Highlights:

- Sui price soars 2% to $3.11 as trading volume spikes 30%.

- The crypto analyst highlights that Sui’s price could be gearing for a rebound.

- With renewed interest, a breach above the $4.09 mark could trigger a rally to $5.95, triggering 90% gains.

The Sui price has spiked 2% to trade at $3.11 at press time, as the crypto market shows signs of recovery. The surge in interest has seen the trading volume soar 30% to $1.07 billion, signaling increased investor interest.

This renewed strength in the Sui market could trigger a breakout above the parallel channel. Ali Charts, a well-known analyst, has mentioned that SUI could be gearing up for a rebound, as the TD Sequential indicator flashes a buy signal on the 4-hour chart.

$SUI could be gearing up for a rebound, as the TD Sequential indicator flashes a buy signal on the 4-hour chart! pic.twitter.com/pT1skPWJ88

— Ali (@ali_charts) February 19, 2025

Can Sui Price reclaim the $5 mark with the renewed momentum? Let’s dive into the technical outlook and decrypt more.

Sui Statistical Data

Based on CoinmarketCap data:

- SUI price now – $3.13

- Trading volume (24h) – $1.07 billion

- Market cap – $9.69 billion

- Total supply – 10 billion

- Circulating supply – 3.08 billion

- SUI ranking – #15

SUI Price Poised for a Breakout Above the Falling Parallel Channel

The SUI price is currently trading at $3.11, reflecting a 2% gain as the crypto market shows signs of a recovery. Key resistance levels can be identified at $4.09, which aligns with the 50-day MA. If SUI breaches this technical barrier, it could pave the way for a more sustainable recovery.

Conversely, a failure to maintain its current position may result in the price retesting critical support levels at $3.00 and the psychological zone of $2.75. Should market momentum improve in favor of Sui, a rally toward $5.95 is likely to extend toward $7 if sentiment shifts.

On the flip side, if bearish pressure persists and the RSI fails to recover above the 50 mark, the Sui price might be under duress, sliding toward the $2.75 region or lower. Traders should carefully observe volume trends and broader market cues to navigate this highly volatile phase.

The Sui price shows signs of renewed strength, and if bullish momentum continues to build, the token could breach the $4.09 mark. A steady rise in trading volume and consistent higher lows indicate growing investor confidence, potentially paving the way for a breakout.

Overcoming key resistance levels will be crucial, as past price action suggests that a successful push above these barriers could trigger a stronger rally. However, sustaining this momentum will depend on broader market sentiment and Bitcoin’s dominance.

Technical Indicators Suggest More Upside In Sui Market

A zoomed outlook at the RSI Divergence Indicator, hovering at 40.15, reflects neutral momentum, signaling indecision in the market. If the RSI rebounds above 50, it may indicate a shift in momentum, favoring buy-the-dip strategies. Conversely, a decline below 40 would confirm bearish control, increasing the breakdown probability.

On the other hand, the MACD indicator upholds a buy signal, calling for traders to rally behind SUI. This is manifested as the blue MACD line has flipped above the orange signal line, indicating bullish sentiment. In other words, traders and investors are inclined to buy SUI unless the MACD changes.

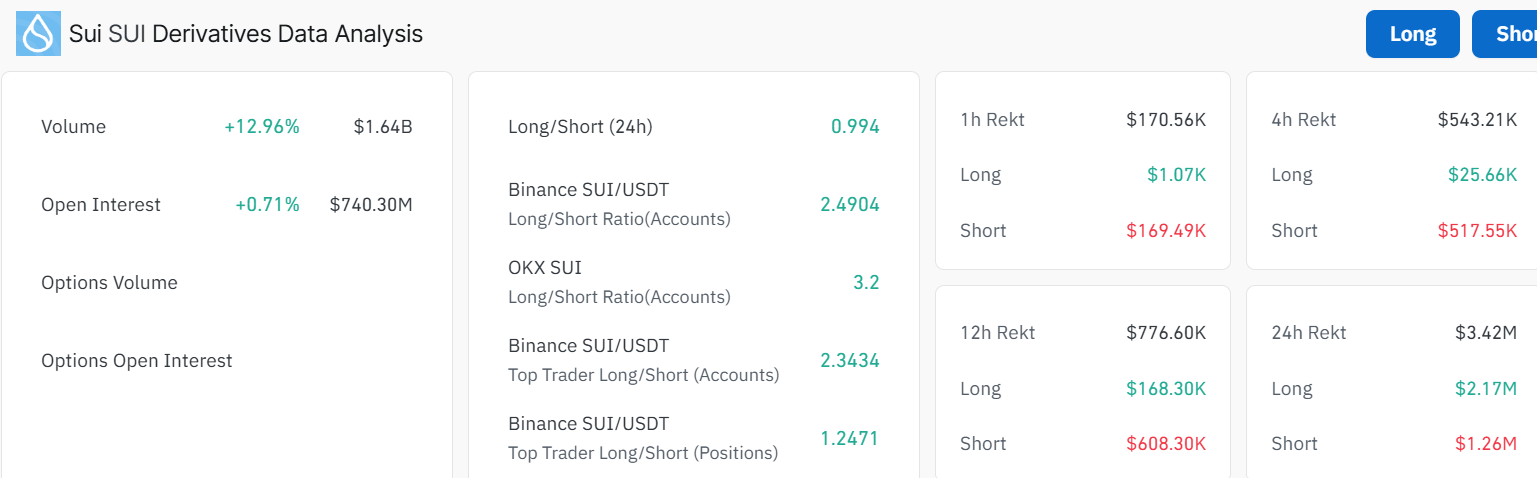

On-chain data further supports a potential price breakout. Open interest has soared 2% to $740.30M, while the trading volume has spiked 12% to $1.64 billion. This suggests increased market activity that may trigger a rally to $5.95 in the near term.

Best Crypto Exchange

- Over 90 top cryptos to trade

- Regulated by top-tier entities

- User-friendly trading app

- 30+ million users

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong.