Highlights:

- The Solana price is in the red zone, plunging 1.76% to $79 mark today.

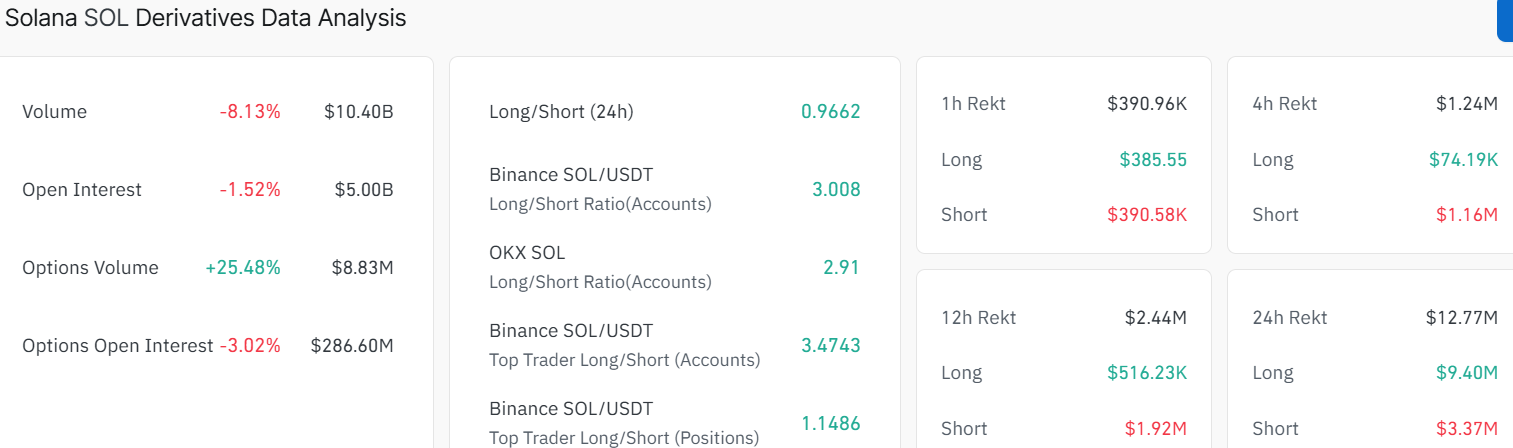

- Derivatives data show a negative funding rate with the open interest down 1.52%, signalling a lack of investor confidence.

- The technical outlook shows mounting bearish grip, as SOL risks a fall to $60.

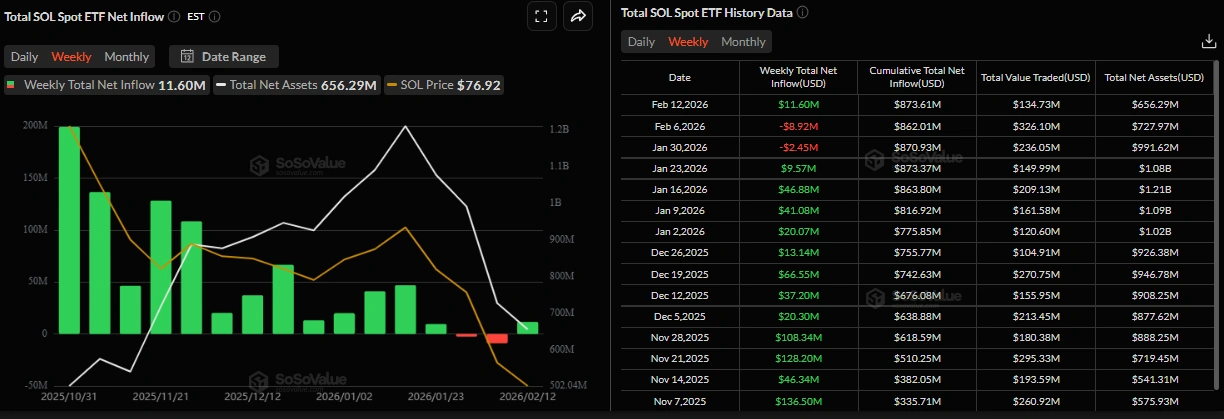

Solana (SOL) price is trading at $79 as of Friday, marking a 1.76% drop in the last 24 hours. According to the data available on the derivatives market, traders are showing mixed sentiment, which further restricts the possibility of price recovery. According to SoSoValue, Solana spot Exchange Traded Funds (ETFs) registered inflows of $11.60 million up to Thursday, ending two weeks of withdrawals in a row. In the event that this trend endures and gets even more intense, SOL price may rebound within the next few days.

Nevertheless, the derivatives markets are an indicator of contravention among the traders. According to the CoinGlass data, the funding rate of SOL on Friday became negative at -0.0070%, showing that short positions are covering long positions. This further reinforces the bearish mood in the SOL market.

Moreover, Solana’s open interest has dropped to $5.00 billion on Friday, and it has steadily decreased since mid-January. This reduction in OI shows a declining participation by the investors and portrays a negative picture. These deviations underscore increasing traders’ uncertainty and undermine bullish confidence, which limits Solana’s recovery.

SOL Risks a Fall to $60 if Support Zone Breaks

Looking at the SOL/USD 1-day price chart, Solana is holding above the key support at $78, just below the current price of $80. This support zone sits near recent lows at $67 and is watched closely by traders.

The 50-day Simple Moving Average (SMA) is at $119, while the 200-day SMA is at $164. The altcoin is trading below both moving averages, suggesting an intense bearish grip. The 200-period SMA, located well above the price, acts as a longer-term resistance against further upside.

On the upside, initial resistance is seen at $119, with a major high at $164. Technical indicators show Solana’s price is in oversold territory. The Relative Strength Index (RSI) is at 27.98, meaning the coin is oversold and the bears are having the upper hand.

Looking ahead, if SOL stays above the $78 support and buyers step in, the price could rebound toward the $90-$106 resistance zones. Meanwhile, a break above this zone will see the bulls eye higher resistance near $119 in the next few weeks. However, if sellers push below $78, reinforced by the negative derivatives data and bearish momentum indicators, SOL may retest deeper support around $67. A drop below this zone may see SOL risk a fall to $60.

In the meantime, traders will be watching key price levels and the broader crypto market. If the crypto market flips green, led by BTC, the altcoins may see a rebound, including SOL, towards $90-$106 in the short term. But for now, traders should be cautious as there is no strong confidence among traders.

Best Crypto Exchange

- Over 90 top cryptos to trade

- Regulated by top-tier entities

- User-friendly trading app

- 30+ million users

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong.