Highlights:

- Solana price slips 7% to $168, despite the trading volume soaring 24%.

- SOL DEX volume has plunged by 70% since the January hype.

- Technical indicators indicate further downside despite VanECK and Grayscale’s updated S-1 filings on SOL ETFs.

The Solana price has dropped 7% to $168, as the crypto market wobbles, led by BTC, which has slipped to $114K. Despite the fall, its daily trading volume has risen 24% to $7.34 billion, indicating growing investor confidence. Meanwhile, Solana DEX trading volumes have decreased by 70% since the January 2025 high, representing a sharp decline in trading activity.

🚨 LATEST: Solana monthly DEX volume is down nearly 70% from its monthly peak in January. pic.twitter.com/z0FUa4Cnxs

— Marc Shawn Brown (@MarcShawnBrown) July 30, 2025

The Solana monthly DEX volume now sits at around $80 billion, from a peak of $262 billion in January. Despite the drop, the cryptocurrency market is showing signs of momentum building. While some analysts claim the meme coin mania on Solana has subsided, others believe Solana is merely catching its breath before the next leg up.

Moreover, the development of Solana-based exchange-traded funds (ETFs) has drawn even more attention. Nate Geraci released information about the movement on Solana ETFs on 31 July 2025, when the firms Grayscale, VanEck, and 21Shares pressured Solana to be approved as ETFs.

S-1 amendments now rolling in on spot solana ETFs…

Grayscale, VanEck, & 21Shares so far. pic.twitter.com/vKpM9eLsAv

— Nate Geraci (@NateGeraci) July 31, 2025

Amendments to Form S-1 filed with the U.S. Securities and Exchange Commission (SEC) indicate that the institutional demand for Solana is growing.

Solana Price Slips Below the Rising Parallel Channel

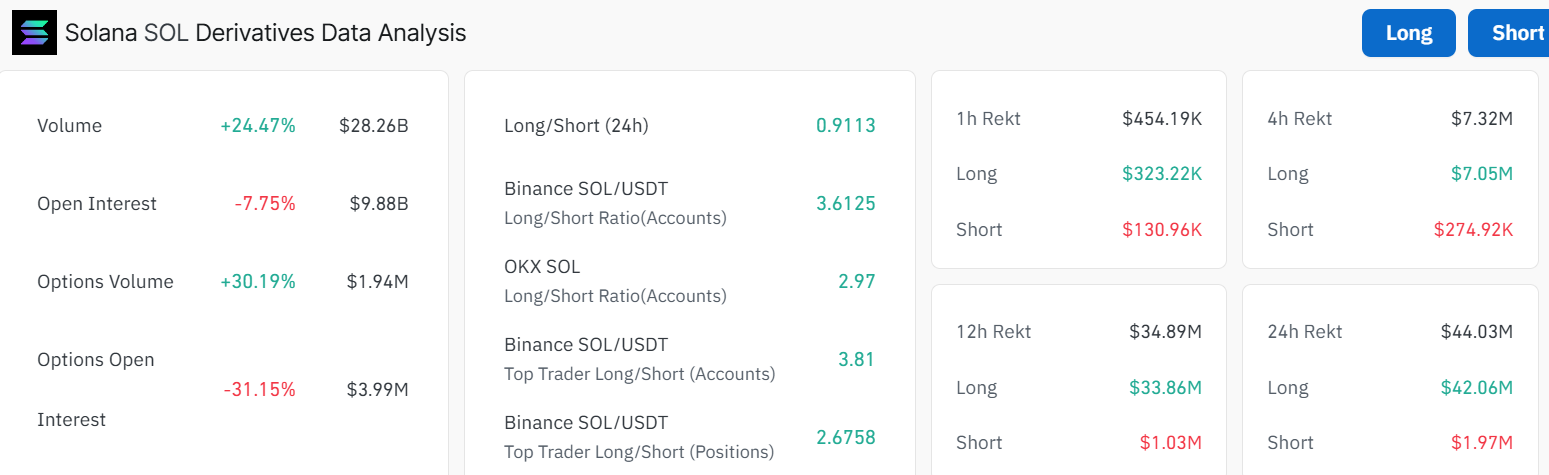

Meanwhile, the latest Solana derivative data is that the total volume of Solana-related derivatives has increased by 24.47% to hit 28.26 billion. This growth suggests increased investor confidence in the Solana market.

Notably, the Solana options volume has increased by 30.19% to stand at $1.94 million, providing a clear indication that more investors are expressing interest. Criticisms are, however, not left out, as there was a decline in the open interest of these derivatives by 7.75% to $ 9.88 billion. This suggests that, despite the continued high interest in Solana derivatives, the market sentiment remains fearful, and some traders are exiting their positions.

As the DEX activity plunged, the Solana price notably slipped below the $170 mark, currently at $168. Despite the drop, it still holds a positive outlook, as the 50-day ($161) and 200-day SMA ($162) provide immediate support. If the Solana price can maintain a strong hold above these levels, a bounce-back in the market is likely.

Meanwhile, the Relative Strength Index (RSI) is at 45.46, which is neither overbought nor oversold. This leaves room for the token to breathe. However, its plunge below the 50-mean level tilts the odds towards the bears.

SOL Threatens Further Downside

With DEX volume crashing 70% from January’s hype, liquidity is drying up, and that could drag the Solana price lower. If the recent $183 resistance holds firm, there might be a dip toward the $162-$161 support zones. The worst case would be the Solana price breaking below $161. It could send SOL crashing to $145-$132, especially if the broader market undergoes a correction. However, if bulls push past $183 with a volume surge, Solana price could eye $209-219 mark soon.

The downtrend from the $183 rejection and plummeting DEX activity suggests caution, as the RSI plunging below the 50-mean level paints a red flag. In the meantime, investors should remain vigilant, awaiting a clearer signal.

Best Crypto Exchange

- Over 90 top cryptos to trade

- Regulated by top-tier entities

- User-friendly trading app

- 30+ million users

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong.