Highlights:

- US-listed Bitcoin ETFs hold 900,000 BTC, showing high investor demand.

- Bitcoin ETFs hit $17B in inflows, with $2B in the first three weeks of July.

- Bitcoin’s strong performance and institutional interest suggest bullish trends ahead.

Nate Geraci, president of The ETF Store, revealed that US-listed spot Bitcoin (BTC) exchange-traded funds (ETFs) hold over 900,000 Bitcoins, 4.3% of the total supply. These assets are valued at about $60 billion. The substantial value of these assets indicates the strong demand for Bitcoin ETFs among investors seeking exposure to the leading cryptocurrency.

A breakdown of the holdings reveals that BlackRock’s IBIT holds the most Bitcoin, with 327,182 BTC valued at $21.79 billion. It is followed by Grayscale’s GBTC, which has 272,193 BTC worth $18.1 billion, and Fidelity’s FBTC, which rounds out the top three with over 180,000 BTC valued at $12 billion.

Now *900,000+* bitcoin held by US-listed ETFs…

4.3% of total btc supply.

Approx $60bil in assets.

$17bil net new inflows since January launch.

via @apollosats pic.twitter.com/LaWt1PUOrI— Nate Geraci (@NateGeraci) July 20, 2024

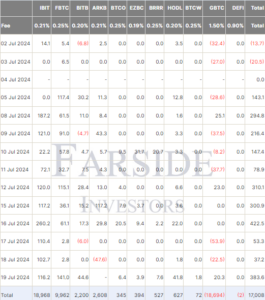

Bitcoin ETFs Draw $17B in Net Inflows Since Launch

The US Bitcoin spot ETFs have reached a new milestone, with $17 billion in net flows over six months, surpassing Bloomberg analysts’ 12-month estimate of $15 billion. According to data from Farside Investors, net inflows were primarily driven by BlackRock’s IBIT, which accumulated $18.968 billion. Fidelity’s FBTC also played a significant role, with net inflows of $9.962 billion. Conversely, Grayscale’s GBTC saw a substantial net outflow of $18.694 billion, indicating a shift in investor preferences.

Bitcoin ETFs hit +$17b in YTD net flows for the first time yesterday. This is most imp number to watch, as it is net the GBTC unlock and independent of price appreciation, basically no bs, can only grow through net demand and adoption. And it can go down but right now moving up. https://t.co/VDUC6tVW5i

— Eric Balchunas (@EricBalchunas) July 20, 2024

Bitcoin ETFs Attract $2 Billion in July

Since early July, Bitcoin ETFs have drawn over $2 billion. Last week alone, the 11 funds saw more than $1 billion in net inflows, marking the third week in a row of positive inflows.

The #Bitcoin ETFs have come storming back in July, amassing $2 billion worth of #Bitcoin in the first three weeks of the month 👀 pic.twitter.com/j4Lfrv5JUz

— Bitcoin News (@BitcoinNewsCom) July 20, 2024

Amidst all this, institutional investors have played a big role. Julian Fahrer from Apollo Sats notes that 79% of institutions have increased their Bitcoin ETF holdings, while only 12.5% have reduced them.

BTC ETFs Surge With $384M Inflows, 2nd Highest this Month

On July 19, BTC ETFs saw inflows of $383.6 million, the second highest for the month, following a record $422.5 million on July 16. The Fidelity Wise Origin Bitcoin Fund (FBTC) and BlackRock’s iShares Bitcoin Trust (IBIT) continued to lead, with inflows of $141 million and $116.2 million, respectively, according to the data. VanEck Bitcoin Trust ETF (HODL) and Bitwise Bitcoin ETF (BITB) saw smaller but notable inflows, showing rising investor interest.

Bitwise’s BITB had the third-highest inflow at $44.6 million, followed closely by VanEck’s HODL with $41.8 million. Grayscale’s GBTC broke a streak of negative flows by bringing in $20.3 million, maintaining its market presence with $18.29 billion in net assets.

Bullish Forecasts for Bitcoin

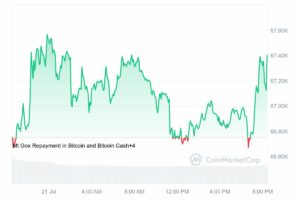

The success of Bitcoin shows this institutional flood as well. Trading at $67,400, Bitcoin’s price rose by 1.05% in the last 24 hours and an impressive 12.26% over the past week.

Both historical records and current trends point to continued improvements. Bitcoin reached an all-time high of $73,630 on March 14, 2024. Despite recent fluctuations, its price above $67K demonstrates strong resilience. Technical indicators suggest a strong bullish sentiment, with a Fear & Greed Index value of 74.

Read More

- Next Cryptocurrency to Explode in July 2024

- Crypto Price Predictions

- Best Solana Meme Coins to Buy In 2024

- Grayscale to Spinoff a Portion of GBTC into a New Bitcoin Mini Trust

- Solana (SOL) Faces a $200 Roadblock: Analytical Platform Uncovers the Critical Barrier

- Five Spot Ethereum ETFs to Begin Trading on July 23, Cboe Confirms

- Binance.US Granted Court Approval to Invest in Treasury Bills

- Argentina Introduces New Tax Rules, Imposes 15% Tax on Capital Gains