Highlights:

- Solana price has risen 3.4% to $200, kicking off the week in a green zone.

- The growing on-chain activities show renewed investor confidence in the network.

- The technical outlook shows a tug-of-war, as bulls aim to overcome the $213 resistance.

The Solana price is trading above $200 today, showing a steady upward momentum. This marks a steady 4.6% increase in the past 24 hours, with the bulls showing no signs of slowing down. Meanwhile, the rising on-chan activities and increasing institutional interest indicate renewed investor confidence in the Network’s long-term perspective.

Another significant sign of Solana showing its desire internationally was when it rang its own symbolic bell on Wall Street in a week full of landmark events. It is also notable to mention that its own APAC Accelerate tour was in full swing across the major cities in China, Shanghai, Hangzhou, and Shenzhen. This dual life indicates the greater strength of Solana, which makes it a truly borderless blockchain.

Ever heard of concentrated shipquidity? 🚢

While Solana rang its own bell on Wall Street, across the world Solana APAC Accelerate kicked off, bringing 索拉拉 to Shanghai, Hangzhou, and Shenzhen.

This week was nothing short of substantial. Here's everything that happened.

— Solana (@solana) October 26, 2025

The Solana ecosystem has been in a flurry of positive news in recent times. These consist of Gemini releasing the initial credit card that offers up to 4% immediate incentives in SOL, a new hub of Solana was launched at 35 Wall Street, and Fidelity granted the retail entry into SOL. The establishment of Solana Spot ETFs that are headquartered in Hong Kong is a sign of the growing institutional and mainstream acceptance of the network.

Solana On-Chain Activity Indicates a Positive Outlook

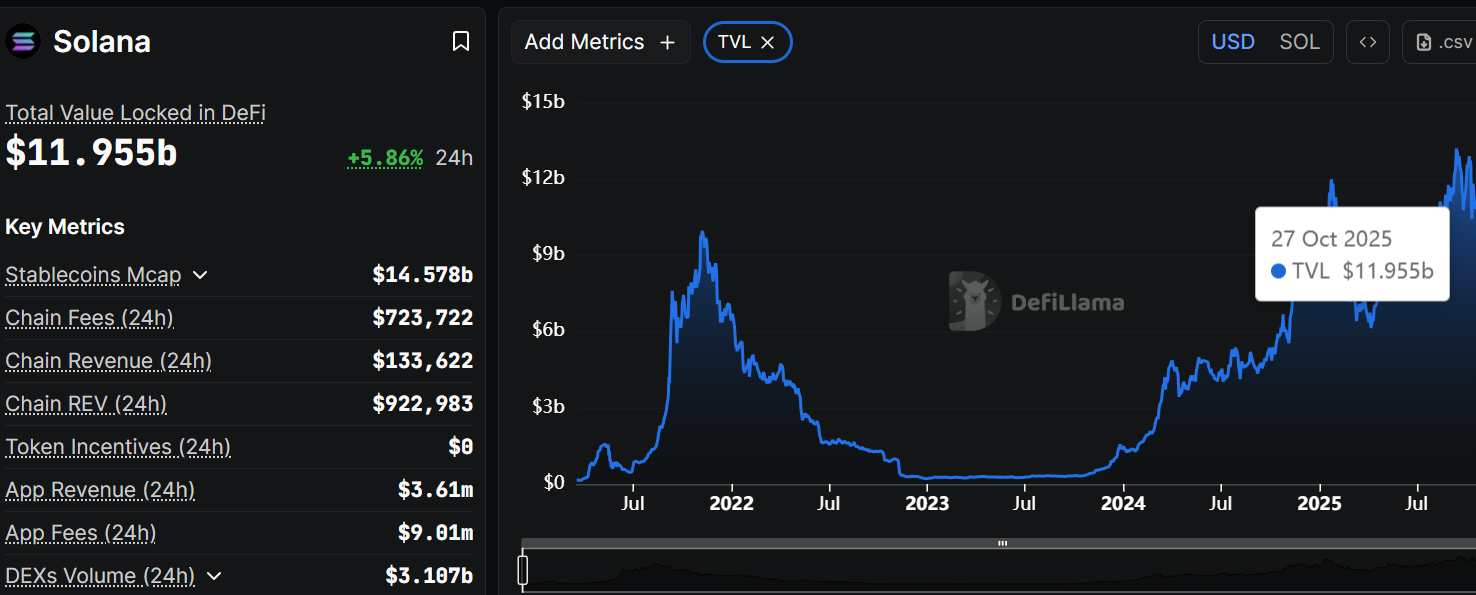

According to the DefiLlama data, the Total Value Locked (TVL) of Solana grew to $11.955 billion on Monday compared to $10.42 billion on October 11. This shows that it is nearing the record high of $13.22 reached on September 14. The increasing TVL is often taken as a sign that the ecosystem of SOL is more active and attractive, and more users are depositing or transacting on it.

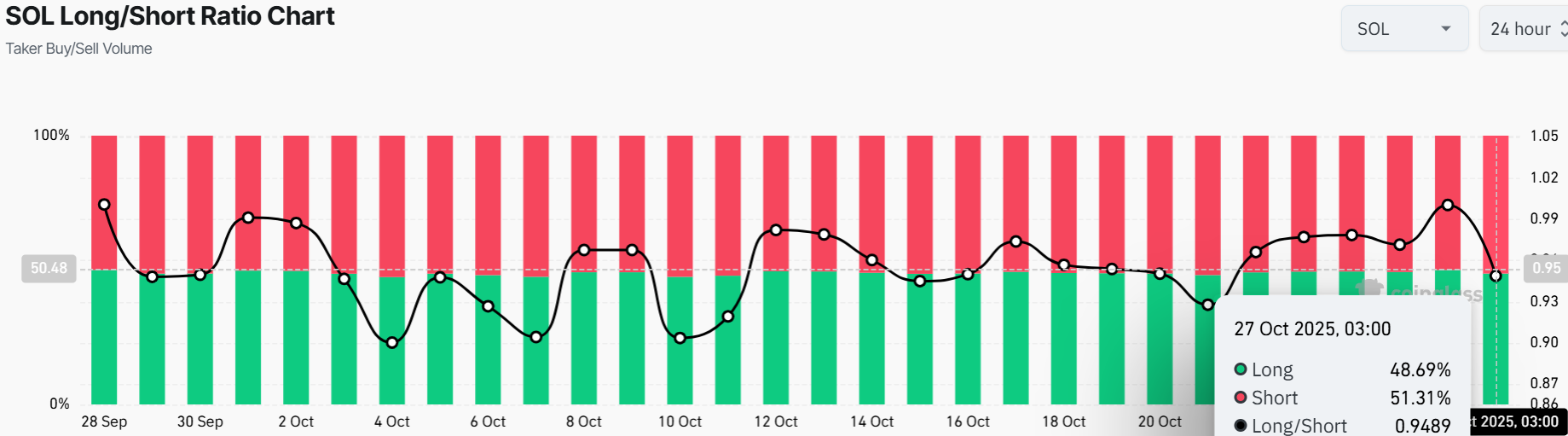

The SOL Long/Short Ratio depicts the short positions slightly exceeding the longs (51.31% to 48.69%). The overall long/short ratio is 0.9489. This minor bearish inclination is a cautious optimism. This is probably because of technical opposition or macro hesitation, but it has not suppressed the overall movement.

Where Is Solana Price Headed Next?

The Solana price 1-day chart shows the price is trading at $200, and the 50 SMA sits at $213, while the 200 SMA clocks in at $177. The Solana bulls, meanwhile, continue to be maintained in a tight wedge formation, and resistance has been set at $213. If the support zone holds and the bulls overcome this level, a strong rally towards $233 is likely.

In the short term, if the bulls push past $213, there could be a charge toward $233 or higher. On the flip side, Solana price could test support around $193-$181 if the recent rally cools off. Any further fall could carry it to $177 (200-day SMA), a future target to observe.

For now, it’s a wait-and-see game. Investors prefer to keep track of the volume and the RSI since when it falls below 50, then it could be time to get ready to fall even more. Long-term, Solana’s fundamentals could fuel a comeback.

Best Crypto Exchange

- Over 90 top cryptos to trade

- Regulated by top-tier entities

- User-friendly trading app

- 30+ million users

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong.