Highlights:

- The price of Solana has surged 7% to $144, rebounding 14% from the weekend lows of $128.

- This comes as President Trump reveals that Israel will not attack Iran.

- Technical indicators suggest a potential breakout towards the $160 mark.

As of 24 June, the Solana price has increased by 7% to $144 mark, rebounding about 14% from the $128 lows, recorded over the weekend. The daily trading volume has shown a bullish trend, spiking 34% indicating intense market activity. Meanwhile, President Donald Trump’s announcement about Israel and Iran in the larger market has contributed to investors’ mood. Recently, Trump tweeted through Truth Social, saying that Israel was not going to attack Iran and that the ceasefire had been announced.

This has eased the worry of the investors who were worried about the rising tension in the Middle East. Additionally, it has also resulted in a temporary rally in the market, with Bitcoin reclaiming the $105K mark. The geopolitical concerns directly affected crude oil prices, thereby driving them and providing relief to the energy-importing nations such as India.

SOL Continues Its Recovery Phase

The current price of Solana as of 24 June is 144.514. It has rebounded about 14% from its weekend lows of $128. Meanwhile, the SOL token is still within the falling parallel channel in the daily chart, as the bears are still in full control. Meanwhile, the immediate resistance lies at $160 and $169 zones, aligning with the 50-day and 200-day MAs, respectively. With the recent rebound and technical indicators howling sins of life, the Siolana price could reclaim the $160 mark in the short term.

The Relative Strength Index (RSI) reading of 45.02 translates into the neutral zone, meaning neither oversold nor overbought. This indicates that the cryptocurrency could be on a bullish course, as the geopolitical environment in the market is stabilizing. The Moving Average Convergence Divergence (MACD) also indicates a looming buy signal. This will only be executed once the blue MACD crosses above the signal line, calling for traders to buy more SOL.

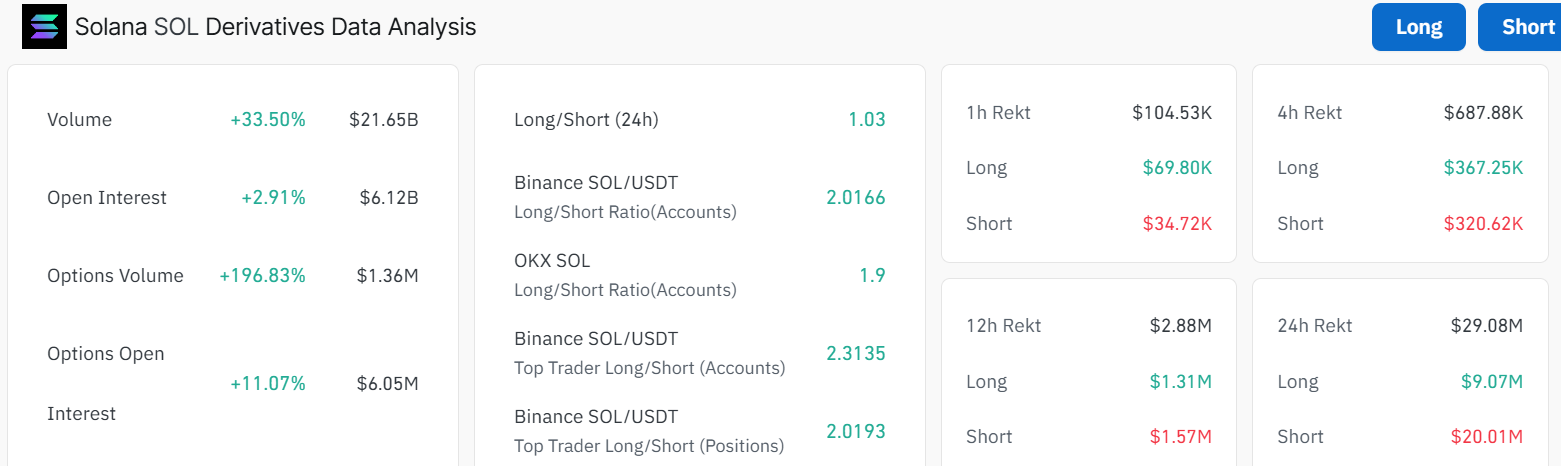

The market of derivatives based on Solana has grown tremendously. Over the last 24 hours, there was an increase in trading volume by 33.50% to reach $21.65 billion. This increased volume indicates that Solana is experiencing increased demand among traders. The open interest also increased by 2.91% to a total of $6.12 billion. This indicates that more investors are currently trading in Solana contracts, further building confidence in a potential surge.

The SOL/USDT long/short ratio stands at 1.03, showing that many traders are in the long position. These figures are in favor of Solana with a bullish attitude in the near future. The increased volume of options (has grown by 196.83%) is evidence that the activity and interest in the performance of Solana in the future are at a new level.

Solana Price Poised for a 37% Surge

With the Geopolitical tensions stabilizing, the crypto market seems to be gaining momentum. This could cause the prices to rebound vigorously, including the Solana price. In the meantime, if the bullish sentiment builds, the Solana price could surge, reclaiming the $152, $160, and $169 resistance levels. A break above the $169 barrier will open the doors for further upside towards $186- $200 level, marking about 37% gains from recent price levels.

On the flip side, if the resistance levels prove too strong, the SOL price could revisit the $139, $135, and $130 support zones. In the meantime, the geopolitical environment, especially the goings on in Israel and Iran, is most likely to keep on shaping investor behaviour. This nature indicates that Solana may gain a considerable price increase in the near future.

Best Crypto Exchange

- Over 90 top cryptos to trade

- Regulated by top-tier entities

- User-friendly trading app

- 30+ million users

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong.