Highlights:

- The Sui price has rebounded from a low of $3.10, currently at $3.38, marking a 5% surge.

- The Sui Foundation is leading the path in scaling stablecoins with a $21.5 million funding round by xMoney.com.

- SUI DeFi TVL has surpassed $2.20 billion, as analyst predicts a breakout to $7.

The Sui price is bouncing within a falling wedge, rising 5% to $3.38, after recently pulling back to $3.10. The daily trading volume has notably increased by 19% to $1.14 billion, indicating growing investor confidence. Meanwhile, stablecoins are shaping the future of global payments, with emphasis on trust, compliance, and speed.

The Sui Foundation is leading the way in scaling stablecoins for global use and making a significant contribution to this effort. Recently, it led a $21.5 million funding round for xMoney.com, whose goal is to create an easy and scalable infrastructure for the digital economy.

Stablecoins already move $7T a year. Scaling them for global payments takes trust, compliance & speed.

That’s why the Sui Foundation is leading @xMoney_com’s $21.5M raise – building the rails for the next era of finance. https://t.co/AaZdZTN4pi

— Sui (@SuiNetwork) September 30, 2025

The new capital raise will help unlock the multi-trillion-dollar stablecoin economy. The money is used to build better and safer rails for the stablecoin ecosystem, enabling faster, more efficient, and compliant global payments.

Sui’s Growing Influence in DeFi

The efforts of the Sui Foundation are yielding impressive results in blockchain and decentralized finance (DeFi). Sui has a total value locked (TVL) in DeFi of over $2.2 billion, marking a 4% surge in the past 24 hours. This indicates a steadily rising trust, as the stablecoin market cap of Sui reaches $677.5 million.

These illustrate the rapid growth of Sui within the overall DeFi space. The numerous apps within the Sui ecosystem are generating substantial revenue, and the trading volume on decentralized exchanges (DEXs) is also increasing. Sui is therefore fast becoming a vital player in the DeFi ecosystem. The recent growth indicates that SUI investors are confident in the SUI price rise in the coming days.

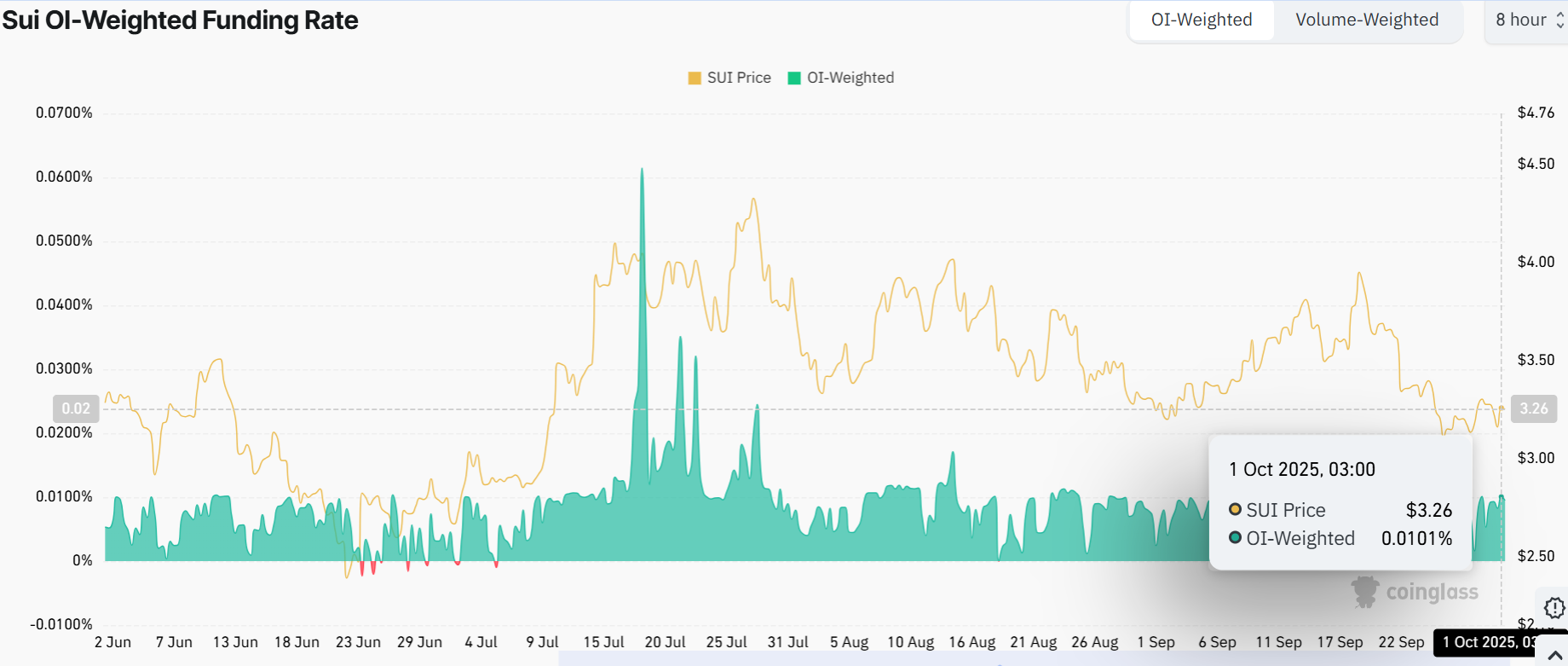

Notably, Coinglass data shows a positive OI-weighted funding rate. Sui appears to be gaining positive foot traffic, as evidenced by the rise in OI-weighted funding rates at 0.0101%. The funding rate chart indicates that interest has been steadily increasing, suggesting a bullish trend.

Sui Price Outlook: Bulls Target a Rally to $7

The daily chart shows SUI price action over the past few months, with a wild ride from a low of $3.10 to its current price of $3.38. The chart zooms in on a falling channel pattern, with a falling resistance currently at $3.50 and support near $3.23. Meanwhile, if the bulls manage to overcome the $3.50 resistance, a breakout to $7 mark is imminent in the Sui price.

Diving into the indicators, the Relative Strength Index (RSI) sits at 48.35, hovering in neutral territory, neither overbought nor oversold. This means there’s room to run before the crypto hits exhaustion territory. If the positive trend holds, the Sui price could blast past $3.50 in the short term. Furthermore, Ali Martinez, a prominent crypto analyst, has noted that SUI appears poised for a breakout to $7.

This looks like the prime zone to buy $SUI before the bullish breakout to $7. pic.twitter.com/Z5kqlXmyj4

— Ali (@ali_charts) September 30, 2025

However, there are risks. If the $3.50 resistance proves too strong, a drop towards $3.23 safety net would be plausible. In the long term, if Sui price can break $3.58 and hold, it might eye $7.00 by Q4 2025. For now, this 5% pump is a green flag to ride the wave, but traders will want to set stop losses in case of a change in trend.

Best Crypto Exchange

- Over 90 top cryptos to trade

- Regulated by top-tier entities

- User-friendly trading app

- 30+ million users

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong.