Highlights:

- Bitcoin ETFs saw increased inflows amid institutional investors buying the Bitcoin dips.

- Schiff predicts Bitcoin ETF holders could capitulate if significant price drops continue.

- Bitcoin rebounds above $56K; altcoins also surge following recent market downturn.

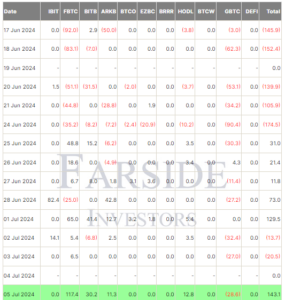

On July 5, spot Bitcoin ETFs experienced a significant $143 million net inflow, signaling renewed investor interest amidst recent market turbulence. According to Farside Investors, this marks their highest monthly net inflow. Bitcoin has rebounded strongly from its Friday low of $53,550. At the time of writing, BTC was trading above the critical $56,000 support level with a 4% increase.

ETF Investors Bought the Bitcoin Dips

Despite market panic, recent inflows into spot Bitcoin ETFs indicate that major investors and institutions have been buying the dips. The Fidelity Bitcoin ETF (FBTC) dominated inflows with a substantial $117 million, underscoring robust investor confidence in the fund. Following FBTC, the Bitwise Bitcoin ETF (BITB) received a net inflow of $30.2 million.

Meanwhile, the ARK 21Shares Bitcoin ETF (ARKB) and VanEck Bitcoin Trust ETF (HODL) saw inflows of $11.3 million and $12.8 million, respectively. On the contrary, the Grayscale Bitcoin Trust (GBTC) saw a net outflow of $28.6 million, sharply contrasting the positive trend seen in other spot Bitcoin ETFs.

Peter Schiff Predicts Bitcoin ETF Holders Could Capitulate

Bitcoin critic Peter Schiff commented on the current situation of Bitcoin ETF investors, suggesting that despite ongoing market turbulence, they are maintaining their positions without showing signs of panic.

He said:

“So far, there’s no sign of panic. It will likely take a much larger drop in Bitcoin before they finally capitulate.”

He also predicted that this sell-off could happen soon, maybe as early as next week, especially if there’s another big drop over the weekend. Schiff’s comments show he still doubts Bitcoin’s stability and investors’ resilience amid market changes.

Based on trading activity it looks like #BitcoinETF buyers are still HODLing. So far there's no sign of panic. It will likely take a much larger drop in #Bitcoin before they finally capitulate. That may come as soon as next week, especially after another big selloff this weekend.

— Peter Schiff (@PeterSchiff) July 5, 2024

Bitwise CEO Highlights Bitcoin Acquisition Efficiency and Promising Market Outlook

Hunter Horsley, CEO of Bitwise Asset Management, praised his team’s efficiency on the X social platform in acquiring Bitcoin at a cost of less than half a basis point. Horsley also said that Bitcoin looks promising, saying the current market conditions are a good time for new and existing investors to buy in.

He stated:

“The outlook for Bitcoin has never been stronger. For many who don’t yet have exposure, this week is a chance to buy the dip.”

In the first week of July, BITB saw over $66 million in inflows, boosting its total Bitcoin holdings to over 38,000. This growth reflects ongoing confidence in Bitcoin’s future despite short-term ups and downs.

~$30,000,000 inflows into $BITB today.

Bitwise PM team efficiently purchased Bitcoin at less than half of 1 basis point of cost.

Cumulatively this week $BITB had >$66,000,000 of inflows, and now holds over 38,000 Bitcoin for investors.

The outlook for Bitcoin has never been…

— Hunter Horsley (@HHorsley) July 5, 2024

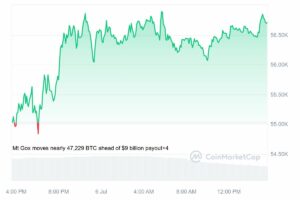

Bitcoin Rebounds Above $56K as Altcoins Follow Suit

At the time of writing, BTC was trading at $56,703, marking a rise of approximately 4% over the past 24 hours. On July 5, BTC dropped to a five-month low of $53,550, but the bulls pushed back and recovered about $3,000. The correction came amid fears of increased selling pressure due to Mt. Gox repaying creditors and the German government liquidating seized BTC.

Most altcoins are also attempting a recovery and have bounced back from recent lows. AVAX, TON, DOGE, and PEPE each soared by 12%. Shiba Inu (SHIB) recovered by 15%. Large-cap cryptocurrencies like Ethereum, Solana, Bitcoin Cash, Binance Coin, and MATIC are gaining between 4.5% and 10%.

Read More

- Next Cryptocurrency to Explode in July 2024

- Crypto Price Predictions

- Best Crypto Exchanges in 2024

- Shiba Inu Price Soars with Over 300 Million SHIB Tokens Burnt in a Week

- Notcoin Price Shows Signs of Potential Upward as NOT Soars 0.1%