Highlights:

- The Solana price is above $200, which is a bullish signal.

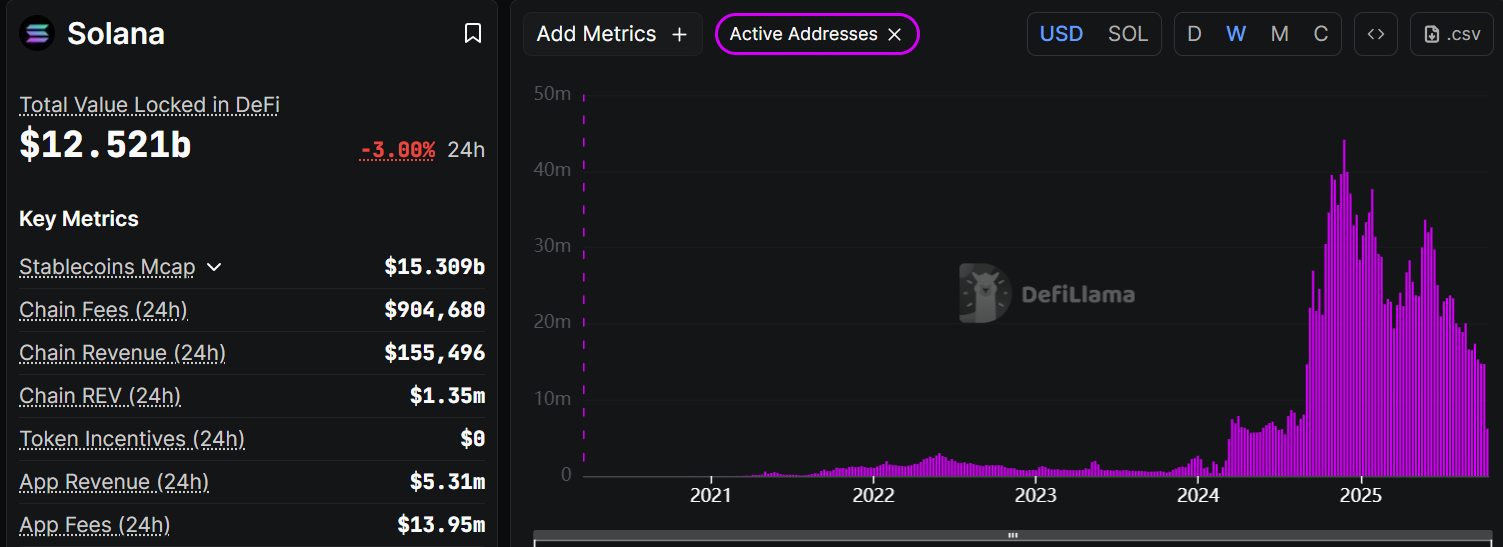

- SOL DeFi TVL is down 3% which is a bearish indicator.

- The $250 resistance is the next target for the bulls as on-chain metrics decline.

The Solana price remains bullish, as it remains above the $200 mark. At the time of writing, the SOL token is trading at $221, down 0.62% in the past 24 hours. Amidst the ‘Uptober’ narrative and potential SEC approval of related ETFs, SOL bulls are prepared to send Solana to highs targeting the $250 resistance.

Solana On-Chain Market Activity Outlook

Solana’s DeFi market has experienced significant growth in recent weeks. As of October 8, 2025, it stands at a solid $12.52 billion, representing a slight 3% decrease. Meanwhile, the total value locked was $12.48 million on Wednesday, down from $12.91 billion on Tuesday.

Investors move their holdings from staking smart contracts when they plan to buy and sell. Therefore, a continuous drop in TVL indicates that investors are exiting the ecosystem, which is a bearish signal.

On the other hand, a consistent drop in the number of active addresses on Solana’s blockchain since late May compounds the bearish sentiment. According to DefiLlama’s weekly statistics, as of this week, there are 6.2 million active addresses that send or receive assets on the protocol. This is a far cry from the 33.33 million active addresses recorded for the week of May 19 to May 25. Such a drastic change suggests less user activity and lower demand for SOL.

With on-chain activity decreasing every week, it may be challenging for Solana bulls to maintain the upward momentum. In other words, investors should brace themselves for high volatility whereby the Solana price breaks out but eventually slashes its gains due to on-chain backing failing to meet price expectations.

Solana Price Eyes $250 Mark Despite Reduced On-Chain Activity

The SOL/USDT daily chart indicates a potential bounce after a recent downward movement to around $220 lows. The price is now at $221, just above a strong support zone around $216. Moreover, the bulls remain within a rising channel, demonstrating strength despite the reduced on-chain activity in the Solana market. In the meantime, if the support zones continue to hold, it could lead to a breakout higher.

The RSI (Relative Strength Index) is currently at 50.57, indicating a neutral zone. This usually means that the bulls and the bears are in a tight tug-of-war. If the RSI starts rising, that could confirm a shift in momentum back to the bulls.

In the short term, SOL may test the $216 support level if the bears continue their campaign. A break below the current immediate support around $1216 could drag it to $194, where bargain hunters might swoop in. However, if support zones hold strong, the Solana price could see a rebound toward $236, especially if the entire market turns green again. The $236-250 zone will be a key point to watch, as buyers target a rally to $300 in the mid-term.

Best Crypto Exchange

- Over 90 top cryptos to trade

- Regulated by top-tier entities

- User-friendly trading app

- 30+ million users

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong.