Highlights:

- The Sui price has dwindled 5% to $1.49, as the bearish grip strengthens.

- The SUI derivatives data show a drop in retail demand as open interest drops 5% and long liquidations exceed $3 million.

- The SUI TVL has declined by 4% as the technical outlook shows mixed signals.

Sui (SUI) price is heavily bearish with losses of 4.95% to trade at $1.49 as of Tuesday. The Decentralized Finance (DeFi) token is plummeting in price as on-chain demand declines amidst a wider market of risk-off mood. Further, the derivatives data indicate that the risk appetite is dropping. The technical outlook of SUI indicates that the next support level is at $1.39, as the Sui bulls target $1.70 rebound.

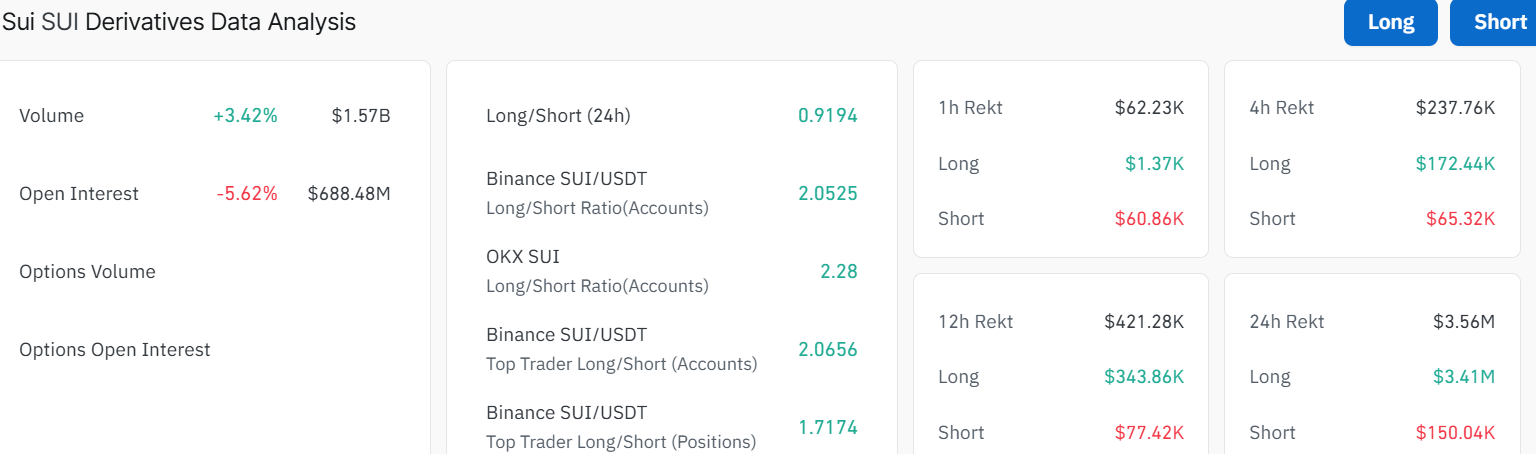

According to CoinGlass data, retail participation in SUI has decreased by a substantial margin. This comes as its futures Open Interest (OI) has reduced by 5.62% in the past 24 hours to $688.48 million. A decrease in OI is usually an indication of risk-off trading by the traders since the notional value of all outstanding positions long and short decreases.

In the meantime, the liquidations over the past 24 hours are long. In the last 24 hours, there were $3.41 million, compared to the short liquidations of $150.040, meaning that more bullish positions were wiped out. This has decreased the long-short ratio to 0.9194, which represents a higher number of active short positions.

On the other hand, the Sui blockchain has experienced a decreasing demand on the network side. Its Total Value Locked (TVL) has plunged by 4.02% in the past 24 hours to reach $866.29 million. It means that users are liquidating their online assets.

Sui Bulls Target $1.70 Resistance Soon

The chart for SUI/USDT on the 1-day timeframe shows a rollercoaster that has hit a rough patch. The price has been in a steady downtrend, after hitting a high of $3.75 in early October, but it’s currently trading at $1.49. The 50-day Simple Moving Average (SMA) at $1.76 and the 200-day SMA at $2.95 are both trending downward, suggesting some long-term bearish strength. However, the Sui price is currently consolidating within a descending parallel channel, as the bulls aim for a breakout.

Digging into the indicators, the Relative Strength Index (RSI) at 41.65 is flirting with neutral territory, not overbought or oversold. This hints that the Sui price might still have room to move in either direction.

Meanwhile, the Moving Average Convergence Divergence (MACD) shows a slight bullish crossover, signaling some short-term strength. In the short term, Sui could test support around $1.39 if this dip continues. A drop below that will see the token revisit the $1.30 lows.

On the flip side, if the bulls push past the current levels, the Sui token could charge towards $1.70 resistance or higher at $1.76. The current consolidation and positive MACD indicator suggest a potential bounce, but the 7% weekly drop is a red flag for caution. For now, it’s a wait-and-see game. Investors may want to keep an eye on volume, which is up 13% and the RSI, to determine the next move in Sui price.

Best Crypto Exchange

- Over 90 top cryptos to trade

- Regulated by top-tier entities

- User-friendly trading app

- 30+ million users

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong.