Highlights:

- Spot Ethereum ETFs saw net inflows of $98 million on Wednesday, led by BlackRock’s ETHA.

- Grayscale’s Ether ETF experienced its lowest daily outflow.

- Bitcoin ETFs face third day of outflows amid recession and geopolitical fears.

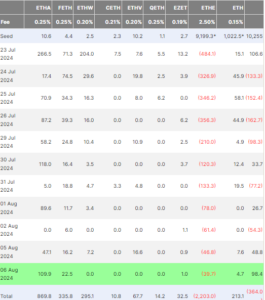

On August 6, US-based Spot Ether exchange-traded funds (ETFs) recorded a total inflow of $98.4 million, the highest since their launch on July 23. According to data from Farside Investors, BlackRock’s ETHA experienced the largest outflows, totaling $109.9 million. Fidelity’s FETH followed with $22.5 million, Grayscale’s mini trust received $4.7 million, and Franklin Templeton’s ether fund saw inflows of less than $1 million. Grayscale’s ETHE continues to bleed, while the other four Ethereum ETFs recorded no flows.

Grayscale Ethereum ETF Sees Record Low Outflows of Nearly $40M

On Tuesday, approximately $40 million left Grayscale’s ETHE, marking the lowest daily outflow since its conversion from a trust last month. On its debut date, the fund experienced daily outflows, reaching a peak of $484 million. By the end of its first week of trading, ETHE’s outflows had surpassed $1.5 billion.

However, the rate of exits has slowed since the beginning of this week. On Monday, ETHE reported net outflows of over $61 million, followed by approximately $47 million on Tuesday. With additional outflows reported on Wednesday, the total outflows for ETHE have surpassed $147 million this week. Analyst Mads Eberhardts had previously predicted a slowdown in ETHE outflows this week and also suggested that a price increase could follow once the outflows stabilized.

BlackRock’s Spot Ethereum ETF Among Top Six

The $109.9 million inflow on August 6 brought BlackRock’s ETHA total inflows to $869.8 million since it started on July 23. According to Nate Geraci, President of The ETF Store, this figure places ETHA among the top six best-performing ETFs launched in 2024. Four of the other top five performers are spot Bitcoin ETFs, including BlackRock’s IBIT.

Enormous regulatory barriers still in place for spot btc & eth ETFs…

-No in-kind creation & redemption

-No options trading

-No staking on eth ETFs

And these products are still challenging & shattering ETF industry records.

Should tell you something about investor demand.

— Nate Geraci (@NateGeraci) August 7, 2024

Notably, ETHA drew $47.1 million on “Black Monday” for the crypto industry, a day when more than $825 million in leveraged long positions were liquidated. Despite the market chaos, the combined inflows for ETHA on August 5 and 6 put it in the top 10% of ETFs launched this year. Moreover, Nasdaq and BlackRock proposed a rule change on Tuesday to list and trade options for BlackRock’s spot ETH ETF. Despite ETHA’s strong performance, spot Ether ETFs have experienced a combined outflow of $364 million, largely due to the $2.2 billion that has exited Grayscale’s ETHE.

Bitcoin ETFs See Outflows for Third Day

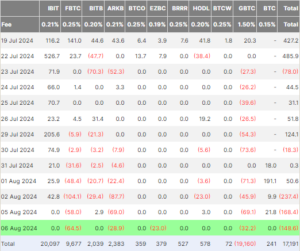

In contrast, US Bitcoin ETFs faced significant outflows on August 6, totaling $149 million. This marked the third consecutive day of negative net inflows. Grayscale’s ETF GBTC recorded an outflow of $32.2 million, Fidelity’s FBTC experienced $64.5 million in outflows, and ARKB saw $28.9 million in outflows.

The total net asset value of Bitcoin spot ETFs is now $51.5 billion. Last week, digital asset investment products experienced outflows totaling $528 million, representing the first decline in four weeks. The exodus is thought to be a reaction to growing fears of a potential recession in the United States, along with geopolitical uncertainties and widespread liquidations across various asset classes.

Both BTC and ETH are recovering more from Monday’s global market downturn. BTC rose 1.73% to $57,067, while ETH grew 2.02% to $2,514 in the past 24 hours, according to CoinMarketCap.

Read More

- Next Cryptocurrency to Explode in August 2024

- Toncoin Price Prediction 2024 – 2040

- Next 100x Crypto – 12 Promising Coins with Power to 100x

- Dogwifhat Price Surges 27%, But Market Signals Suggest Short-Lived Uptrend

- Spot Ethereum ETFs See $98M in Inflows, Grayscale’s ETHE Outflows Hit Record Low