Highlights:

- The Solana price has soared nearly 5% to $138, as the trading volume skyrockets 141%.

- The derivatives SOL market shows a positive outlook, as the funding rate flips positive.

- SOL technical outlook shows a glimmer of hope reinforced by the MACD and RSI.

The Solana (SOL) price is up nearly 5% on Monday to $138, as the crypto market shows signs of recovery. Meanwhile, the derivatives data have shown an increase in the funding rate, which is an indicator of less motivation for traders to have short positions. In the meantime, Solana-centred Exchange Traded Funds (ETFs) have recorded their sixth consecutive week of inflows, which has given rise to the interest of institutional investors.

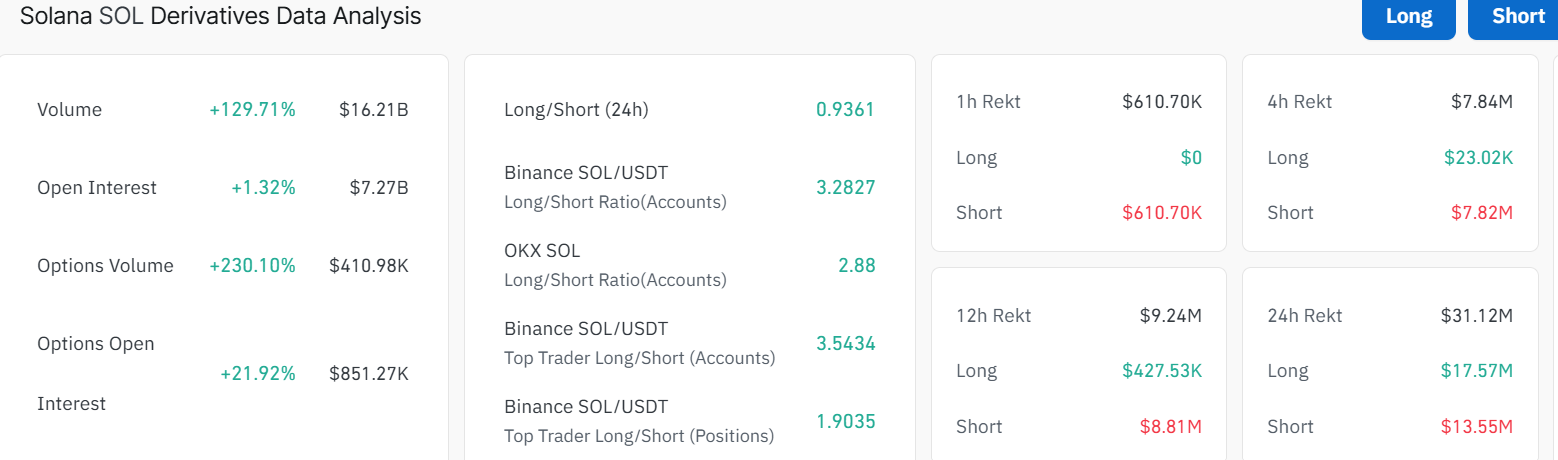

The futures Open Interest (OI) of Solana price remains stable at over $7 billion, marking a 1.32% surge. This indicates that the capital flow of SOL derivatives is nearly flat. The CoinGlass data shows SOL futures OI at $7.27 billion on Monday and has generally remained stable over the past 24 hours.

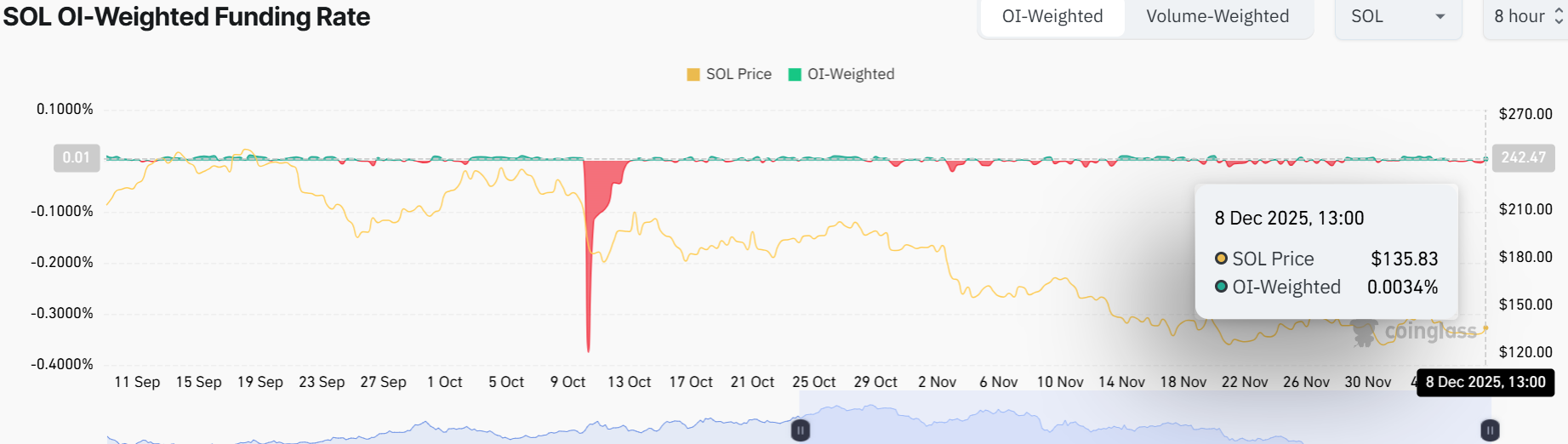

Nevertheless, the increase in the OI-weighted rate of funds shows that the short-position interest has declined significantly. The rate of funding is at 0.0034% compared to -0.170% on Sunday. The positive funding rate in the SOL market suggests increased bullishness, as the bulls are willing to pay a premium to retain their long positions.

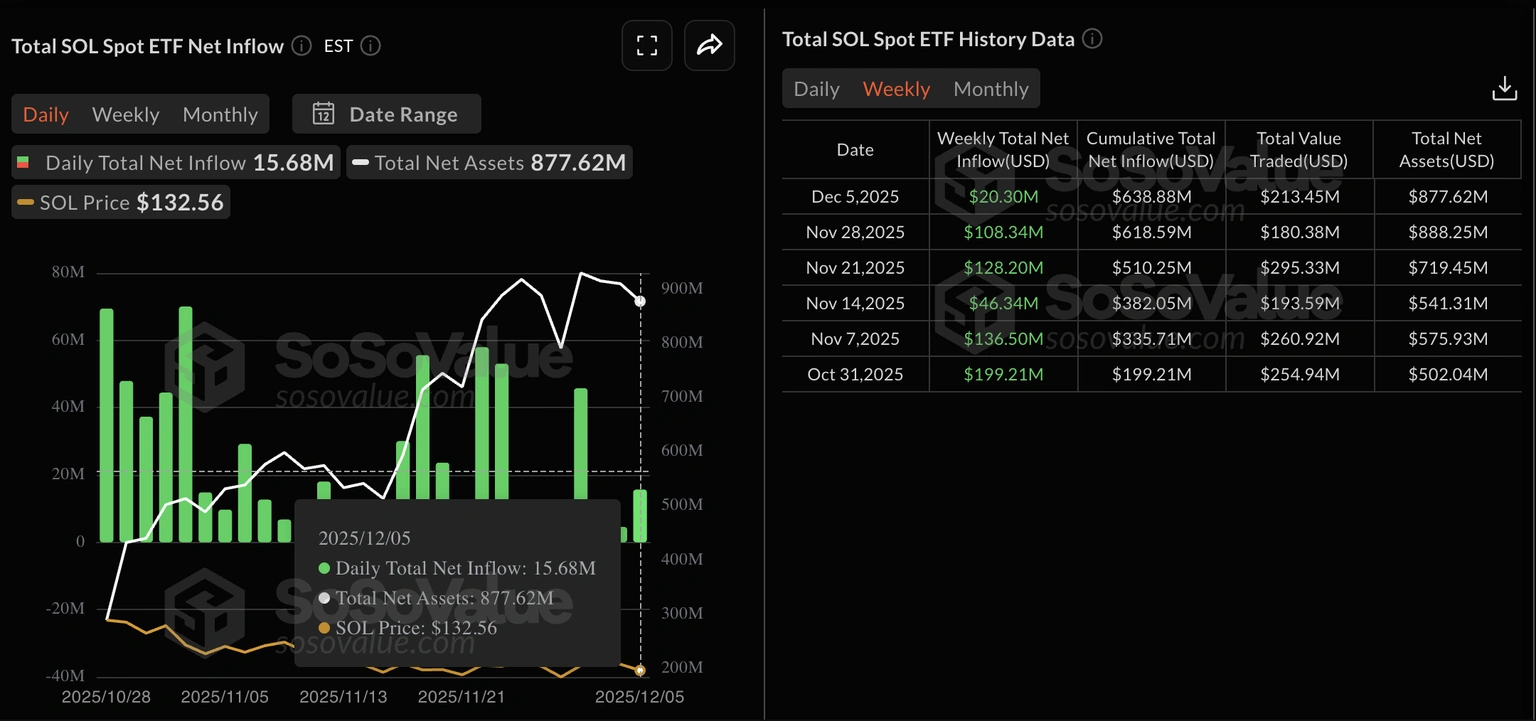

On the other hand, the institutional appetite for Solana has waned. A total of $20.30 million in net weekly inflows into SOL ETFs, compared to $108.34 million the previous week. Nevertheless, the inflows of $15.68 million on Friday extended the streak of weekly inflows to six weeks.

Solana Price Eyes a Breakout to $147

The SOL/USD 1-day chart shows the price is trading at $138.95. The 50 SMA sits at $156, while the 200 SMA clocks in at $177, which is a tight convergence, suggesting a death cross. However, the price is flirting with a support zone around $124, as bulls eye a breakout above the falling parallel channel.

Zooming into the indicators, the RSI at 47.50 is hovering in the neutral territory, leaving room for the crypto to rally. The MACD also shows a slight bullish crossover. This calls for traders to buy more SOL tokens unless the MACD changes.

Looking ahead, the recent death cross spells trouble, but the volume doesn’t back it up. If the immediate resistance at $147 holds firm, there might be a dip toward the $131-$124 support zone. The worst case would be the Solana price breaking below $124. It could send SOL crashing to $115, especially if the broader market undergoes a correction.

Meanwhile, a popular analyst, Ali Martinez, has predicted that the Solana price needs to hold firmly above $124 to avoid further downside towards $115 or even $106.

Solana $SOL must hold $124 to avoid a drop toward $115, or even $106. pic.twitter.com/uZXib5jTRC

— Ali (@ali_charts) December 8, 2025

However, if bulls hold above the $124 support with volume, Solana price could eye $147 in the next few days. A break above this level could ignite a short-term rally towards the next key resistance at $156 or even $177. The positive derivatives market and surging volume, which is up 141% suggests a potential breakout in the SOL market. Further, the MACD crossover and RSI give a glimmer of hope.

Best Crypto Exchange

- Over 90 top cryptos to trade

- Regulated by top-tier entities

- User-friendly trading app

- 30+ million users

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong.