Highlights:

- The Solana price is on fire, trading at $208, a 3% surge.

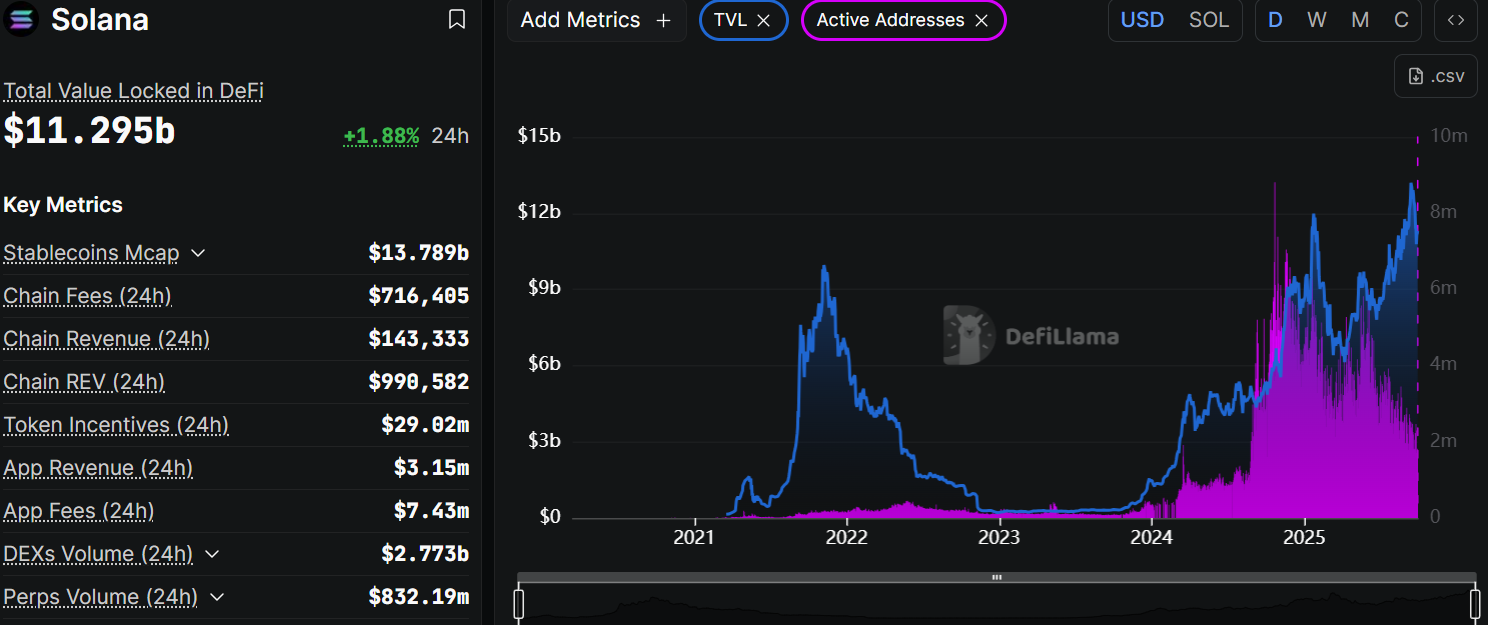

- SOL’s DeFi TVL has soared 1.88% to $11.29, indicating growing confidence.

- The technical outlook suggests a rebound to $250 if the $209 resistance level is breached.

The Solana price is showing signs of life, climbing 3% to $208, kicking off the week in the green zone. Its daily trading volume has notably spiked 55% to $5.25 billion, indicating growing investor confidence. Solana’s ecosystem is changing rapidly as new technological advancements will drive future growth.

Jump’s Firedancer team has proposed SIMD-0370 following the Alpenglow update for removing Solana’s strict compute unit block limits, which is a significant development. The present framework has a fixed limit of 60 million compute units (CUs), which increases to 100 million in SIMD-0286. The system operates with a dynamic adjustment mechanism that scales according to the validator’s power, rather than imposing limits.

Jump’s Firedancer team proposed SIMD-0370 to remove Solana’s fixed compute unit block limit after Alpenglow. Instead of a static cap (60M CUs, rising to 100M in SIMD-0286), block producers pack max transactions, and slower validators skip blocks. This drives a cycle: producers…

— Wu Blockchain (@WuBlockchain) September 28, 2025

Notably, HumidiFi’s growing prominence in Solana’s ecosystem is a noteworthy highlight in the blockchain space. HumidiFi prop AMM has surpassed Meteora and Raydium in weekly trading volume of DEXs. Over the past week, HumidiFi pulled in $8.55 billion, making it the largest protocol on Solana. The trading volumes for decentralised exchanges (DEXs) indicate a bullish sentiment towards the Solana DeFi ecosystem, which is growing despite turbulent periods in the cryptocurrency market.

🚨NEW: @humidifi_ (prop AMM) has become the #1 DEX on @Solana by weekly trading volume, surpassing Meteora and Raydium. pic.twitter.com/Q6UZPss5bG

— SolanaFloor (@SolanaFloor) September 29, 2025

Market Sentiment and SOL DeFi TVL

According to DeFiLlama data, the TVL of Solana’s DeFi stands at $11.295 billion after a 1.88% rise in 24 hours. Solana’s fundamentals enable the platform to achieve growth, with $2.7 billion in DEX trading volumes. In addition, the platform allows for decentralised apps (dApps) to flourish. The figures show that, although activity is rising on Solana, decentralised finance remains the most prominent activity on the platform.

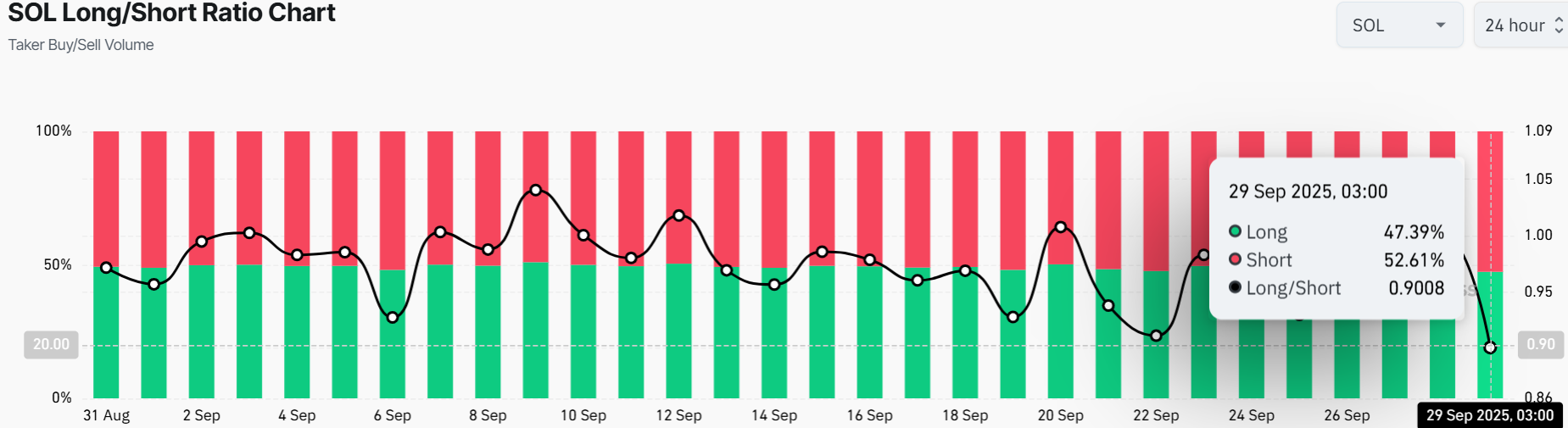

The Solana Long-Short ratio brings insight into market sentiment. As of September 29, 2025, the ratio stands at 0.9008, with long positions accounting for 47.39% and short positions for 52.61%. It means that neither buyers nor sellers are fully in control of the market. If the ratio shifts, it indicates a directional move could happen, either way in the Solana price.

Solana Price Outlook: Can SOL Overcome $209 Resistance?

The Solana price has plunged below the ascending channel, currently at $208 mark. Meanwhile, the bulls are regrouping, targeting the immediate resistance at $209, coinciding with the 50-day SMA. Over the weekend, the SOL price saw a drastic drop, as the bulls defended the further downside at $192 support zone. However, with the bulls reclaiming the $208 mark, how high can Solana price go?

The Relative Strength Index (RSI) is at 45.59, indicating that the asset is in a neutral state. Meanwhile, the price could break out in either direction, as both the bulls and bears are in a tug-of-war. On the downside, support is found around $192-$166. If that breaks, the next strong support is near $148, where buyers stepped in before.

The RSI (Relative Strength Index) is at 45.59. This means Solana isn’t oversold yet, but it has room to rebound. That said, the longer-term structure remains bullish unless SOL breaks down below the $166 zone. A daily close above the $209 level would confirm renewed buying strength and set the stage for a move toward the $250 resistance zone. While Solana is currently under short-term pressure, the broader price structure favours continuation to the upside, especially if it manages to reclaim $209.

Best Crypto Exchange

- Over 90 top cryptos to trade

- Regulated by top-tier entities

- User-friendly trading app

- 30+ million users

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong.