Capital 🇺🇸 (@HODL15Capital) July 12, 2024

Similarly, Australia’s Monochrome Bitcoin ETF (IBTC) has gained significant attention, accumulating 83 BTC since its launch. This brings its total holdings close to 100 BTC.

Interestingly, this development coincides with the German government selling off all its Bitcoin holdings in the past month. It seems that inflows into ETFs have effectively absorbed the selling pressure on Bitcoin. This also indicates that institutional demand for regulated Bitcoin products remains strong despite current price volatility.

Is Bitcoin Headed for Recovery?

Bitcoin has made slight gains recently, recovering from its recent price lows and renewing market optimism. Despite the recovery, Bitcoin still has a substantial distance to cover. Its current value remains well below its $60,000 support level and is down by 20.7% from its peak of $73,780. Recent analyses have emphasized critical support levels, identifying $60,000 as pivotal for Bitcoin to regain bullish momentum. If the cryptocurrency remains below this mark and drops below $50,000, it might prompt substantial selling pressure across the industry.

Read More

- Next Cryptocurrency to Explode in July 2024

- Crypto Price Predictions

- Best Solana Meme Coins to Buy In 2024

- Ether.fi Price Drops 8.6% as Season 2 Concludes and Season 3 Begins

- CDK Global Pays Hackers $25 Million in Crypto as Ransom