Highlights:

- Solana’s price rises 2% with $10.92 million in liquidated funds.

- Solana co-founder calls meme coins’ digital slop.’

- Bullish technical indicators show a potential surge to $247 in the short term.

The Solana price is showing strength, as it has soared 2% to $192 in the past 24 hours. The daily trading volume has increased by 92%, indicating heightened market activity. SOL is now up 30% over the past month, despite a slight plunge of $0.91% over the past week. Meanwhile, Solana co-founder Anatoly Yakovenko has called meme coins and NFTs “digital garbage” with zero intrinsic value. He has notably compared them to loot boxes in mobile games.

I’ve said this for years. Memecoins and NFTs are digital slop and have no intrinsic value. Like a mobile game loot box. People spend $150b a year on mobile gaming.

— toly 🇺🇸 (@aeyakovenko) July 27, 2025

The co-founder has received heavy backlash from blockchain users who pointed out that the majority of Solana network users either use it for meme coins or NFTs. Despite the attack on meme coins, which are powering the Solana network, the SOL price is showing remarkable growth.

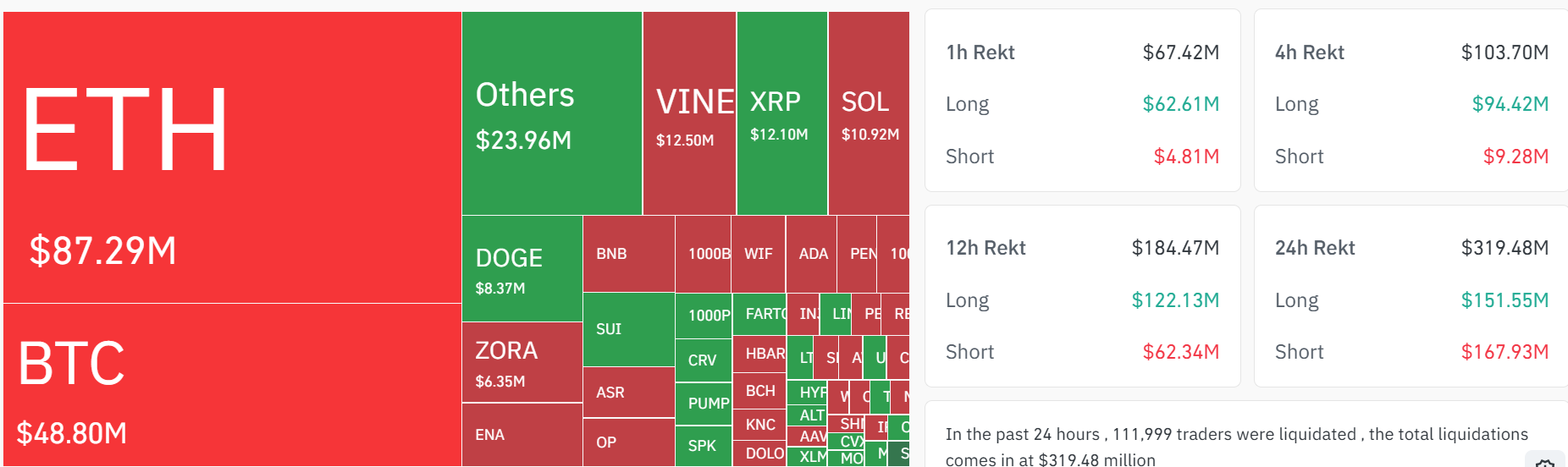

On the other hand, the extensive participation of both short and long traders has been observed, as shown in the liquidation heatmap. In total, Solana saw $10 million in liquidations, with $6.45 million coming from short trades. Across the entire cryptocurrency market, liquidations totalled $228 million in the last 24 hours, with Ethereum leading the wipeout at $87 million.

Solana (SOL) has also demonstrated impressive market performance, with trading volume increasing by 60.8% to $21.16 billion. The open interest has increased by 3.88%, totalling a billion. Although the quantity of options decreased (-22.23%), the long/short ratio of SOL is positive at 0.9775. This indicates that there are more traders in positions with long shares. The net sentiment is bullish, and there is significant liquidation in both long and short positions, amounting to 10.92 million in 24 hours.

Solana Price Technical Outlook

The daily chart outlook shows Solana price trading well within the confines of a parallel channel. The bulls have put their best foot forward, establishing immediate support levels at $160 and $162, aligning with the 50-day and 200-day MAs.

However, the altcoin seems to have taken a slight short-term pullback from the $206 highs on 21 July. If the bulls build momentum and the support zones hold, a breach above $200 could rekindle a bullish breakout to $247.

The Relative Strength Index (RSI) at 63.00 is hovering just below overbought territory, indicating room for a rally before a potential pullback.

What’s Next for SOL?

Examining the chart’s technical setup, the Solana price action appears to be in an ascending parallel channel. The recent breakout above $180 is a green light for further gains. If SOL bulls continue their campaign, the price may surge to $247 in the short term. However, if bears crash the party, the SOL price could retrace back to $182 or $162 support zones. A breach below the $162 mark will see the bears gain momentum, triggering panic sell-offs potentially to $159-$95.

In the long term, the Solana price may surpass the $300 level by year-end if the bulls continue to charge. Investors may want to keep an eye on the $264 resistance level. If SOL breaks it, the asset could rally higher. However, if the price is rejected at this level, SOL may enter a consolidation trend before the bulls strike.

Best Crypto Exchange

- Over 90 top cryptos to trade

- Regulated by top-tier entities

- User-friendly trading app

- 30+ million users

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong.