The Solana price has kicked off the week in the green zone, as it has increased by 2% in the past 24 hours, with the SOL/USD exchanging hands at $147. Accompanying the noticeable price movement is its 24-hour trading volume, which has skyrocketed 103% to $1.85 billion.

This growing interest in the token suggests a recent rise in market activity in the Solana market. SOL has, however, plummeted 4% in a week, despite a rise of 15% in a month and an increase of 523% in a year.

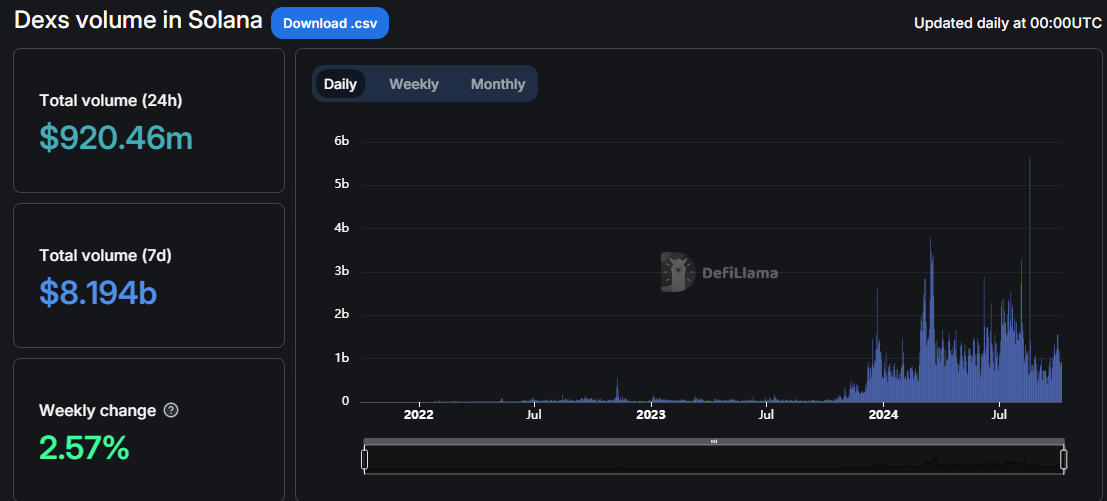

Meanwhile, Solana’s DEX volume has soared about 2.57% weekly, with $8.914 billion processed during this time, as per DeFiLlama data. The data indicates that Solana has processed $920.46 million in DEX volume over the last 24 hours.

With the growing DEX volume and spiking interest in 24-hour trading volume, Will the Solana price rally? Let us decrypt more as we dive into the technical outlook.

Solana Statistical Data

Based on CoinmarketCap data:

- SOL price now – $147

- Trading volume (24h) – $1.85 billion

- Market cap – $69 billion

- Total supply – 586 million

- Circulating supply – 469 million

- SOL ranking – #5

Solana Price Technical Outlook Flashes Bullish

The Solana price has reclaimed the $146 mark after rebounding from a low of $132 on October 3. The token trades well within the rising channel as the bulls show strength in the market. However, the bearish sentiment is not to be entirely ignored, as the Solana price has hinted at selling pressure, depicted by the red wicks in the 4-hour chart.

However, if the buyers gear up at this level, the Solana price could surge. Diving into the technical outlook, the bulls are dominating the market, as they have flipped the 50-day SMA and 200-day SMA into support levels. The $141 and $146 areas act as immediate support levels in the market, leaving the Solana price in a resistance-free zone.

Notably, the Relative Strength Index (RSI) sits well above the 50-mean level, currently at 54.46. This suggests that the bulls have the upper hand in the Solana market. Moreover, there is room for upward movement before SOL is considered overbought.

However, the RSI has plunged from the 63.04 level to 54.46 despite upholding the bullish sentiment. If the RSI keeps declining, it might plunge below the 50-mean level, tilting the odds in favor of the sellers.

On the other hand, the Moving Average Convergence Divergence (MACD) calls for traders to rally behind SOL. This is evident as the blue MACD line has flipped above the orange signal line. As the momentum indicator gradually ascends above the mean line (0.00) into the positive region, the path with the least resistance stays on the upside. Moreover, the green histograms are increasing in size, quashing the selling pressure in the market.

Will the Solana Bulls Gain Momentum At This Level?

The Solana price paints a bullish picture. However, that may be short-lived if the bulls won’t gear up at this level. To start with, if the $146.61 support holds, the Solana price could rally, targeting the next technical barrier at $157. In a highly bullish case, it may reclaim the $160 mark.

However, if the $146.61 support breaks, the Solana price could fall. In such a case, the bears would step into the market, invalidating the bullish outlook. Meanwhile, the $141 support, coinciding with the 200-day SMA, would absorb the potential selling pressure before the bulls regroup for a substantial leg up.