Highlights:

- Solana’s price has increased almost 1% to $193 at press time, as the spike in interest has increased its trading volume.

- SOL has demonstrated resilience and potential for further upward movement.

- Solana’s technical indicators hint at a possible breakout to the $247 mark.

The Solana price is showing some bullish muscle, as it has increased almost 1% to $193. Its trading volume has notably soared a whopping 45% to $3.5 billion, suggesting increased investor demand.

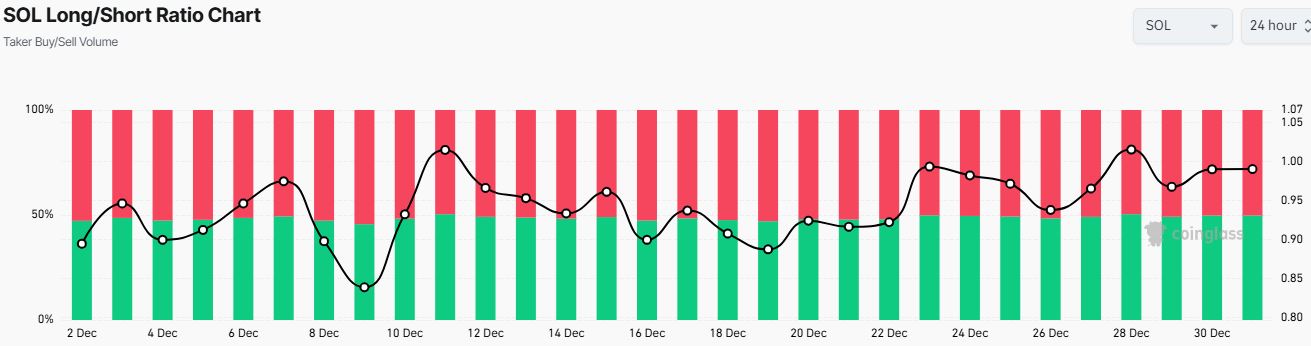

The Solana Long/short positions suggest some cautious optimism. In a daily chart outlook, SOL’s long/short ratio showed 49.76% long positions versus 50.24% shorts, suggesting rekindling investor interest.

However, despite the bearish lean, SOL has displayed resilience, with buyers gradually gaining control. If the buyers gain momentum at this level, the odds could shift towards the buyers as they extrapolate the gains above the $ 240 mark.

Solana Statistical Data

Based on CoinmarketCap data:

- SOL price now – $193

- Trading volume (24h) – $3.5 billion

- Market cap – $2.89 billion

- Total supply – 591.2 million

- Circulating supply – 479.72 million

- SOL ranking – #6

Solana Price Poised for a breakout Above the Consolidation Phase

After forming a rounding pattern, the Solana price has pushed into a consolidation channel as the bulls aim to surpass the $220 mark. Solana’s ongoing bullish trend may extend to create a breakout rally, having had a positive recovery of 1% in the past week. This is supported by the altcoin’s emergence of a consolidation phase in the daily chart timeframe. This might act as an accumulation period, propelling the Solana Price above the $220 psychological level.

Meanwhile, the Bitcoin price is seen to be recovering, as it is up almost 1% to $94,717 as of writing. Increased momentum in the BTC market might see a recovery even in the altcoins, including Solana. Currently, the support level of $168 enables the Bulls to have the upper hand. However, to be safe, the bulls must bring down the $220 resistance barrier to enable already sidelined traders to join the trend without any fear of price correction.

The rising RSI, currently sitting at 43.43, shows that the bulls are building up momentum for a breakout. Moreover, there is still more room for the upside before the SOL token is considered overbought. An increase above the 50-mean level would indicate that the bulls are having the upper hand, invalidating the bearish sentiment.

However, the MACD indicator has introduced a positive outlook, as it has flipped above the orange signal line. This signals a bullish outlook in the Solana price. Moreover, this calls for traders to rally behind SOL unless the MACD changes. As the momentum indicator pushes from the neutral area to the positive territory, the path with the least resistance stays on the upside.

Solana Price Targets

According to the one-day chart analysis, the odds tend to tilt towards the bulls, painting the bigger picture as bullish. If the buyers capitalize on the rising RSI and a buy signal from the MACD indicator, the Solana price could rally above $200. A break and close above the $200 level would confirm the bulls’ case, triggering a significant leg up to the $247 mark.

On the downside, if the bears capitalize on the resistance at $220, they may cause the Solana price to fall through. In such a case, the $183 support level will absorb the potential selling pressure.

Best Crypto Exchange

- Over 90 top cryptos to trade

- Regulated by top-tier entities

- User-friendly trading app

- 30+ million users

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong.