Highlights:

- The Solana price has risen by 2% to $138 over the past 24 hours.

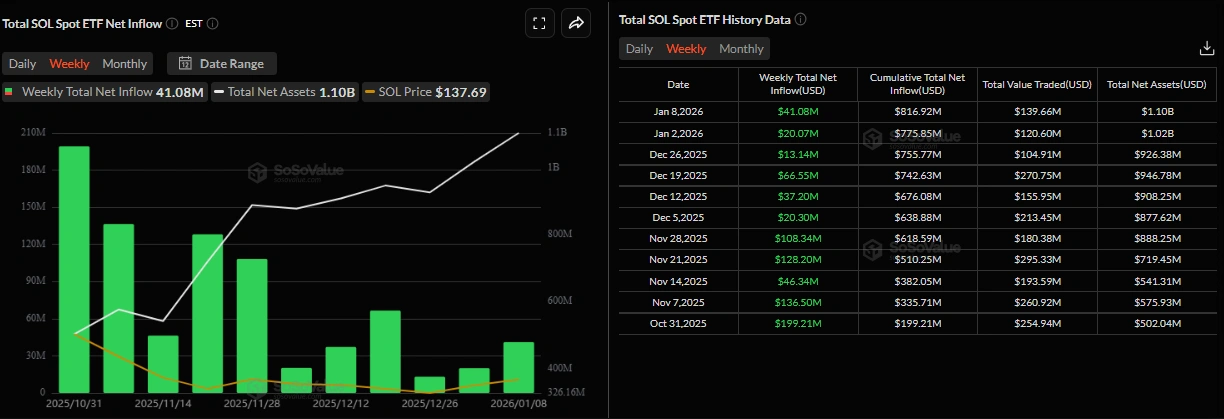

- The SOL ETFs have recorded a net weekly inflow of $41 million amid bullish momentum in the SOL market.

- The technical outlook suggests a potential breakout towards $160 if $131 support zone holds.

The Solana (SOL) price is gaining momentum, trading at $138 after recovering from a major support level on Thursday. Institutional demand is also increasing, as the spot for SOL Exchange-Traded Funds (ETFs) has recorded weekly inflows totalling more than $41 million to date. The derivatives market is showing growing investor confidence, as open interest and volume have increased over the past 24 hours. Technically, bulls are in control, as SOL targets $160 level soon.

Meanwhile, the institutional demand for Solana has been high this week. The SoSoValue data indicate that Solana ETFs recorded the highest weekly net inflow of $41.08 million through Thursday. This has marked the first time since mid-December that they have led weekly net inflows. This is the second consecutive week of net inflows since their launch on October 28.

In addition, the overall net asset value reached $1.10 billion this week, indicating rising institutional demand. Provided that inflows persist and intensify, SOL’s price may increase.

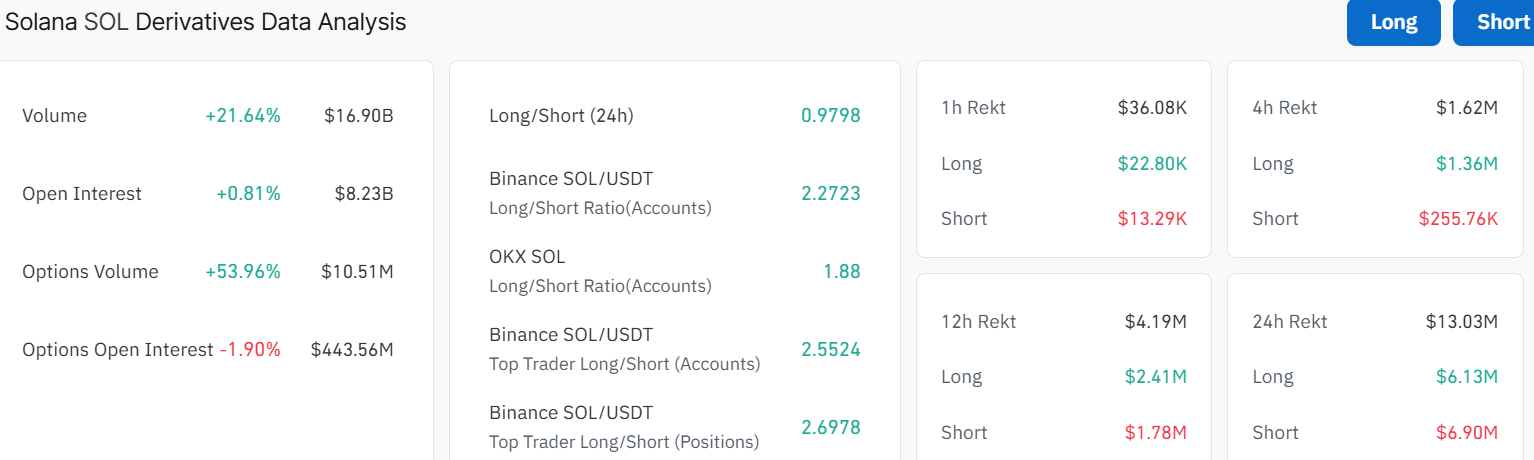

On the other hand, the derivatives market is projecting a bullish outlook. According to CoinGlass data, Solana’s trading volume has increased by 21% to $16.90 billion, indicating intense market activity. Open interest has also increased by 0.81% to $8.23 billion, indicating that new capital is entering the SOL market and potentially leading to a price increase.

SOL Targets $160 After Retesting Key Support

The technical analysis of the Solana price shows that the coin has broken above the 50-day SMA at $131 and flipped it into immediate support. Currently, the altcoin is trading at $138, with the long-term resistance at $172, which aligns with the 200-day SMA.

The relative strength index (RSI) is 60.21, indicating that SOL is not overbought. However, buying pressure is rising, and SOL still has room for further upside before a strong correction is likely.

On the downside, if sellers take control and the 200-day SMA proves too strong, SOL could slide back to $131. A break below this zone will tilt the odds towards the bears, with a deeper support at $120. This would test investor patience and likely bring in new dip buyers. The Moving Average Convergence Divergence (MACD) indicates a bullish crossover, suggesting that traders should rally behind the altcoin.

SOL has been largely range-bound between $120 and $143, with $131 serving as an important pivot. If the Solana price can hold above this level, the next resistance lies near $143- $160. A successful break could see SOL push towards the psychological $172 level and perhaps even challenge the $200 zone, if momentum gathers pace.

In the meantime, based on market models and forecasts, the SOL price may increase by 10%–15% through the rest of January, with typical target ranges moving towards $160 and possibly extending to $172 if bullish signals persist.

Best Crypto Exchange

- Over 90 top cryptos to trade

- Regulated by top-tier entities

- User-friendly trading app

- 30+ million users

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong.