Highlights:

- Sui price drops 5% to 3.54 as trading volume soars 41%.

- Mill City Ventures closes a $450M private placement and buys 76,271,187 SUI to commence its treasury strategy.

- SUI’s long-term outlook remains bullish despite the bearish outlook

The crypto market is wobbling today, and the SUI price has decreased 5% to $3.54. Despite the crypto market experiencing a bloodbath following Trump’s imposition of tariffs, Sui’s trading volume has surged by 41%. This indicates a rise in investor confidence in the market. SUI is now down 3% over the past week and 26% up over the past month.

Meanwhile, the launch of Mill City Ventures marks a significant milestone for Sui, as it enters another crucial stage in its evolution. This is the step that represents a greater perspective of blockchain technology. The launch not only gives access to Sui on Nasdaq but also opens the door to increased retail and institutional involvement.

Welcome to Sui, Mill City Ventures.

With Mill City’s launch today, everyone can access Sui on Nasdaq. Together, we are showing what’s possible when blockchain is built for mass adoption.

Public market access unlocks greater retail and institutional participation—and a stronger… pic.twitter.com/2m3UBTeZTM

— Sui (@SuiNetwork) August 1, 2025

In a treasury plan, Mill City Ventures has raised $ 450 million privately and acquired 76,271,187 shares of the Sacred Union of India. Mill City claims to be the first crypto treasury strategy to have an official foundation supported on the market. The collaboration with Mill City Ventures suggests that Sui is committed to integrating blockchain into mainstream financial systems.

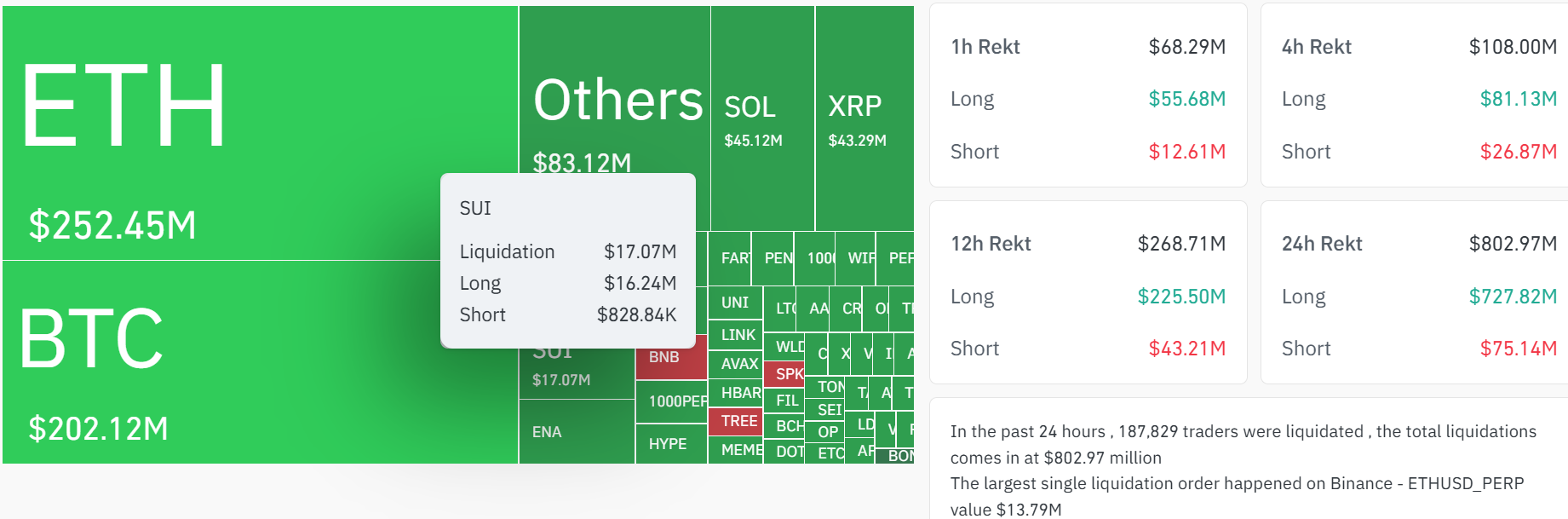

SUI Price Drops 5% as $16M Longs Are Liquidated

In the past few days, Sui has experienced a high level of liquidation, totalling $17.07 million. The distribution of the long and short positions shows that long positions represented up to 88% or $16.24 million, with short positions representing a mere 12% of the total, or $ 828,840. This indicates a slight bullish sentiment among traders, who tend to hold long positions in the Sui market.

The Sui price is exhibiting bullish sentiment despite a recent 5% plunge to $3.54. The bullish grip is manifested as the 50-day SMA ($3.28) and the 200-day SMA ($3.18) act as immediate support zones, cushioning against further downside. However, SUI is still trading well within a rising parallel channel.

The Relative Strength Index (RSI) is indicating a neutral market, with a reading of 46.76. This suggests that the market may either continue to rise or undergo a correction, depending on the broader market’s dynamic situation and institutional activity.

Long-Term Outlook Remains Strong

On the downside, support is found around $3.28-$3.18. If that breaks, the next strong support is near $2.81, where buyers stepped in before. The RSI (Relative Strength Index) is at 46.76. This means the SUI price isn’t oversold yet, but it has room to fall further before bouncing. That said, the longer-term structure remains bullish unless SUI breaks down below the key support zones.

A daily close above the $4 level would confirm renewed buying strength and set the stage for a move toward the $4.54-$5 resistance zone. While the Sui price is currently under short-term pressure, the broader price structure favours continuation to the upside, especially if it manages to reclaim $4. If support around $3.28 holds, SUI could soon aim for the higher zones.

Best Crypto Exchange

- Over 90 top cryptos to trade

- Regulated by top-tier entities

- User-friendly trading app

- 30+ million users

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong.