Highlights:

- The price of Sui has increased 8% to $4.15 in the past 24 hours.

- SUI technical indicators signal further upside, potentially to $5.

- CoinGlass data shows a positive growing sentiment in SUI, painting the bigger picture as bullish.

The SUI price is riding on the bullish wave evident in the crypto market, surging 8% to $4.15 in the past 24 hours. The crypto market, led by Bitcoin hitting a new ATH at $111K, has spurred bullish momentum, with investors optimistic of further increases. Bolstering the bullish outlook in the SUI market is its daily trading volume, which has spiked 66% to $2.03B. With heightened market activities, how high can the Sui price go?

Sui Price Outlook

Checking the charts for SUI/USD, we can see a developing upswing with a noticeable rounding bottom pattern. Such a structure signals that the market may reverse from a period of stability to a price rise. Currently, the bulls have flipped the 50-day MA into support at $3.85, as the price is boasting a bullish grip, up 8% to $4.15.

Sitting at 64.39, the RSI represents purchase momentum, yet the market hasn’t yet entered overbought territory, so further gains are possible. At the same time, the MACD indicator has crossed above the neutral line, further pointing to upside growth. Based on the chart, SUI is getting ready for a significant move higher, with a possible target of $5 soon.

Meanwhile, according to BitcoinSensus, he has pointed out on Twitter that SUI is gearing up for another rally following a period of holding steady. The technical overview points out an ongoing ascending wedge, showing a series of impulsive waves that have grown stronger the further they go. The expert forecast that SUI will trade at $11.50 in the future, since there is strong market trust in the company’s upcoming success.

Bullish on the future of $SUI 💧?

From a technical perspective, #Sui is getting ready for its next major move up.(currently in the consolidation process).

Since its creation, $SUI has been moving within this ascending wedge pattern, with consecutive impulsive waves to the… pic.twitter.com/r5PUyiRMZs

— Bitcoinsensus (@Bitcoinsensus) May 21, 2025

Market Sentiment and On-Chain Metrics Confirm SUI’s Strength

Michaël van de Poppe points out that the network’s usage and trade volume stats show the potential for SUI to rise. The author says that DEX utilization for SUI is at its highest point yet (ATH), meaning that SUI’s trading interest and liquidity have risen. A surge in stablecoins coming into SUI-related assets shows that investors are more confident and placing more of their capital in the token.

The higher the breakout, the heavier the move will be.

That's always how it goes with price action.$SUI isn't different.

– DEX volume on SUI has hit an ATH.

– Most stablecoin inflow is happening in SUI.

– SUI's DAU's have tripled over the past three months.The chain is… pic.twitter.com/2Tyx1zERQW

— Michaël van de Poppe (@CryptoMichNL) May 21, 2025

Michael also notes that daily active users of the SUI blockchain tripled during the past three months. Since many people are using the SUI platform now, it could lead to steady valuation for the SUI token. As he sees it, SUI is a key player in blockchain which makes it more likely that its price will surge.

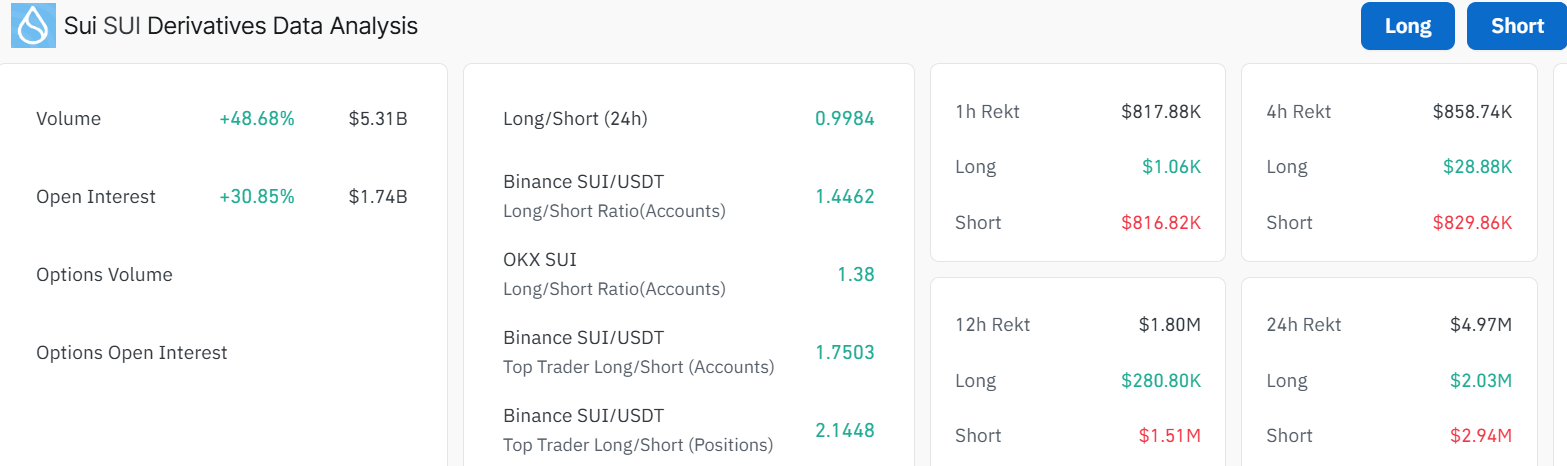

Derivatives Data Reflect Positive Trader Sentiment and Growing Volume

According to Coinglass data, SUI shows that both trading activity and open interest in derivatives have risen. The market volume currently stands at $5.31 billion, a 48.68% rise, and open interest has increased to $1.74 billion, showing a 30.85% jump.

SUI is growing across a range of sectors. Experts say the number of users and total transactions is increasing, and technical charts suggest a breakout is right around the corner. Traders’ overwhelmingly positive outlook in the derivatives market makes SUI a worthy asset to track over the next few months.

If the buying pressure keeps dominating and the bulls take advantage of the buy signal from the MACD, SUI could soar further. In such a scenario, the rally towards $4.31, $4.50, and $5 could be plausible in the short term. In the medium term, the bulls could target $10.

On the other hand, if the bears step in and the crypto market turns negative, the token could drop. In such a case, the $4.02, $3.95, and $3.85 will be in line to absorb the potential selling pressure. Only a breach below the $3.85 mark would invalidate the bullish thesis, potentially triggering panic sell-offs in the market. However, as the adoption rate increases and the market gains steam, SUI is becoming well-known as a prominent name among emerging blockchain companies.

Best Crypto Exchange

- Over 90 top cryptos to trade

- Regulated by top-tier entities

- User-friendly trading app

- 30+ million users

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong.