Highlights:

- The Sui price is above $2.00, currently trading at $2.09.

- The Sui DeFi TVL has decreased by 12% amid risk-off sentiment.

- Sui’s technical outlook is bearish, as bulls hold above key support.

Sui price is climbing, currently at $2.09, as the crypto market recovers. The positive shift in the Sui level was preceded by a downturn that wiped out gains from $2.20 to $1.98 the previous day. Sui’s interest in the field of decentralized finance (DeFi) has remained low, as its total value locked (TVL) has steadily decreased.

TVL, the notional value of all assets staked on the protocol, is down 12% to $1.37 billion over the last 24 hours, according to DefiLlama data. Meanwhile, Sui’s TVL, which reached a record $2.63 billion on October 9, has been in decline. This indicates the risk-off trend in the overall cryptocurrency market.

Traders have pulled assets out of staking protocols, signaling a lack of confidence in the token and its potential to establish an ecosystem. The reintroduction of these tokens into the market would increase selling pressure and increase the likelihood of a gradual decline in Sui’s price.

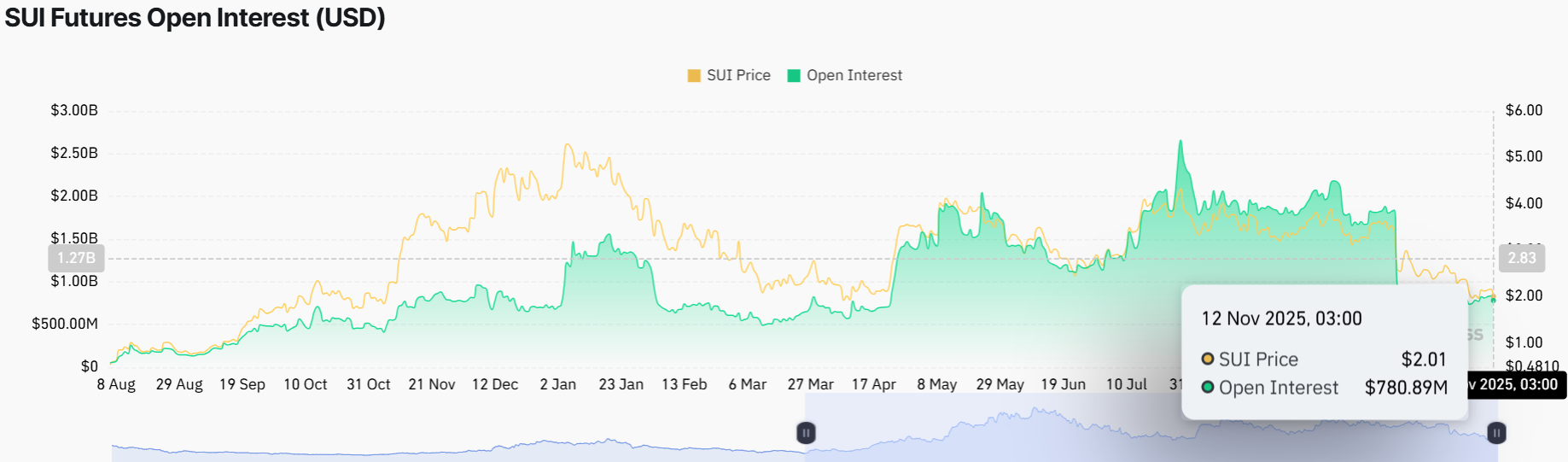

In the meantime, retail demand for Sui has been markedly dampened since mid-October. This does not indicate whether investors believe the Layer-1 token will sustain a short-term recovery. Open Interest (OI) in futures is now about $780 million on Wednesday, compared to $835 million on Tuesday and $1.84 billion on October 1. However, the OI must increase gradually to help Sui to recuperate. Otherwise, there is a possibility the downtrend could fall below $2.00.

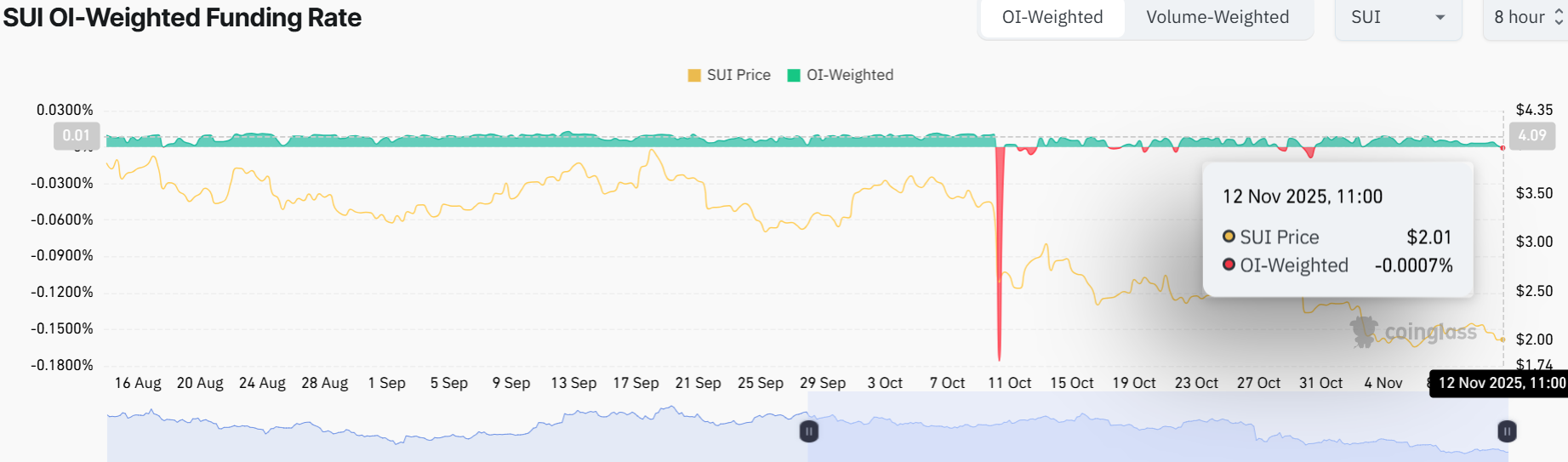

The OI-Weighted Funding Rate indicator has taken a drop to -0.0007% at the time of writing. This indicates that traders are indeed adding to short positions in large numbers, further increasing sales pressure.

Sui Price Holds Above $2 As Bulls Target Higher Levels

The chart shows SUI’s 1-day price action, with the current price hovering around $2.09, up from a current low of $1.98. The 50-day Simple Moving Average (SMA) sits at $2.72, above the current price, indicating a strong resistance zone.

The 200-day SMA at $3.28 marks a psychological floor that, if broken, could ignite a strong rally. The chart also shows a falling wedge pattern, in which the Sui price is trading within. This setup often signals a breakout, which may cause SUI to skyrocket above the resistance zones soon.

The Relative Strength Index (RSI) at 39.04 has rebounded from 35, showing that the bearish momentum is easing. If the bulls regain their footing, ignite a buy-back strategy, and move above 50, it would invalidate the bearish outlook.

If the Sui price stays above $2.00, the altcoin will be in good shape. But if it falls below that, it could drop to around $1.81. However, if trading volume remains strong, the price could reach the $2.72-$3.26 resistance zones by the end of November. For the risk-takers, if it breaks above $2.72 with strong volume, a jump to $3 is possible.

Best Crypto Exchange

- Over 90 top cryptos to trade

- Regulated by top-tier entities

- User-friendly trading app

- 30+ million users

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong.