Highlights:

- Solana price is looking fantastic, gaining 2% to $139.

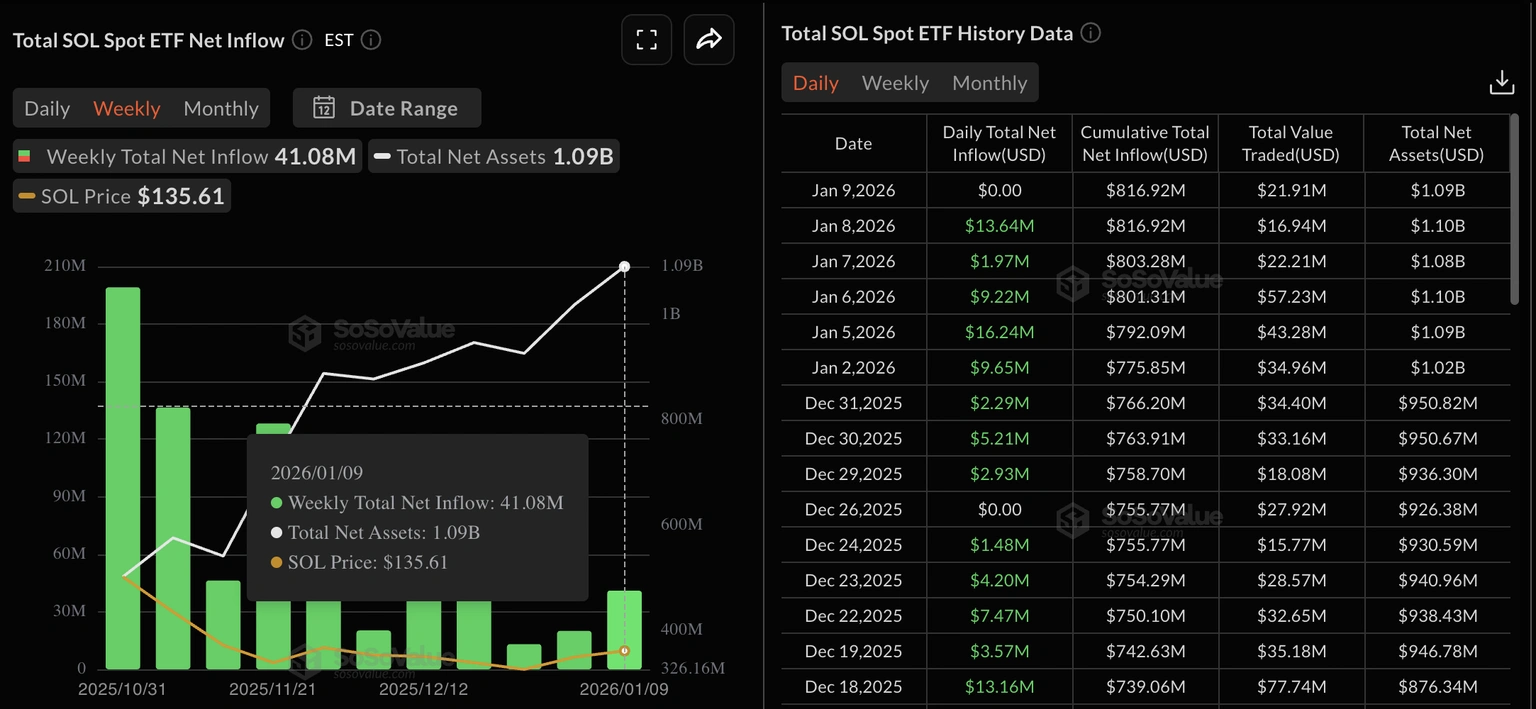

- The SOL Spot ETFs have recorded more than $41 million in total inflows over the past week, indicating renewed investor demand.

- The technical outlook indicates SOL bulls eye $144 as immediate resistance soon.

Solana (SOL) has gained 2% over the past 24 hours, trading at $139, with daily trading volume surging 255%. The continued inflows into US spot SOL-based Exchange-Traded Funds (ETFs) indicate further institutional backing for Solana. Additionally, Solana is experimenting with Wallet-to-wallet operations through a three-day hackathon starting Monday, which could boost demand from retail and smart money.

The SOL-based ETFs recorded $41.08 million in inflows last week, marking the eighth consecutive week of inflows. This suggests institutional investors remain interested in Solana, as the blockchain is discussing privacy capabilities comparable to Monero.

On Monday, the Privacy Hack will provide rewards of up to $75,000 per individual payment, a launchpad, and an open track for other privacy-focused protocols. Entries shall close on the 1st of February, and results shall be announced on the 10th of February.

Due to strong interest from builders, Privacy Cash is increasing our Solana Privacy Hackathon bounty to $15,000 as a major sponsor.

🏆 Best New App – $6,000

🔗 Best Integration to Existing App – $6,000

⭐ Honorable Mentions – $3,000 totalLet’s bring privacy to Solana apps. https://t.co/W02LWNhVdp

— Privacy Cash (@theprivacycash) January 10, 2026

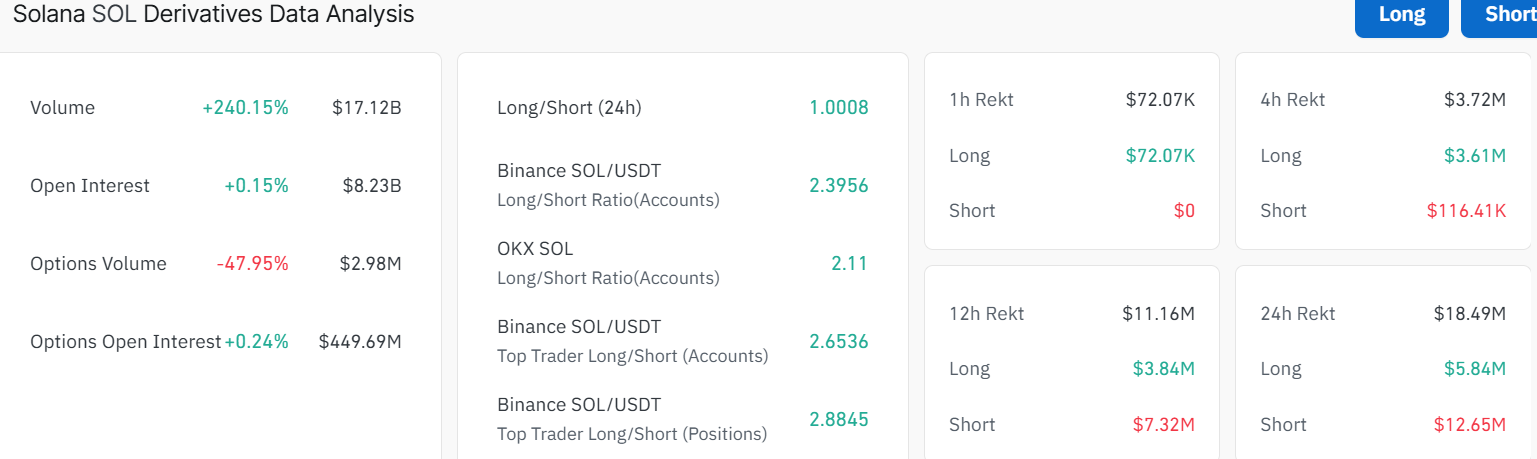

On the other hand, the Capital inflows into Solana futures on the derivatives side indicate renewed trader demand. According to CoinGlass data, SOL futures Open Interest (OI) has increased by 0.15% over the past 24 hours, reaching $8.23 billion.

Also, the long-to-short 24-hour ratio is at 1.0008, which implies that there are more active long positions. Short liquidations of $12.65 million exceed long liquidations of $5.84 million, consistent with the long-to-short ratio, indicating a larger wipeout of bearish positions.

SOL Bulls Target $144 Resistance

Price action for Solana indicates growing bullish strength, with the price trading at $139. Right now, SOL trades above its 50-day simple moving average (SMA) at $131, which serves as critical support for buyers. The long-term 200-day SMA is above the price at $172, so bulls must break through this zone to ignite a bullish trend.

During the week, SOL rose about 3% as buyers came in strong around $136, pushing the price back up to $142, before slightly retracing to current levels. This confirms that the support zone is holding, and recent rally attempts have restored optimism in the market.

The RSI (Relative Strength Index) is at 60.78, showing rising buying momentum in the token. The MACD (Moving Average Convergence Divergence) is positive, indicating that bulls are ready to buy. This renewed interest may see SOL bulls target $144 breakout zone soon.

Based on the chart, the next resistance zone for SOL is $144-$172. If buyers can break above $144, the coin could quickly move toward the long-term resistance at $172. Passing this level could open the door to a run toward $189 or even $200, depending on the level of demand entering the market.

On the downside, a break below $131 would flip the market into bearish. In that case, the next support level will be approximately $119- $125. However, with strong demand evident in SOL ETF inflows, most analysts expect buying to resume before SOL falls that low, given solid fundamentals and active network participation. Technical indicators remain bullish in the short term. As always, prices can fluctuate with market volatility, but Solana is well-positioned to outperform most rivals if the bullish momentum holds.

Best Crypto Exchange

- Over 90 top cryptos to trade

- Regulated by top-tier entities

- User-friendly trading app

- 30+ million users

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong.